Manufactured Capital

By definition, and as it applies to the Bank, Manufactured Capital includes artificial (as opposed to natural) physical objects that are on hand for use in the provision of products and services. These objects include buildings, vehicles, and equipment. Manufactured capital may be created by external entities and is often used directly for the benefit of customers and other stakeholders. As the Bank continues to grow – expanding its branch network for instance – so too will its manufactured capital.

In addition to meeting stakeholder expectations, the Bank uses such tangible assets to meet future challenges. Naturally the quality of these assets has a profound impact on the Bank’s future-readiness and the value it creates for all stakeholders. To ensure that the value it derives is at a premium, the Bank makes every effort to develop and continues to maintain the high standards of its manufactured capital.

This section explores how the Bank deploys manufactured capital to meet three of the Bank’s strategic imperatives – namely operational excellence, customer centricity and risk management.

Operational excellence

Diversified property. Maintaining a healthy balance between owned and rented buildings is one example of how the Bank optimises its manufactured capital. Since 2009, Sri Lanka’s property market has been on an upward trajectory with the demand for commercial and residential real estate growing each year.

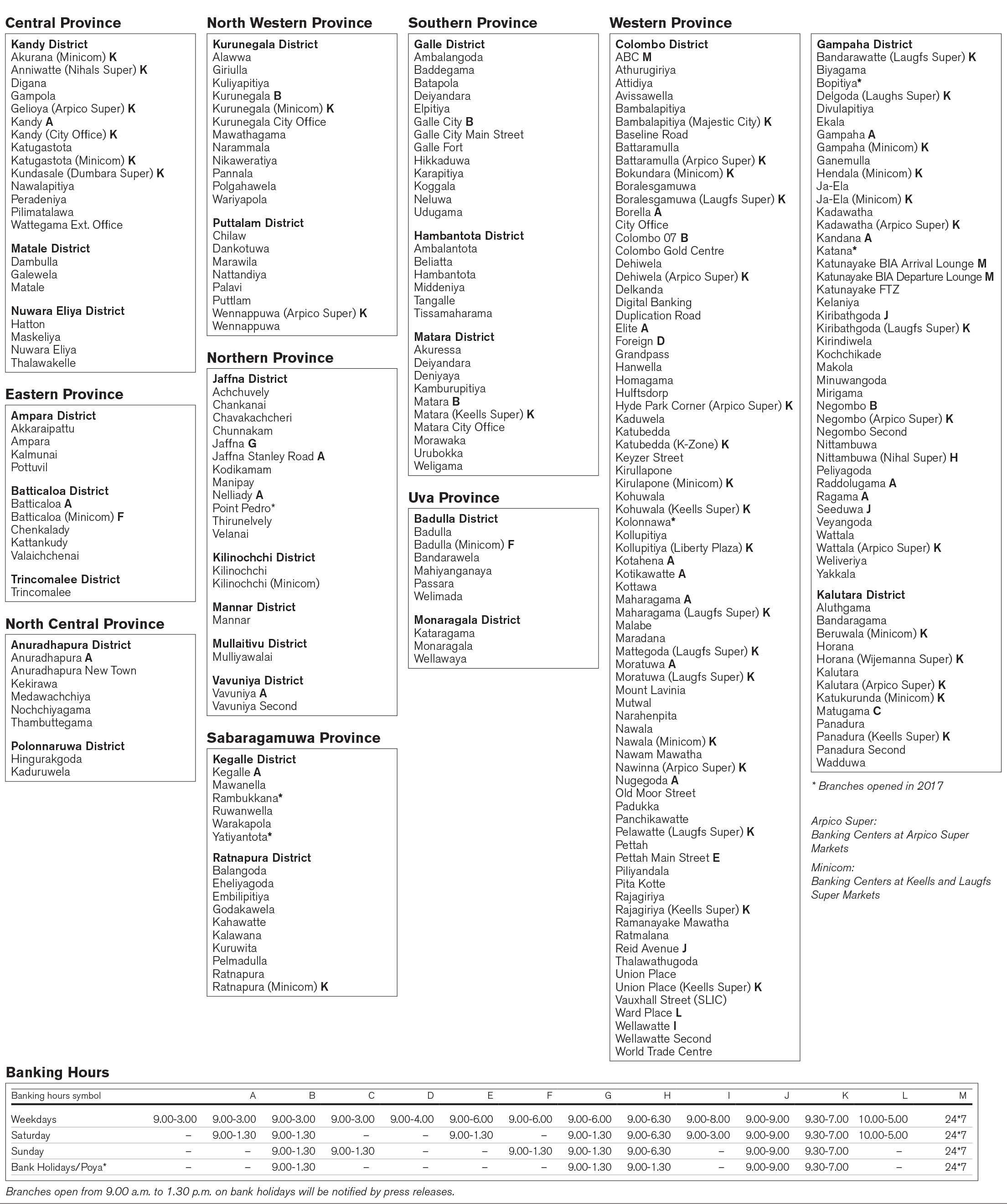

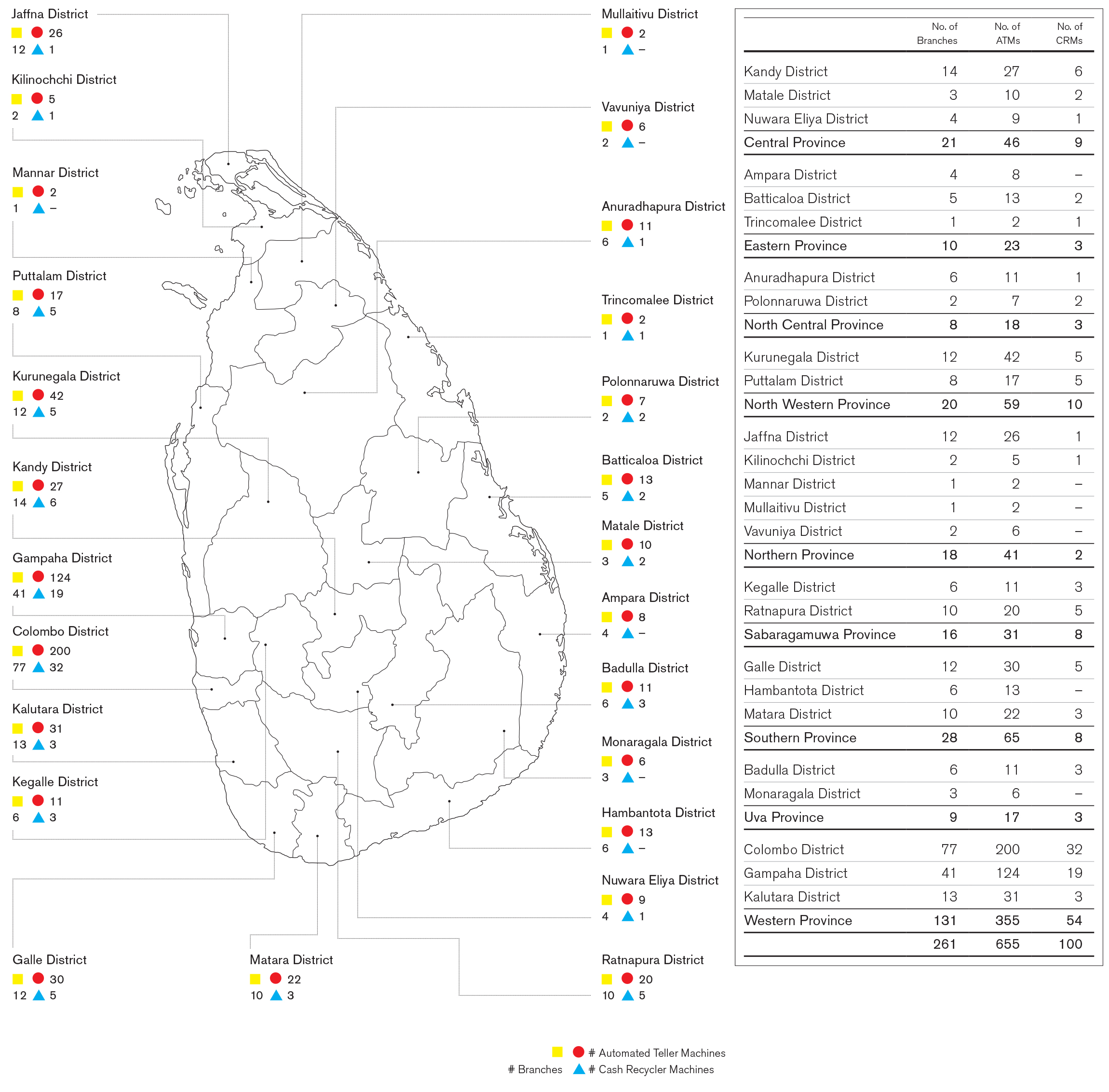

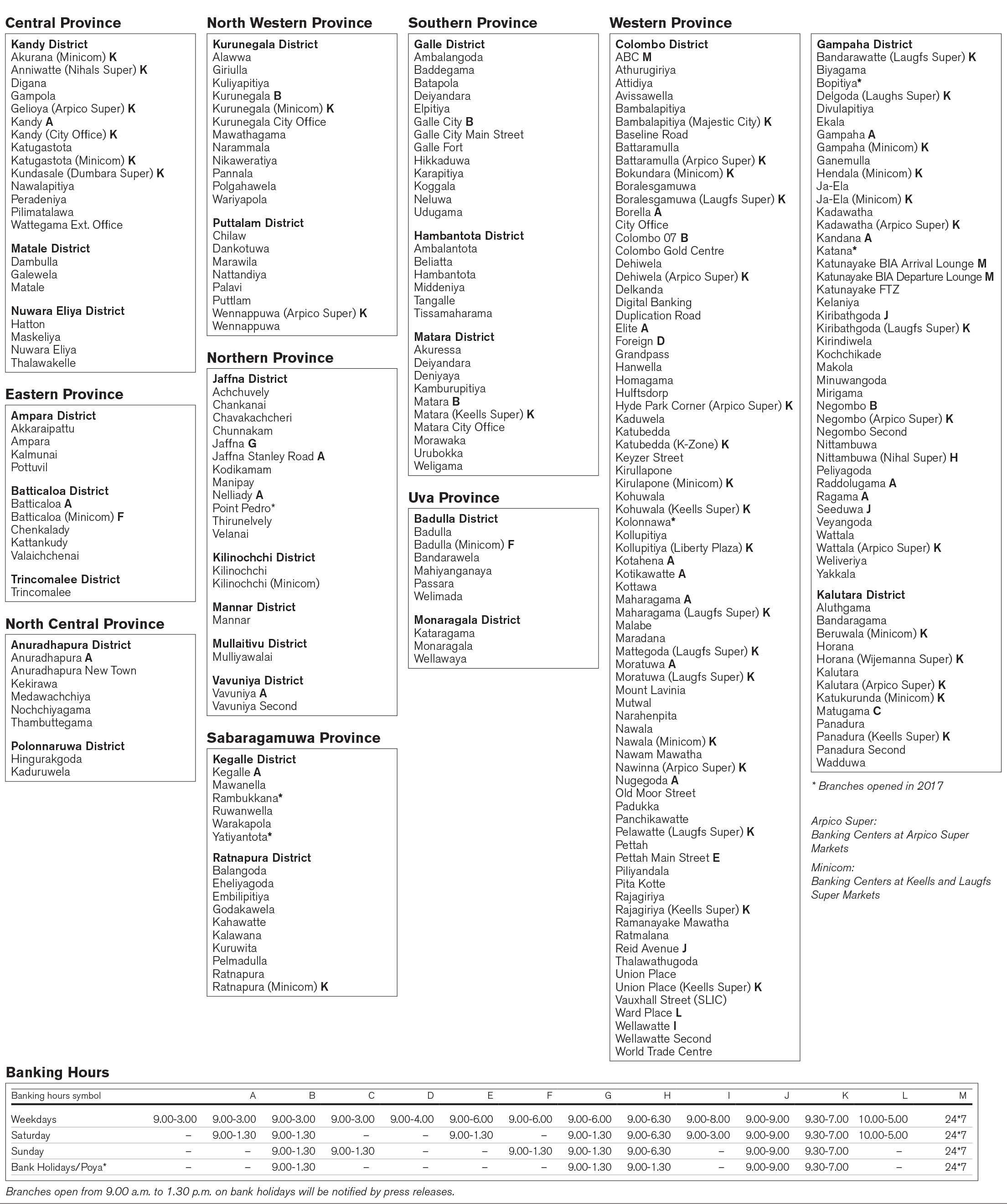

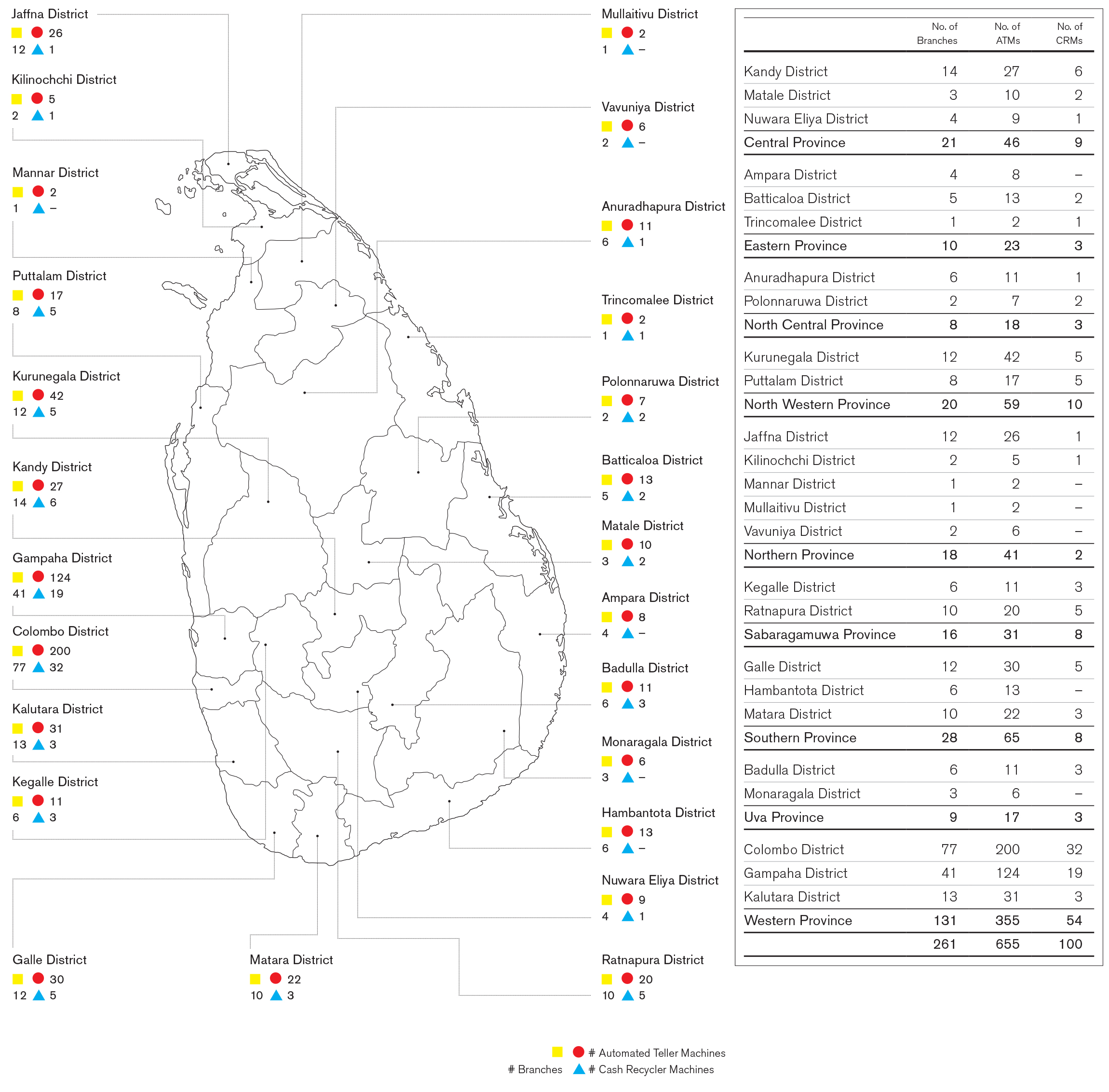

Network of delivery points in Sri Lanka

Figure – 13

At the end of 2017 there were an estimated 8,000 apartments being built in Colombo compared to less than 1,000 in 2008. Following concessions for foreign investors in the real estate sector included in the 2016 and 2017 Government budgets, investments in strategic development projects in the city, such as, the Shangri-la, Tata Housing, and the Astoria are also expected to increase.

Such development means that renting in urban centres such as Colombo, Galle, and Kandy is neither easy nor cost-effective. Property owners have their pick of short-term tenants from start-ups to established companies all jostling for a piece of the action.

To meet the challenges presented by this scenario the Bank has made every effort to move back office and support staff into owned buildings. Buying premises strategically in key locations and renting – especially in rural areas where the security of renting to a trusted local bank is highly valued – the Bank has balanced its investments in properties to generate greater economies.

Smarter branches. The Bank is mindful of the requirement to maintain the state of art work environment within the Bank premises and continues to make substantial investments in upgrading the existing premises to be in line with industry standards.

To reflect its continued goal of providing customers with a consistent, high standard of service at every touch point the Bank redoubled its focus on standardising the façades of all its branches in the Colombo area. Work on standardising the internal layout of branches is also ongoing.

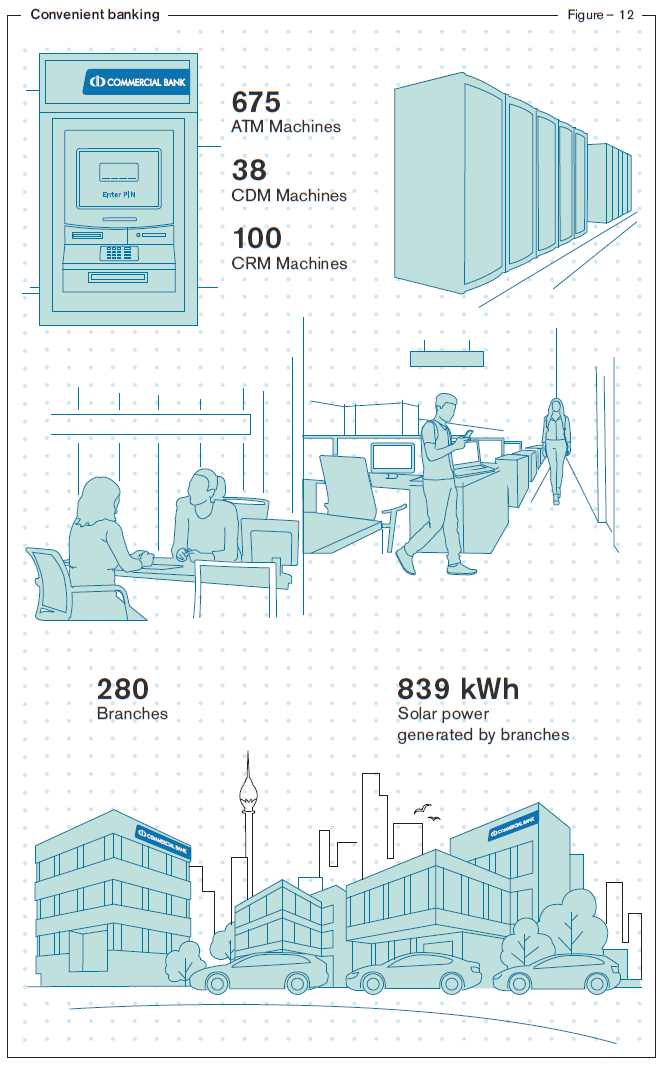

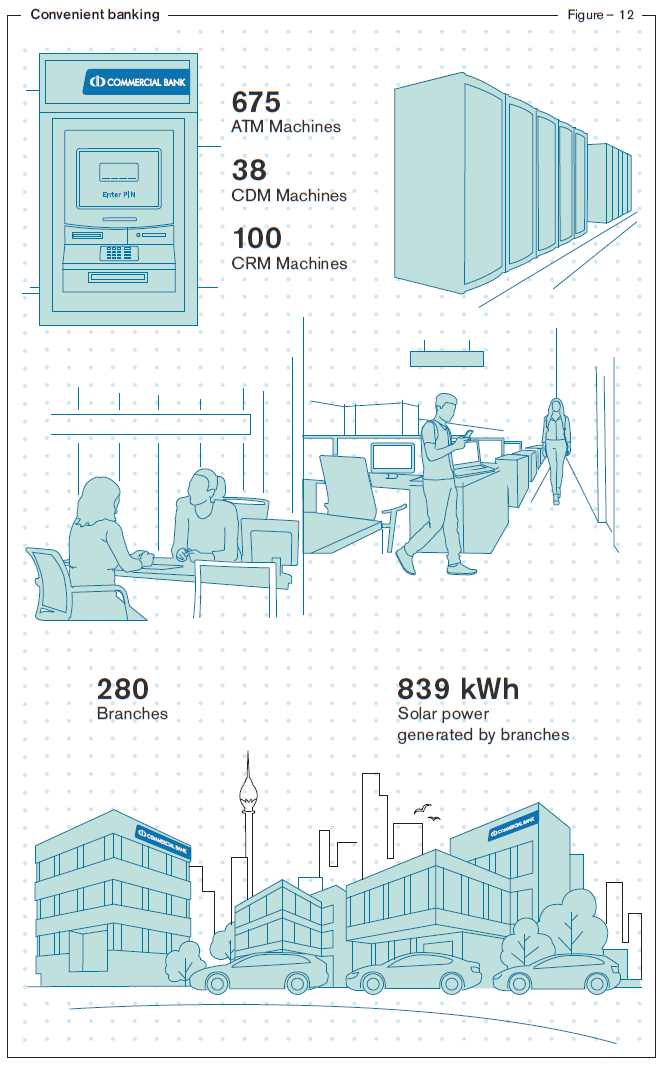

Six new branches were added to the Bank’s network during the year, taking the total to 280 by end of 2017. Taking up less square-footage these branches include an automated banking services section to provide greater customer convenience.

Sustainable energy. The Bank installed solar panels in 20 branches during the year under review, converted all lighting to LEDs (light-emitting diodes). It also invested in the optimisation of air conditioners in the Head office building through its subsidiary Commercial Development Company PLC, which resulted in the Bank achieving approximately 15% reduction in its energy bill.

Rationalising office equipment. Buoyed by the ability to reap benefits of moneys spent on strengthening infrastructure, the Bank will continue to invest in ICT with the objective of delivering unprecedented customer experience through technology.

During the year under review the Bank also increased its ratio of hired versus owned office equipment, engaging a third party supplier for the renting of machines such as printers. This has resulted in approximately 35% shift from capital expenses to operational expenses across the branch network, with maintenance and repair costs being borne by the supplier.

Customer centricity

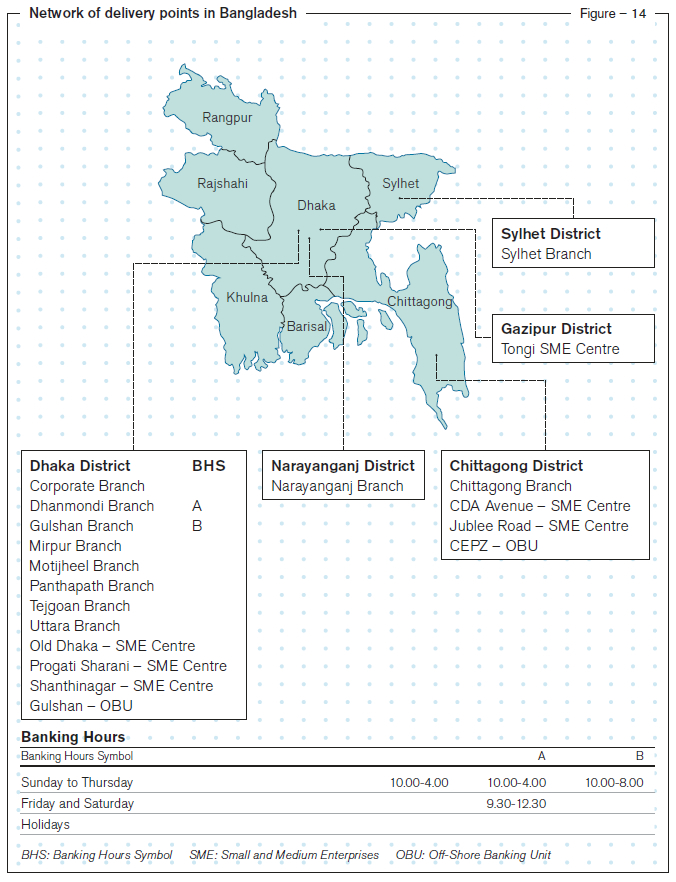

Software solution. In 2012, the Bank launched its own home-grown online financial services solution which provided distinctive experiences for both retail and corporate customers. Five years on and the needs of its stakeholders have grown exponentially. With plans to further expand digital solutions for customers – including mobile banking solutions for its Small and Medium Enterprise (SME) segment – the Bank procured a new digital platform from Fiserv, a global leader in financial services technology solutions, during the year and it will become fully functional in 2018.

The Bank will continue to upgrade its IT platforms to maintain a state of the art infrastructure.

Effective transport. To maintain the cost-efficiency of the transport arrangements the Bank now employs a combination of owned and rented vehicles. In addition to the use of commercial cab services the Bank has also negotiated with a third-party supplier to provide manned vehicles at a monthly fixed rate per kilometre.

Managing Risk

Online procurement. Online procurement of all fixed assets and inventory was a challenging but productive operation which involved changing employee mindsets throughout the Bank. Maintaining the usual dual control system, monthly requirements are submitted to the Bank’s Logistics team who in turn alert the Procurement team. This process, including the supply of items from the Bank’s warehouses to the point of delivery, is now entirely traceable online. This has helped in proper accounting and physical verification.

It is heartening to note that the Bank has received zero complaints on procurement practices through its whistle-blowing system this year.

Total investments in the Manufactured Capital of the Bank (Property, Plant and Equipment, Intangible Assets, and Leasehold Properties) stood at Rs. 15.484 Bn. as at end 2017 (please refer Note 39 for details).

Maintaining an efficient and productive environment for all its stakeholders is of paramount importance to the Bank and helps fulfil its aim of creating value and being future ready.