Human Capital

We live in an on-demand economy where advancing technology – particularly cheap computing power – and changing social habits are transforming our expectations as consumers. Given this scenario the Bank is gearing itself for a radical change in mindset; in the way it caters to the changing needs of its customers. Such change begins with its people.

Human Capital refers to the store of knowledge, habits, and skills accumulated by the Bank’s people over the years.

This section examines our employees’ ability to create value for the Bank and for its stakeholders in a fast changing environment and also how the Bank creates value for them in return.

Providing customers with the kind of experience they expect from Sri Lanka’s leading private bank means having a team of people on the ground who are agile and nimble, able to understand the customers, quickly learn and adapt to new technologies and new ways of thinking in order to maintain the customers’ trust.

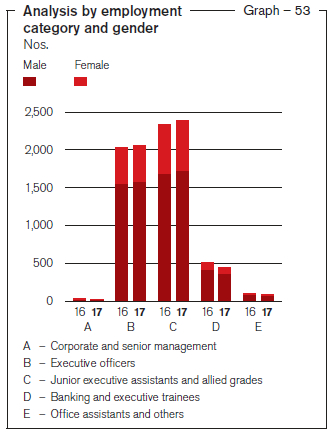

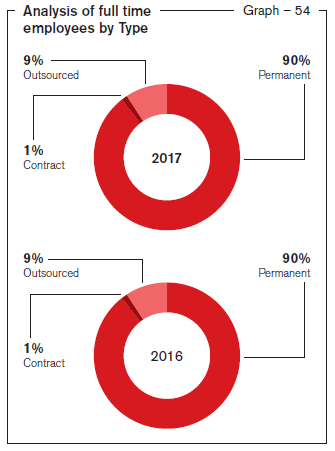

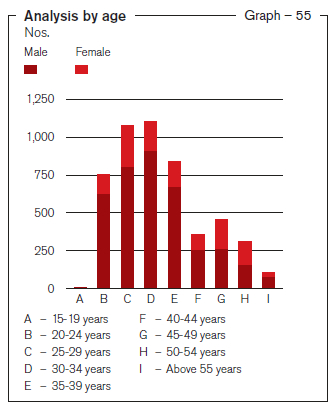

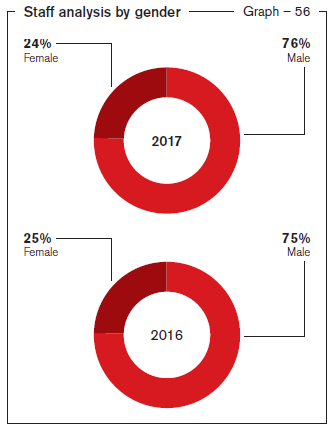

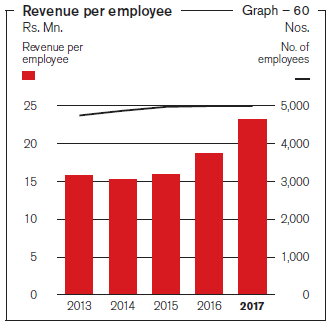

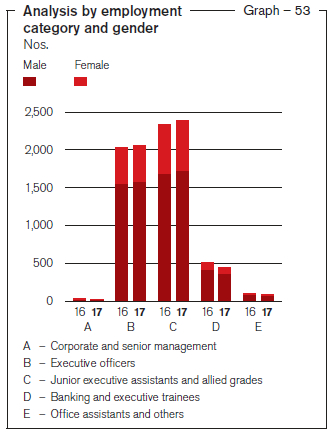

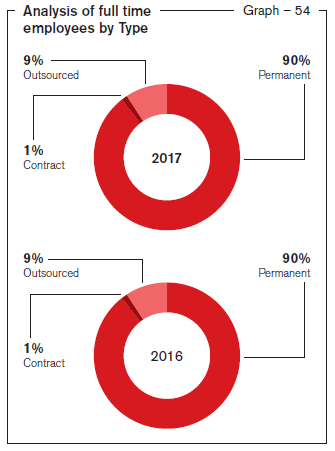

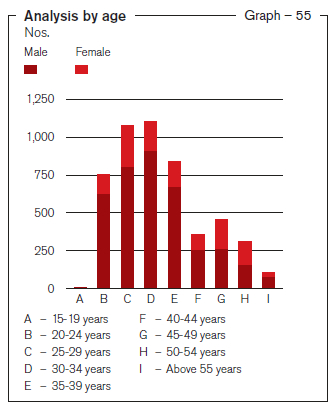

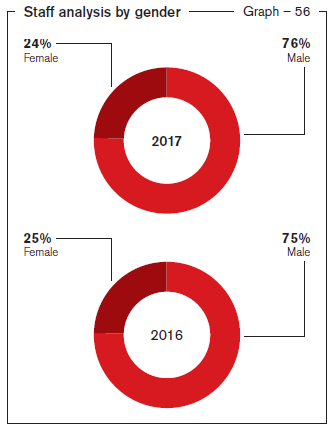

Winning team. Any organisation is only as strong as its weakest link as the saying goes but the Bank’s strength and success is testament to its winning team. Comprising 4,982 individuals representing diversity in gender, ethnicity and generations X, Y and Z, this is a team that upholds the brand values and works well together to achieve common goals with dignity, dedication, and mutual respect (refer graphs 53, 54, 55 and 56). Numbering 311, the Bank’s overseas cadre has increased by 11.47% over 2016 as we expand our footprint beyond Sri Lanka’s shores. Typically employee contracts are full time while a few are time-bound contracts. We also use outsourced employees for specific non-critical functions.

The Bank continues to maintain high levels of employee engagement, satisfaction and retention. With effective training and development measures, and succession planning in place the Bank promoted 447 employees during the year, helping them achieve career goals. During the year under review, a total of 243 new employees became part of our winning team, bringing fresh ideas and perspectives. At the annual long service awards ceremony, they witnessed the value created for employees by the Bank as they joined in felicitating 136 experienced employees who had completed a quarter century with Commercial Bank.

The 2017 A. C. Nielsen brand health study of the Banking sector shows that while other banks in Sri Lanka have declined in sectors such as branch employees’ ability to provide relevant services and advice, their ability to understand the customer’s requirements and provide exceptional service, their ability to provide quick banking services, and provide speedy service at counters, Commercial Bank has increased its scores in these categories over the previous year. These findings are a reflection of the dedication and commitment of our entire team.

Within this Capital we look at four of the Bank’s strategic imperatives and how they are met – namely prudent growth, operational excellence, customer centricity and risk management.

Prudent growth

Governance. In addition to a winning team on the ground, the Bank owes its prudent growth to good governance practices. Assisted by

the Board Human Resources and Remuneration Committee (BHRRC) the Board takes responsibility for ensuring that the Bank’s People Strategy is effectively implemented. The Bank’s approach to managing Human Capital is clearly defined in its policy framework. Its Code of Ethics is designed to ensure that employees are made aware of the Bank’s high expectations of them.

The implementation of the people strategy is the purview of the Human Resources (HR) Department. Continuous improvement of employee-related processes and procedures also falls within the HR domain. HR’s performance is assessed by the Board, the BHRRC, and the MD/CEO. The Bank complies with all regulatory requirements relating to its Human Capital going above and beyond base requirements.

Aligning with corporate strategy. To continue to build on its strong and dependable workforce the Bank is focused on developing the skills and competencies of employees, providing adequate compensation, and rewarding and recognising them. Keenly aware of the Bank’s strategic direction its employees follow the corporate values as they gear themselves to be future ready while meeting and exceeding stakeholder needs. The Bank strives to align the goals, skills and competencies of its people with its corporate strategy to ensure that no one is left behind on this journey to a prosperous and meaningful future.

Workforce by growth

Table – 16

| Gender |

2017 |

2016 |

2015 |

2014 |

2013 |

| Male |

3,769 |

3,760 |

3,711 |

3,453 |

3,539 |

| Female |

1,213 |

1,227 |

1,240 |

1,190 |

1,191 |

| Total |

4,982 |

4,987 |

4,951 |

4,643 |

4,730 |

Senior management by gender

Table – 17

| Gender |

2017 |

2016 |

2015 |

2014 |

2013 |

| Male |

28 |

37 |

40 |

41 |

44 |

| Female |

11 |

12 |

13 |

11 |

9 |

| Total |

39 |

49 |

53 |

52 |

53 |

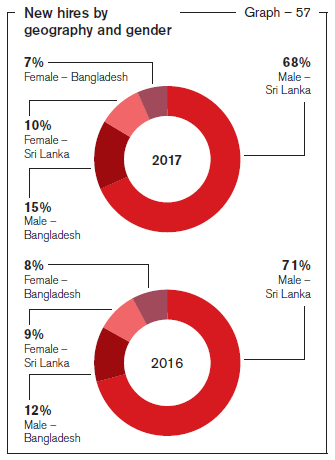

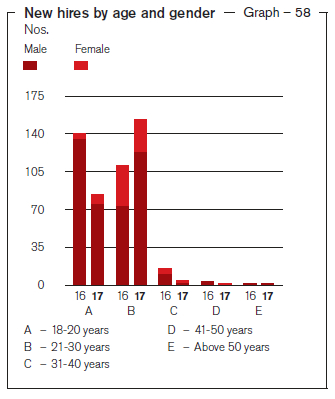

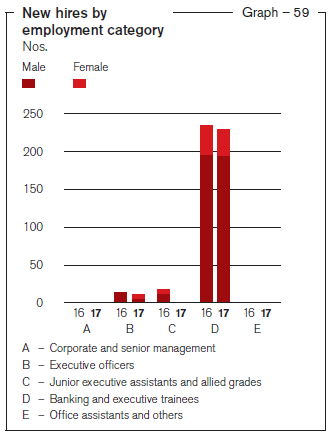

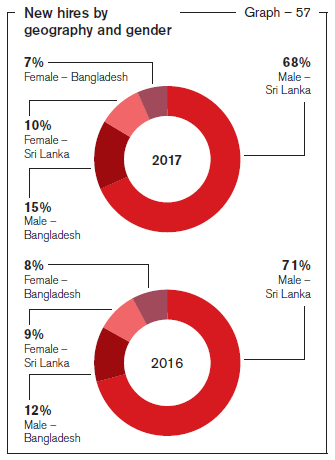

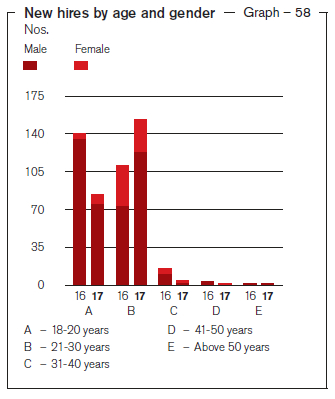

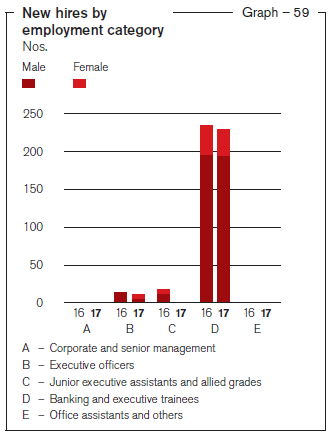

Employee recruitment. Prudent growth is also a result of prudent recruitment practices. Employee recruitment was approved prudently. For example, while over 100 new branches were opened and business volumes have doubled over the past seven years, only 500 new employees were hired by the Bank. Despite a majority of school-leavers going abroad for higher studies or choosing careers in Business or Marketing rather than Banking, the Bank has been able to attract the necessary talent, especially for its Banking Trainee intake. Despite changing trends in the job market the Commercial Bank brand still has a strong attraction. During the year, the Bank recruited 243 employees, of whom 40 were females.

The Bank’s equal opportunity policy is consistent with global best practices with selected candidates being assessed according to their suitability for the particular role and business need. The internal talent pool is always the first stop for vacancies. Even for external recruitments, first preference is always given to local talent in the countries within which the Bank operates. The Bank’s policy of secondment to other countries helps entrench its unique culture and values. Through a comprehensive induction programme, new recruits come to understand and embrace the organisation’s values, policies and procedures.

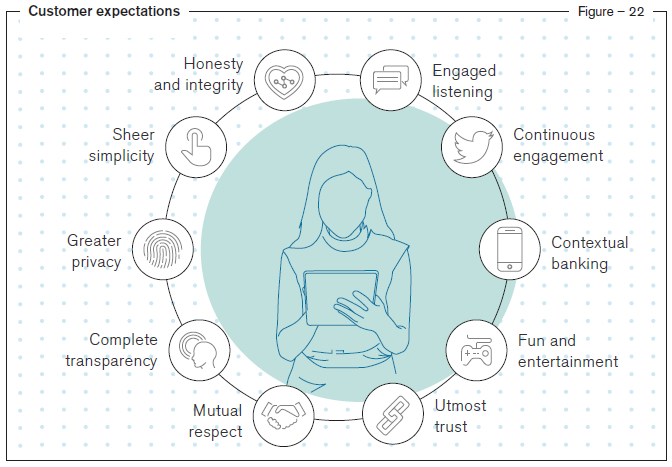

Sales culture. Constantly in touch with what the customer wants, the Bank is aware of rapidly changing customer expectation trends in the sphere of banking.

To ensure that customers receive the service they expect, the Bank is focusing on freeing up employees from operational chores so that they have more time to focus on building meaningful relationships with customers. This includes an overhaul of existing processes and automation at both the customer end as well as the employee end.

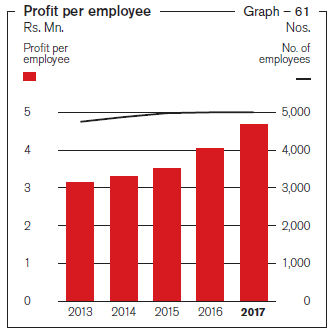

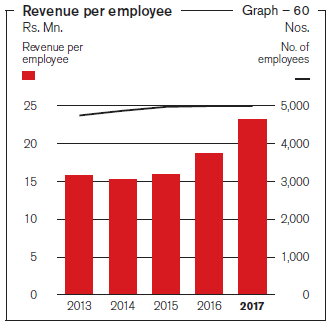

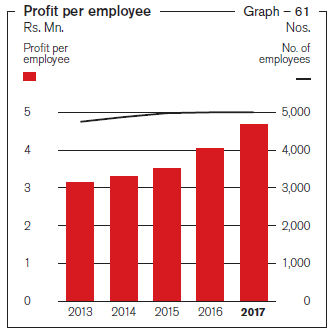

To prudently improve growth and productivity means gearing employees to change attitudes, behaviours, and skills. It also means managing change in such a way that it empowers rather than overwhelms people (refer graphs 60 and 61).

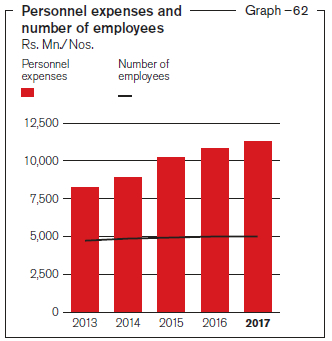

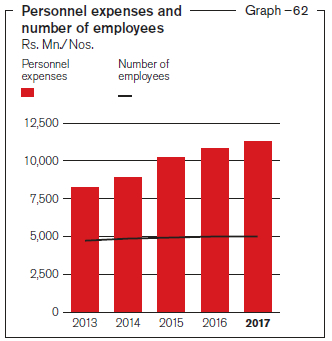

Remuneration and benefits. Employees are the backbone of the Bank – the key drivers of prudent growth. To ensure that they remain engaged and satisfied in their pursuit of meeting the organisation’s goals the Bank maintains an impartial remuneration structure which compensates for employee contributions and rewards performance refer graph 62).

Remuneration consists of guaranteed “fixed” pay and performance-based variable pay – the former is determined by regular market surveys conducted in Sri Lanka and Bangladesh. Performance incentives for executive officers, including Executive Directors, are provided through mutually agreed benchmarks linked to the performance appraisal system and a well-defined rewards matrix. The Collective Agreement covers all other employee categories.

A list of benefits available to full time employees is given below:

- Performance-based bonuses or those decided on the Collective Bargaining Agreement.

- Employee share option scheme for executive staff.

- Overtime for non-executive staff.

- Fuel allowance, transport allowances, entertainment allowance and (for certain employee categories) reimbursement of expenses incurred in performing official duties.

- Accommodation/house rent and/or subsidised transportation or special allowances for employees working in remote locations.

- Medical benefits including a special coverage for surgical and hospitalisation, spectacles, dentures, hearing aid for staff and immediate family, annual health

check-up for employee and spouse.

- Financial support for employees with differently-abled children (to cover routine medical expenses).

- Group life cover extended for permanent employees who are not eligible for pension.

- Retirement benefits and commuted pension.

- Honorarium for successful completion of Diploma in Banking at the Institute of Bankers of Sri Lanka.

- Reimbursement of annual subscription of professional bodies.

- Staff loans at below-market interest rates.

- Holiday bungalows and holiday allowances

- Insurance scheme covering critical illnesses and personal accidents.

Employees seconded to the Bank’s overseas offices as Business Promotion Officers and Representative Officers receive remuneration that is commensurate with similar roles in Sri Lanka. Their pay is also supplemented by an allowance that covers expenses incurred while living abroad.

Where necessary labour is outsourced through reputed third-party suppliers and the Bank ensures that they are remunerated according to regulatory requirements including the remittance of Employees’ Provident Fund and Employees’ Trust Fund contributions.

Talent inventory. A talent inventory records the skills, education and experiences of existing employees. Analysing the availability of human capital and identifying gaps in this matrix helps the Bank to meet its strategic goals and increase productivity. This is all the more vital in a period of change as the Bank continues to gear itself for the future. The talent inventory was created to help utilise employee skills effectively.

Operational excellence

Employee survey. Contributing to the Bank’s future direction gives employees a sense of ownership and responsibility. In turn, employee surveys help the Bank to measure and understand employees’ attitude, feedback, motivation, and satisfaction. Recent employee survey provided useful information which was taken into account for driving the future direction of the Bank and optimising operational excellence. In addition, the increasing foreign training, improving the transfer system, re-looking at the pension proposal, and increasing the number of holiday bungalows were all decisions based on employee feedback.

Employee retention. The employee survey reflected high engagement levels and which are reflected in strong employee retention rates.

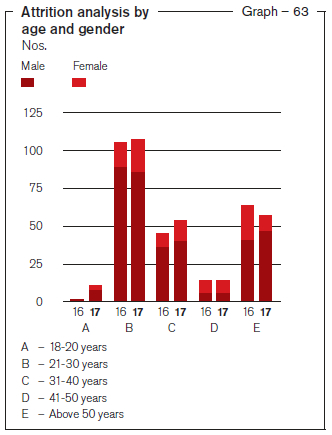

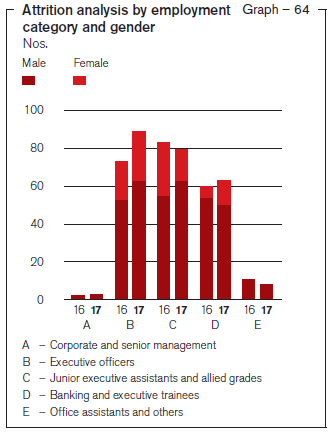

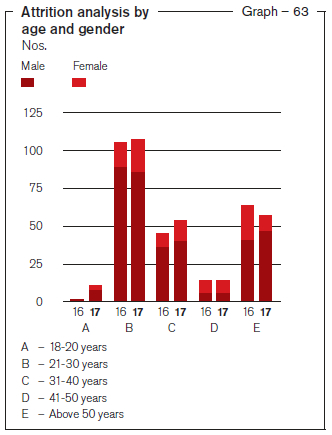

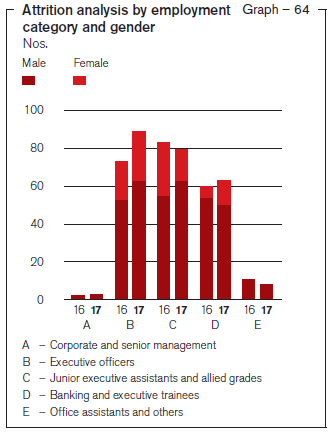

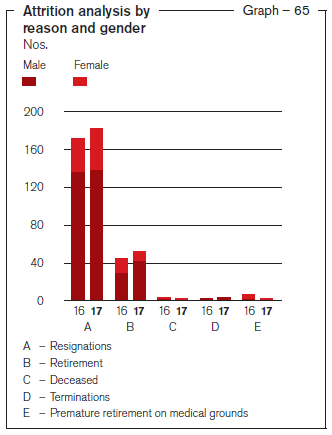

In every country that the Bank operates in, employment separation processes are fully compliant with applicable labour laws. Reasons for employee exits are tracked and monitored via exit interviews with feedback escalated to the highest levels of management. Attrition rates are highest in the under 30 age group category reflecting the high demand for young, experienced Commercial Bank employees in the market. This demand in turn feeds into the aspirations of Generation Y employees who wish to fast-track their careers by negotiating for higher posts at other banks.

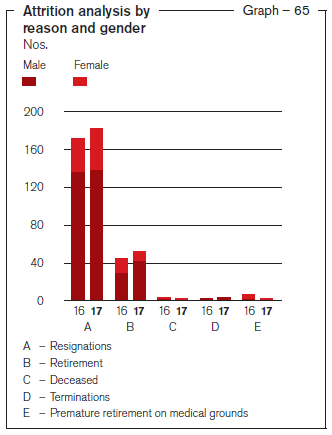

Employees bidding farewell to the Bank in Sri Lanka and Bangladesh numbered 219 (4.64%) and 29 (10.43%) respectively during the year (refer graphs 63, 64 and 65).

High rate of returns to work from maternity leave demonstrates employees’ willingness to continue with their careers with the Bank (refer table 18).

Return to work and retention rate after maternity leave

Table – 18

| Employment category |

2017 |

2016 |

2015 |

2014 |

2013 |

| No. of employees |

|

|

|

|

|

| – Entitled for leave |

1,213 |

1,227 |

1,240 |

1,226 |

1,180 |

| – Availed leave |

52 |

65 |

53 |

54 |

65 |

| – Due to return |

57 |

65 |

53 |

54 |

64 |

| – Returned after leave |

53 |

62 |

53 |

54 |

63 |

| – Still remain in employment |

57 |

53 |

54 |

63 |

64 |

| Return to work (%) |

94.64 |

95.38 |

100.00 |

100.00 |

98.44 |

| Return to rate (%) |

91.94 |

100.00 |

100.00 |

100.00 |

100.00 |

Talent discussions. Employees in Executive Grades are privy to talent discussions with the Human Resources representative for their particular unit. This was implemented to ensure that each employee at that level is assured of a clear career progression path and can work towards their own personal career goals with the knowledge and support of the Bank.

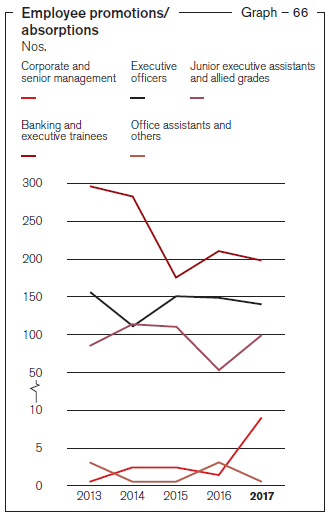

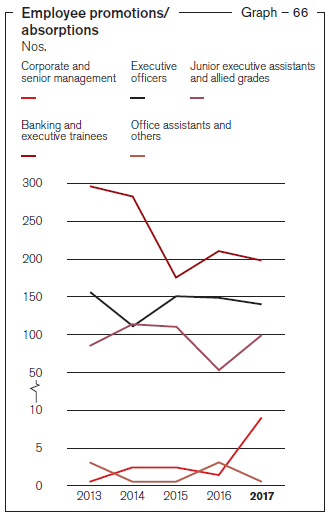

Employee recognition. The Bank’s annual performance evaluation process covers all employees who are appraised based on criteria mutually agreed at the beginning of the year. This tool helps the Bank to build a target driven culture, reward and develop the employees. A total of 447 employees were promoted during the year under review (refer graph 66). Long service awards were presented to 136 employees for a quarter century of service with the Bank.

Commercial Bank honours 136 staff for 25 years of service

Commercial Bank felicitated 136 of its staff members in recognition of 25 years of loyal service at the Bank’s annual Seniority Awards ceremony for 2017.

Leadership training. Given the great diversity of employees that a manager is called upon to oversee, sound leadership skills – in addition to technical expertise – is imperative for taking the Bank forward into a bright future. The Organisation has a history of grooming and producing its own leaders –

men and women who have grown with the Bank, often progressing from trainee positions. This year too the Bank focused on providing management education, leadership development and coaching. The employee survey results illustrated that employees too appreciate the investment and trust the Bank places in them by providing such coaching. Employees started their career in the Corporate Management level were provided with external coaches – so that confidence was assured – who worked on improving their management and leadership skills.

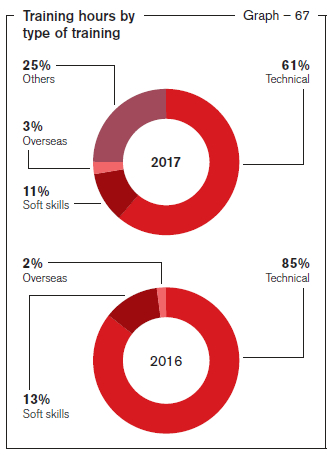

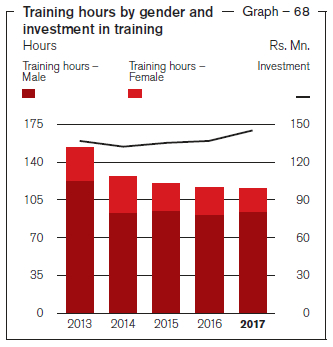

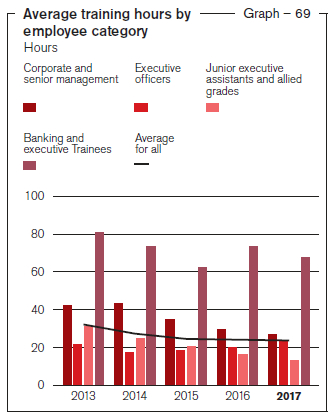

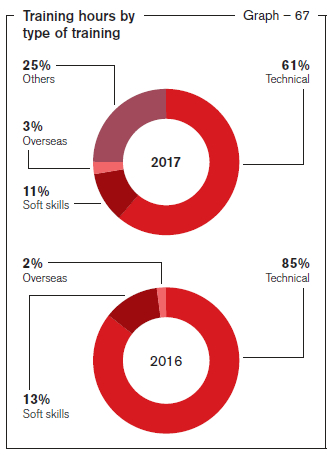

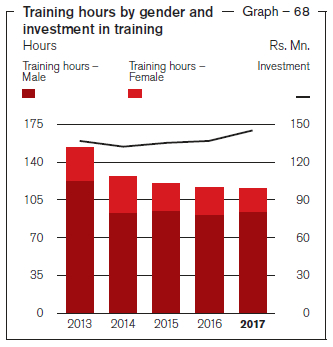

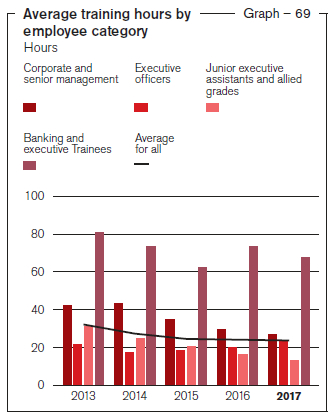

Employee development. Training and development has always been of paramount importance for the Bank. With many employees joining the Bank prior to taking their tertiary examinations the Bank understands its role as an ‘educator’ and is focused on creating a learning culture where people are encouraged to continuously acquire knowledge, competencies and develop skills. It encourages employees to better themselves via internal and external training and educational programmes (both within country and without), ensuring they gain invaluable experience, carrying out talent discussions, encouraging them to apply for financial support, and giving recognition to those who perform well at banking exams. The Bank also supports a mentorship programme to guide and groom the next level of leadership (refer graphs 67, 68 and 69).

Equal opportunity. Committed to being an equal opportunity employer the Bank is committed to ensure that its ratio of basic salary and remuneration of women and men at all locations of operation and across all employee categories remains at 1:1.

Ratio of the basic salary

Table – 19

| Employment category |

2017 |

2016 |

2015 |

2014 |

2013 |

| Corporate and senior management |

1:0.75 |

1:0.95 |

1:0.94 |

1:0.84 |

1:0.87 |

| Executive officers |

1:0.90 |

1:1.10 |

1:1.09 |

1:0.93 |

1:0.98 |

| Junior executive and allied grades |

1:0.92 |

1:1.08 |

1:1.10 |

1:0.91 |

1:0.85 |

| Banking and executive trainees |

1:0.97 |

1:1.01 |

1:1.04 |

1:1.00 |

1:0.98 |

| Office assistants and others |

1:1.05 |

1:1.01 |

1: N/A |

1: N/A |

1: N/A |

Whilst the Bank provides training to its employees on need basis and promotions on merit, the Bank has provided such opportunities in proportion to its gender mix of employees as depicted in the table 20 below.

Gender mix – Staff count/promotions/training (male:female)

Table – 20

|

2017 |

2016 |

2015 |

2014 |

2013 |

| Staff count |

76:24 |

75:25 |

75:25 |

74:26 |

75:25 |

| Promotions |

80:20 |

72:28 |

78:22 |

67:33 |

88:12 |

| Training |

82:18 |

79:21 |

80:20 |

73:27 |

80:20 |

Customer centricity

Diversity valued. To better serve customers the Bank is keen to ensure that its employee force is as diverse as its customer base and reflects the communities within which it operates. Employees in Sri Lanka now number 4,671 while those overseas number 311, an increase of 11.47% over 2016. With an abundance of diversity that spans gender, generations, geographies, ethnicities, experience, and capabilities within its employee force, the Bank is committed to drawing strength from such difference, while also providing equal opportunities irrespective of these categorisations. 243 new employees were added to the talent pool during the year, after rigorous assessment, and through effective, time-tested induction programmes. All new recruits are welcomed and introduced to the culture of the Bank. Just as they learn to work together as a team to reach common goals so too does the Bank benefit from the new ideas and suggestions they bring with them driving change in the way we serve our customers.

Employee communications. Effective employee communications ensure that the Bank’s people remain engaged and committed to adding value to the customer experience. To this end the Bank employs a range of effective communications channels including circulars, an intranet, various internal events, and staff TV. This year the Bank also arranged townhall meetings where employees got to spend time in discussion with the Senior Management Team in the absence of their own managers. In this open forum they were able to make suggestions for improvement as well as ask questions about the direction and strategy of the Bank. The Bank is also looking at upgrading its intranet to suit the taste of its youngest employees who appreciate information at their fingertips.

ComBank Sports Club Cricket Carnival

Commercial Bank of Ceylon PLC is seen handing over the Champion’s Trophy to the Winning Team during the concluding session of the Cricket Carnival arranged in Bangladesh in December 2017.

Employee communication channels

- Employee Surveys

- Employee suggestion schemes

- “Speak out” web portal

- Townhall meetings

- Managers conference

- Trade unions

- Emails

- Intranet

- Circulars

- Staff notice board

- Formal letters from HR Department

- Staff TV

Annual Staff Conference 2018

Bangladesh Management Committee during the Annual Staff Conference held in Dhaka on January 20, 2018.

Managing risk

Health and safety. All permanent employees are covered by a comprehensive medical insurance scheme that includes in-house medical treatment and reimbursement of outpatient medical costs.

The collective agreements provide for the Bank to reimburse expense of a full medical check-up (annually) upon reaching the age of 35 years.

Alarm systems, CCTV cameras and trained security personnel are employed to ensure that all Bank premises, people and customers remain secure at all times.

The Bank’s Security Department conducts training programmes for our people including fire drills and responding to various threats and has identified dedicated teams within each business/service unit of the Bank to supplement its work. Each business or service unit has a dedicated Health and Safety Champion who has received comprehensive training on how to respond to emergencies such as fire, burglaries or natural disasters. No significant health and safety issues were reported during the year.

Code of Ethics. Based on the UN Global Compact principles and the Universal Declaration of Human Rights proclaimed by the UN the Bank’s Code of Ethics and its comprehensive policy framework focus on encouraging a culture of respect for human rights and values. Leaders and managers within the Bank are trained to ensure human rights are upheld at all times. Compliance with the policy framework is regularly verified by the Inspection Department.

Employees are empowered by the Bank’s Whistle-Blower Charter which encourages the reporting of potential human rights violations. Any such violations are investigated swiftly with prompt disciplinary action, including dismissal, being taken against violators.

The “Speak Out” web portal is another avenue for employees to voice concerns regarding working conditions, labour practices or potential violations of human rights. Regularly monitored by the HR Department, legitimate concerns are investigated and acted upon.

The Bank’s open door policy has encouraged proactive two-way discussions enabling the early identification and resolution of issues.

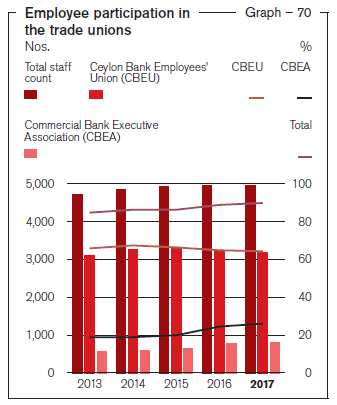

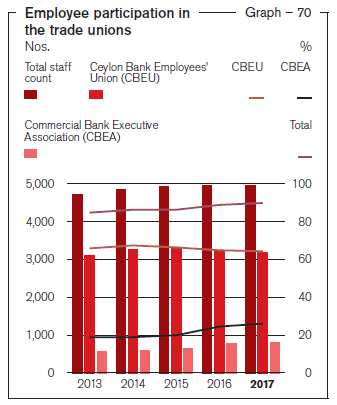

Freedom of association. Maintaining positive relationships with its employee associations, the Commercial Bank Executive Association (CBEA) and the Ceylon Bank Employees Union (CBEU), the Bank recognises its employees’ rights to freedom of association and collective bargaining. When formulating relevant policies and procedures the Bank has regular dialogue with these parties and giving due consideration to their feedback.

The collective agreement that is in place with the Ceylon Bank Employees Union covers, among others, salaries and other perquisites, staff loans, and provision of accommodation for employees placed far from home stations. Changes to any of the terms require minimum notice periods (refer table 21). In total, 89.94% of the employee force are members of trade unions with whom the Bank enjoys positive relationships. (refer graph 70) Though the Bank does not have a similar agreement in Bangladesh, the Bank maintains a cordial relationship with its employees.

Minimum notice period

Table – 21

| Type of change |

Minimum notice period |

| Collective bargaining |

36 weeks |

| Transfers |

2 weeks |

| Terminations |

4-12 weeks |

| Retirements |

3-4 weeks |

| Dismissals |

Immediate |

| Voluntary resignation schemes |

As specified in

scheme |