- Introduction

- Strategic

Report- Chairman’s Statement

- Managing Director’s Review

- Board of Directors and Profiles

- Our Value Creation Process – Business Model

- Connecting with Stakeholders

- Materiality Matters

- Risk Review

- Managing Financial Capital

- Funding and Liquidity Management

- Strategic Priorities and Responses

- Outlook for 2018 and Beyond

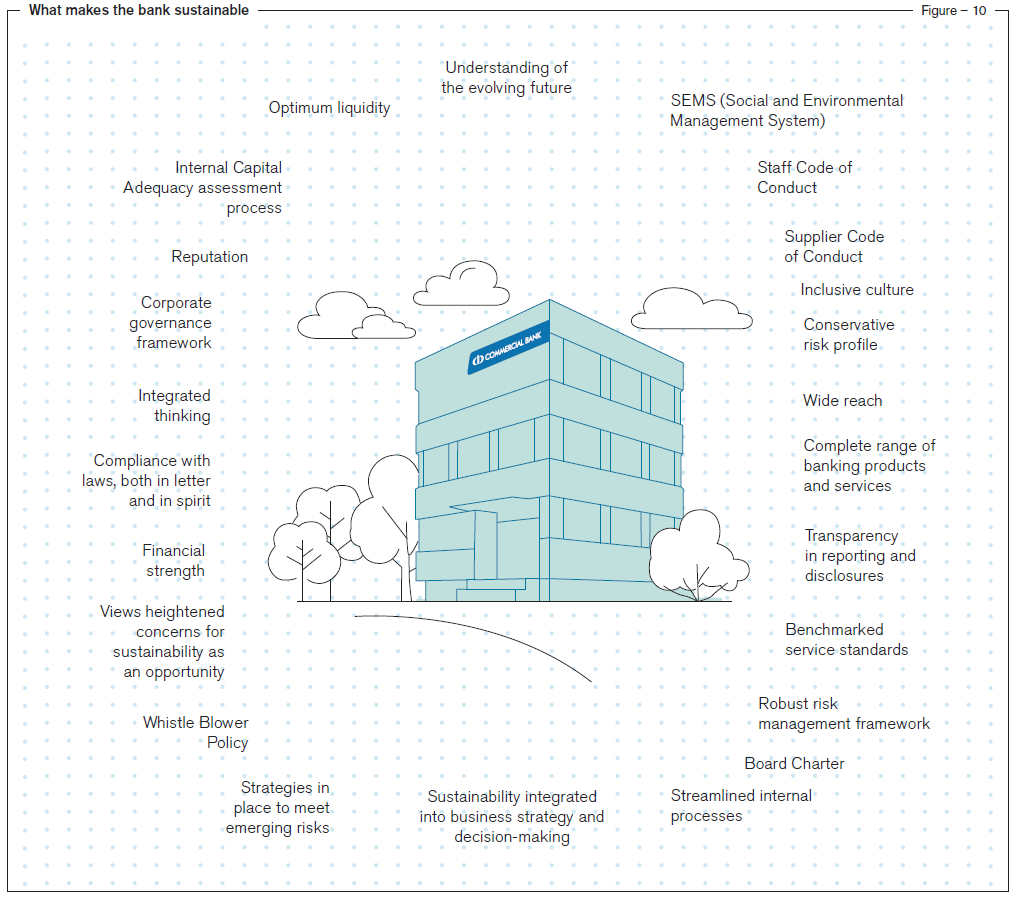

- What makes the Bank Sustainable

- Management Discussion

and Analysis - Governance and

Risk Management- How We Govern

- Corporate Management and Profiles

- Senior Management

- Board Subcommittee Reports

- Board Audit Committee Report

- Board Integrated Risk Management Committee Report

- Board Nomination Committee Report

- Board Human Resources and Remuneration Committee Report

- Board Related Party Transactions Review Committee Report

- Board Credit Committee Report

- Board Investment Committee Report

- Board Technology Committee Report

- Annual Report of the Board of Directors

- Statement of Directors’ Responsibility

- Directors’ Statement on Internal Control

- Assurance Report on Internal Control

- Managing Director’s and Chief Financial Officer’s

Statement of Responsibility - Directors’ Interest in Contracts with the Bank

- Managing Risk: An Overview

- Financial

Reports- Financial Calendar – 2017

- Independent Auditors’ Report

- Financial Statements Highlights – Bank

- Financial Statements – Table of Content

- Income Statement

- Statement of Profit or Loss and Other

Comprehensive Income - Statement of Financial Position

- Statement of Changes in Equity – Group

- Statement of Changes in Equity – Bank

- Statement of Cash Flows

- Notes to the Financial Statements

- Notes to the Financial Statements – General (Notes 1 -11)

- Notes to the Financial Statements – Income Statement (Notes 12 -24)

- Notes to the Financial Statements – Statement of Financial Position: Assets (Notes 25 -48)

- Notes to the Financial Statements – Statement of Financial Position: Liabilities and Equity (Notes 43 -58)

- Notes to the Financial Statements – Other Disclosures (Notes 59 -70)

- Annexes

- Supplementary

Information- Our Sustainability Footprint

- Decade at a Glance

- Income Statement (US Dollars)

- Statement of Financial Position (US Dollars)

- Correspondent Banks and Agent Network

- Group Structure

- Glossary of Financial and Banking Terms

- Acronyms & Abbreviations

- Alphabetical Index

- Notice of Meeting – 49th Annual General Meeting

- Circular to the Shareholders on the Final Dividend for 2017

- Notice of Meeting – Extraordinary General Meeting

- Circular to Shareholders on Proposed Debenture Issue

- Corporate Information