Intellectual capital

The latest business trends, such as digitalisation, disruptive technologies, unorthodox competition, demographic changes, and increasing concerns about sustainability, are shaping the future at an incredible pace. These developments will undeniably challenge conventional business models, making past financial performance less relevant for any assurance about the future potential of a company.

While tangible assets (refer Manufactured Capital section in the chapter on Management Discussion and Analysis) used to be considered the primary driver of a company’s value this view is now obsolete. Mismanaging knowledge-based intangible assets can significantly impair the Bank’s value so great care is taken to safeguard them. Intellectual Capital includes all intangibles that are of value to the Bank, providing it with a competitive advantage, future readiness, and the ability to meet stakeholder expectations. Such intangibles encompass brand, employee knowledge and skills, systems and processes, software, and good governance. The Bank’s Intellectual Capital sets it apart from the competition and impacts its total market value.

The Bank was adjudged the highest ranked private sector bank in the inaugural “Best Sri Lankan Brands in 2017” ranking announced in December 2017 by Interbrand, and was placed fourth overall among the country’s top brands with a value of Rs. 20.33 Bn. Total investment in intangible assets of the Bank stood at Rs. 2.151 Bn.

as at end 2017.

In this section, prudent growth, customer centricity, operational excellence, and risk management are four of the Bank’s strategic imperatives that are explored in relation to Intellectual Capital.

Prudent growth

Brand values. At its heart, collaboration is a social activity that is rooted in generosity, openness and a shared sense of purpose.

In addition to ensuring that all employees are aware of its strategic direction the Bank has also identified five brand values that embody all that it stands for (Figure 19).

Awards and ratings. The outcome of living by its values is the ability to provide a service offering that is unique and differentiated – one that is recognised locally and internally.

Brand Building

Ranked one of the top banks in Sri Lanka as well as in the world, Commercial Bank has been recognised over the years for its excellence. With a rating of AA (lka) from Fitch Ratings Lanka Limited, it is the highest rated private sector bank in the country.

First included in 2008, it is the only

Sri Lankan bank to be included in the World’s Top 1000 Banks consecutively for the past six years. With increasing regional presence, our brand is fast gaining recognition beyond our shores. Awards, Ratings and Accolades bear testimony to our brand building initiatives.

Customer centricity

>Data management. In today’s fast-paced world, understanding the customer means knowing more than just the basics that are covered by the Bank’s KYC (know your customer) policy. Used to experiences with global giants such as Apple and Amazon, customers today expect the Bank to be where they are, whenever they want it. They expect a personalised experience at each contact point with the Bank.

The gap between what a customer wants and what an organisation can provide is often more of a chasm than a gap. Many organisations are unable to find the information they need, when they need it, and lack the knowledge to manage what they know in order to meet the expectations of their stakeholders.

The Bank maintains effective databases that are designed to help it fulfil and exceed stakeholder expectations. These include a management information dashboard for decision-makers, credit card data analytics and a database of information on various industries to help lending officers. Overall customer profitability of its

corporate portfolio is also tracked and monitored monthly.

An internal wiki is also being created to capture the invaluable experience of senior employees in the Bank – including those who have recently retired. To suit the needs of today’s Millennial generation who are used to having information at their fingertips whenever they need it, this database will be eminently searchable.

Customer confidence. The Bank’s goal of maintaining financial stability is just as important as its aim to maintain customer confidence. Its intellectual capital – including corporate governance, risk management frameworks, business ethics and values are the cornerstone of sustaining such continued faith in the Bank.

Responsive Bank. The biannual customer survey revealed that customers were keen to hear more often from their Bank. For this reason the Research and Development Department, in collaboration with the Treasury Department, began producing a monthly economic overview for top customers covering activities in global markets and local macro-economic developments.

Operational excellence

Strategic planning. The Bank’s Research and Development Team assists the Management Team by providing on-demand and monthly management information reports that assist in the development of strategic plans. The economic analysis and forecasts undertaken contribute towards the accurate pricing of products and the minimisation of risks. Other studies cover trends and best practices in the banking industry, contributing towards the Bank’s ethos as a forward-looking organisation and a leader in its field.

Cross-functionality. With the Bank’s network expanding across businesses, time zones and space, so too has the importance of collaboration. In 2015, the Bank set up cross-functional teams to provide customers with a seamless experience. For example, personal banking account holders are able to discuss their corporate account with one person rather than having to visit multiple counters at a branch. During 2016, these teams began fine-tuning systems and processes that would facilitate ease of collaboration. With teething problems overcome, the teams achieved greater collaboration during the year under review.

Communications policy. The Bank has a robust Communications Policy to ensure that the Bank’s operations continue without interruption. It contains a media policy – which identifies members of the senior management team who alone are allowed to speak to the media, including during a crisis. It also consists of a social media policy which outlines how the Bank and its employees should behave online in a manner that safeguards brand and reputation.

Filling skills gaps. Through a Qualification Matrix, skills gaps are identified and actions are taken to plug those gaps – including the recruitment of necessary people, with all new recruits provided with a formal induction programme and the Code of Ethics.

Risk management

Integrated audits. Long-term operational excellence is stymied when the Bank’s actions are outside the scope of regulations. During the year under review the Bank’s Audit, Compliance and Risk teams collaborated more closely with each other, adjusting their strategy so that rather than performing post-mortems of various issues they were providing business and service units with a more proactive and future-oriented service. Continuous near time and real time online monitoring by Audit was one step taken in this new direction. Others included replacing essay-type reports with check lists and symbols that underline ultra-important issues, highlighting issues that affect business performance so that business units are able to prioritise effectively, and bringing in key risk indicators which reflect the Board’s risk appetite into reports.

The Audit team uses two main channels: electronic – where everything from account opening to lending can be audited through online systems, and physical – where on-site visits are necessary for checking signatory documents and other physical assets. The Audit function is also assured a seat at the table for important discussions such as new product development so that their input is received at an early stage.

The Audit function is now geared to move from an assurer’s role to that of a trusted advisor.

The Section on “How we Govern” provides a comprehensive outline of the Bank’s governance structures.

Ensuring its Intellectual Capital is preserved and nurtured is a key goal for any organisation and one that the Bank takes very seriously in its quest to be future ready.

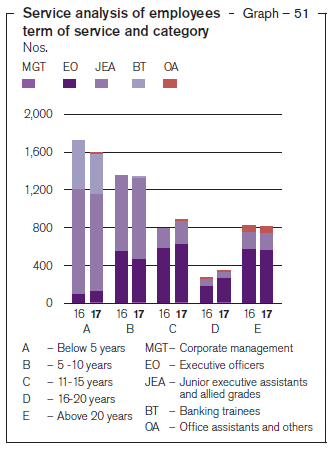

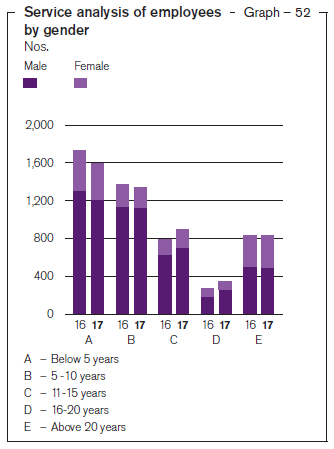

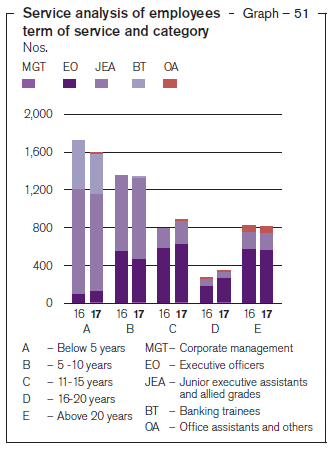

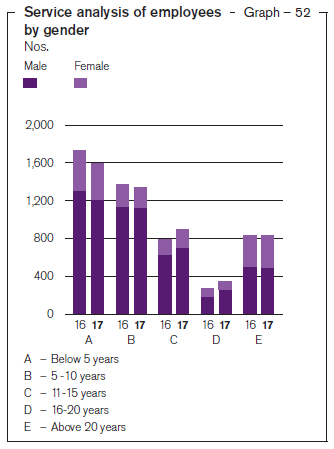

Effective policies. Over the past half century or so the Bank has accumulated a significant amount of institutionalised tacit knowledge. It has 4,982 employees with a cumulative service period of 57,852 years. In addition to those described above, the Bank’s day-to-day operations are guided by a large number of policy documents and manuals which include the following:

Policies

- Compliance

- Credit

- Investment

- Assets and liabilities management

- Risk management

- Related party transactions

- Communication and disclosure

- Human resource management

- Information security

- Outsourcing of business activities

- Anti money laundering

- Social and environmental management

Manuals

Commercial Bank tops private sector banks in Interbrand’s inaugural ranking of country’s best brands

Commercial Bank was the highest-ranked private bank in the inaugural “Best Sri Lankan Brands 2017” ranking announced by the Interbrand, and was placed fourth overall among the country’s top brands. Interbrand assigned a value of Rs. 20.33 Bn. to the Commercial Bank brand.

Commercial Bank wins overall award for Best Annual Report at CA Sri Lanka Annual Report Awards

Commercial Bank won four awards including

the coveted overall award for the best annual report by a Sri Lankan company

Overall Award for the best annual report among banking institutions

Gold Award for management commentary

Silver Award for Integrated Reporting – Best Disclosure on Capital Management.