Funding and Liquidity Management

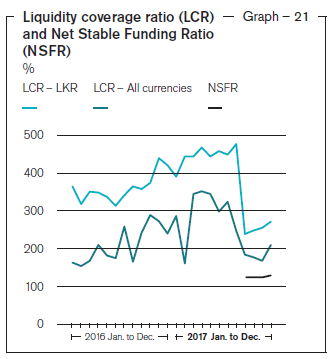

Funding and liquidity is an important criteria for the resilience of the financial services industry. Circumstances that led to the financial crisis in 2007 and events that followed reinforced the fact that funding and liquidity is as important, if not more, as capital. Yet, unlike for capital, there were no internationally harmonised standards with regard to liquidity. As a result, Basel III included provisions to strengthen the funding and liquidity risk management of banks with a view to promote the short-term and long-term resilience of a bank’s liquidity risk profile through the introduction of the Liquidity Coverage Ratio (LCR) and the Net Stable Funding Ratio (NSFR) respectively. In addition to the Statutory Liquid Assets Ratio, the LCR came into effect in 2015 while the NSFR will come into effect from April 1, 2018, both promising to penalise banks for excessive reliance on short-term, wholesale funding to support long-term assets.

Accordingly, to make it viable as well as for maintaining public trust in the Bank and the financial services system, the Bank accords as much importance to funding and liquidity as for capital, for ensuring that the Bank has sustainable sources of funding and maintains adequate levels of liquidity at all times. The Bank never compromises on its liquidity in its drive to generate returns for investors. The Assets and Liabilities Committee (ALCO) of the Bank which meets fortnightly actively monitored the funding and liquidity requirements and pricing of assets and liabilities, taking into account liquidity constraints and pricing challenges. The Bank took measures to encourage the use of electronic cash and cards in order to reduce cash holdings. The Bank has established credit lines with strong overseas counterparties, enabling it to access foreign currency funds at attractive prices.

The Bank has wider access to retail deposits through its branch network and relies on that stable funding source as the primary source of funds for onward lending. However, the Bank is not averse to avail low cost foreign currency borrowing opportunities available in the market, provided the interest and swap cost attached to such borrowing is cheaper as compared to the cost of wholesale deposits.

The Bank deploys tools such as compliance with reserve requirements, liquid assets ratio, Liquidity Coverage Ratio, Net Stable Funding Ratio, loans to deposits ratio, interest rates, Government securities, money market instruments, debt instruments and SWAPs etc. and debenture interest, maturity profile of assets and liabilities, sensitivity analysis and contingency funding arrangements for managing its funding and liquidity profile.

Objectives

Objectives of the Bank’s funding and liquidity management efforts included;

- Honouring customer deposit maturities/withdrawals and other cash commitments efficiently under both normal as well as stressed operating conditions

- Compliance with the regulatory requirements

- Maintaining internal funding and liquidity targets which are more stringent than the regulatory requirements

- Optimum usage of liquid assets for maximum profitability thereby meeting the expectations of investors

- Funding future business expansion at optimum cost

- Supporting desired credit rating

- Ensuring smooth transition to Basel III funding and liquidity requirements

Factors affecting funding and liquidity

Interest rates – both current and perceived, changes in money supply, money market developments, demand for Government securities, Treasury Bills/Bonds holding of the Central Bank of Sri Lanka, developments in the capital markets, level of imports and exports, loan growth, market liquidity, national savings ratio, regulatory developments, Government tax regulations etc. affect the funding and liquidity levels of banks. Relative to the wholesale funding sources, retail customer deposits tend to be more stable since a core component therein is likely to remain with the Bank for the medium to long-term.

During the year, foreign inflows to the Government securities and the capital markets as well as the reduction of the CBSL’s holding of Treasury Bills and Bonds contributed to the higher market liquidity and to limit currency depreciation. Higher loan growth in the initial months of the year resulted in negative mismatches in assets and liabilities which were financed through new foreign currency borrowings. Increase in M2b money supply by 16.70% (source: CBSL) during the year was also a contributory factor for the market liquidity.

Progress in 2017

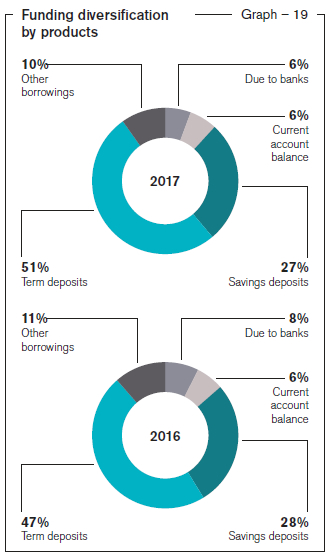

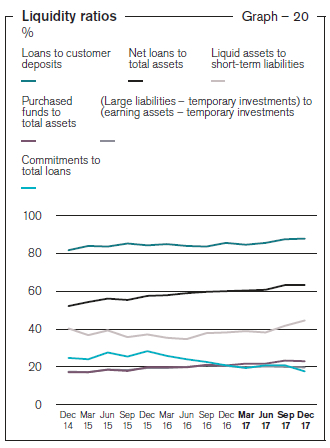

With due regard to the factors affecting it and as guided by the ALCO, the Bank maintained optimum levels of funding and liquidity, under normal as well as stressed conditions, throughout the year as evident from the indicators given in graphs below, enabling the Bank to earn higher net interest income. Both the Bank’s assets and liabilities are well diversified without any significant concentrations. Diversifying its funding sources, the Bank borrowed USD 100 Mn. from IFC during the year. Suitable standby arrangements are also in place to meet contingency funding and liquidity requirements in the event of any stressed conditions.

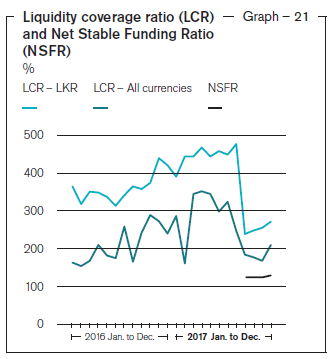

74.35% of the Bank’s assets are funded by customer deposits and customer deposits made up 82.04% of the liabilities as at December 31, 2017. The funding portfolio was sufficiently diversified by type as well as maturity and represented a stable source of funding. As at December 31, 2017, the LCR at 209.17% (for all currencies) was well above the minimum requirement of 100%. The NSFR which will become a prudential requirement in 2018 was at 127.87% as at December 31, 2017.

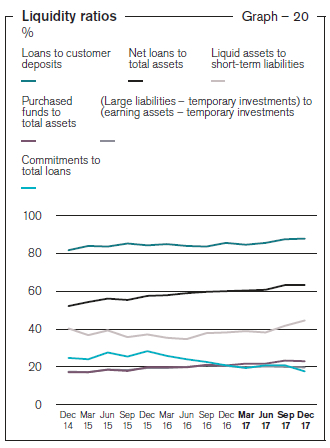

Movement of liquidity ratios over the last four years are given in graph 20 below:

The Bank had an available-for-sale securities portfolio of Rs. 154.87 Bn. as at December 31, 2017 (Rs. 160.02 Bn. as at December 31, 2016) that can be used to meet any funding requirements if the need arises in the normal course of business or due to market stress.

Movement of the liquidity coverage ratio and net stable funding ratio are given in graph 21 below.

The Bank tested its ability to withstand stressed liquidity conditions using several metrics. In December 2017, the Bank re-evaluated and updated its liquidity stress testing framework in December 2017.

The Bank observed that stress testing results at varying degrees of risk thresholds could result in strain on the day-to-day operations. However, even during a severe stress scenario, it was noted that the strain can be withstood with the resources at disposal and contingency plans are in place in the Bank.

2018 and beyond

In the wake of the LCR and the NSFR and also in preparation for any potential liquidity tightness in the region, the Bank will continue to move its current short-term reliance for funding more towards medium to long-term tenors. The Bank anticipates a certain amount of money to flow out of the region due to the extremely good performance in the US economy and satisfactory performance in Europe as well as geopolitical tensions. The Bank is also exploring the possibility of gradually reducing its dependence on deposits of low liquidity value such as interest sensitive wholesale funding. In order to improve its funding profile further, the Bank is currently evaluating broad-basing its funding sources to other multilateral lending institutions and also to other currencies by borrowing in currencies other than United States Dollars.