Natural Capital

Encompassing natural resources including water, soil, earth, and oil, Natural Capital refers to resources that people and animals depend on to live and function. Unlike other forms of capital (such as buildings and infrastructure), which can be created or refurbished regularly, most natural resources are finite; they cannot be replenished. As a responsible organisation our focus continues to be on using Natural Capital in a sustainable manner that ensures it is preserved for future generations.

Our focus on the environment goes beyond the greening of our operations. A firm believer in the importance of responsible stewardship of our planet, Commercial Bank seeks to influence its stakeholders – including customers, business partners and employees – for good. The Bank’s Social and Environment Management System (SEMS) plays a key role in its environment management framework.

This section examines Natural Capital in light of three of the Bank’s strategic imperatives – namely operational excellence, customer centricity, and risk management.

Customer centricity

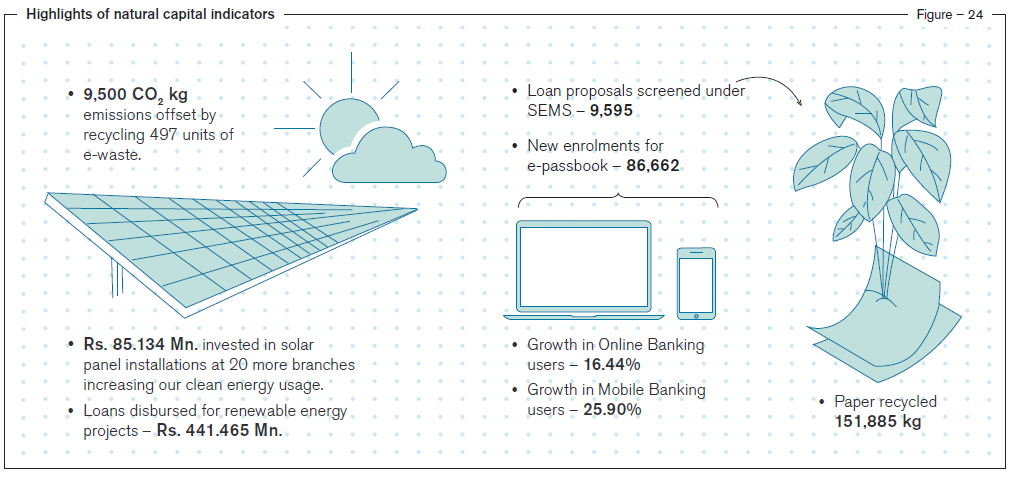

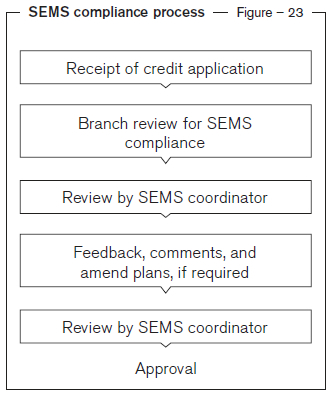

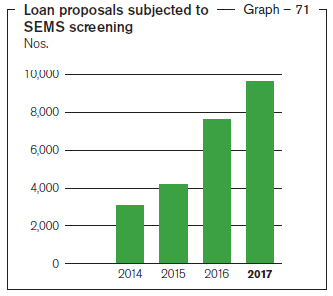

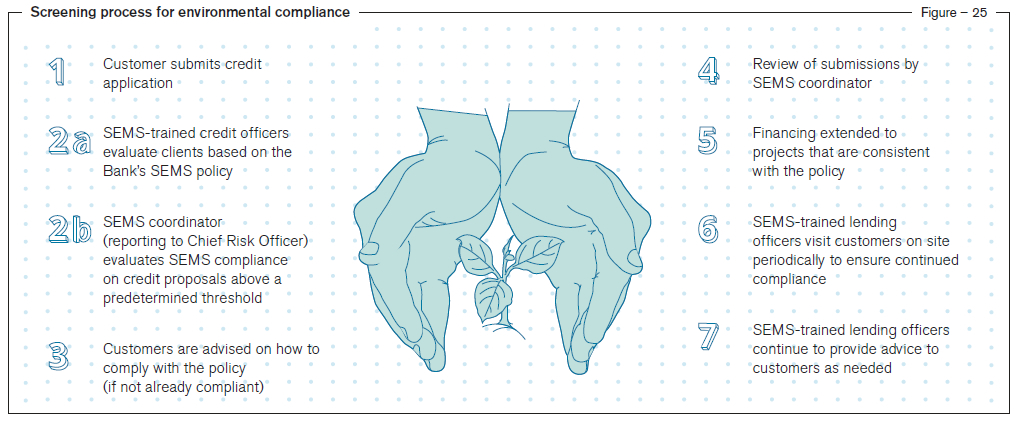

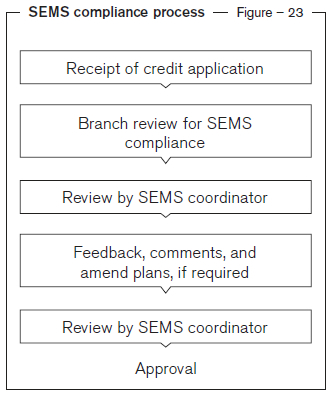

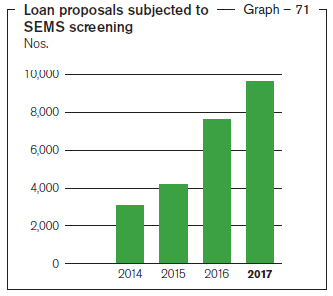

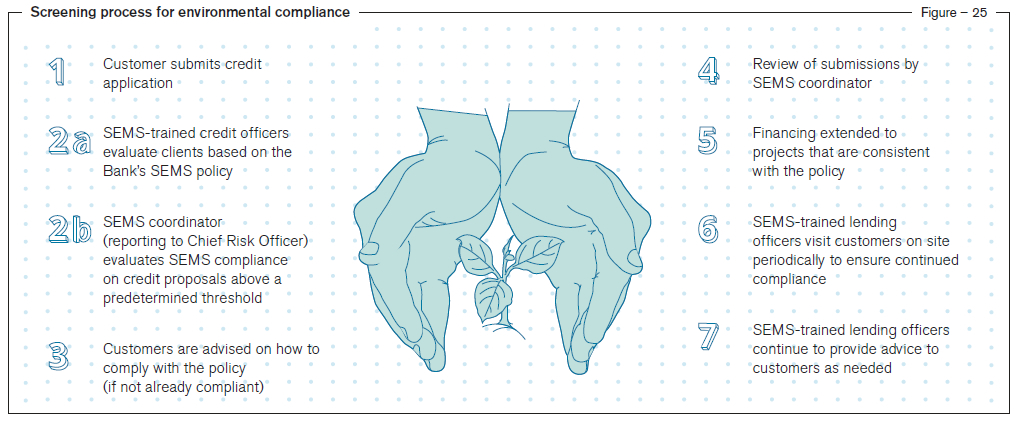

Environmentally responsible financing. At Commercial Bank, our Social and Environmental Management System is always in force when screening loans and advances for customers. This ensures that the Bank is compliant with applicable national laws and regulations on environmental and social issues at all times. This is possibly one of the Bank’s most significant contributions to sustainability because it extends beyond its own actions. Whenever any issues regarding lending decisions are identified through the SEMS policy the Bank works hand-in-hand with customers to educate, advise, and resolve such issues for them throughout the approval process, implementation stage, and beyond (refer graph 71).

Through the introduction of attractive, purpose-designed loan schemes customers are also encouraged to adopt green technologies that reduce their environmental footprint.

The SEMS is also used to screen suppliers and influence them to maintain environmental compliance. Suppliers who do not comply are removed from the Bank’s supply chain.

Risk management

SEMS-trained employees. Dedicated resources have also been allocated specifically to ensure that loans and advances are processed according to the Bank’s SEMS policy.

Operational excellence

Managing inputs. The Bank has implemented procedures to manage consumption in a way that leaves the environment and the organisation more

“fit for the future”.

Managing the following inputs in a sustainable manner while maintaining set goals for materials and energy helps the Bank better manage its cost income ratio.

Materials

A major part of the Bank’s consumption of materials continues to be paper and toner for printers. Reducing our environmental footprint continued to be a key focus during the year under review and included the promotion of:

- E-passbook, by migrating savings accounts holders to paperless mediums which also provided greater convenience.

- Automated banking – including an investment of Rs. 12 Mn. on six ATM machines and Rs. 289 Mn. on 92 automated cash recycler machines (CRM) – to minimise the use of paper and dispense with deposit slips and envelopes.

- Online and mobile banking at branches to migrate customers towards paperless banking.

- E-statements over paper based statements.

- Programmes for employees to reduce and reuse paper more often.

The Bank only engages ethical suppliers who adhere to its Supplier Code of Conduct. This ensures the sourcing of materials that are accredited. The code guarantees that environmental and social standards are adhered to across the value chain and covers the transparent, fair and honest dealings in finances and employees in the suppliers’ respective companies.

Energy

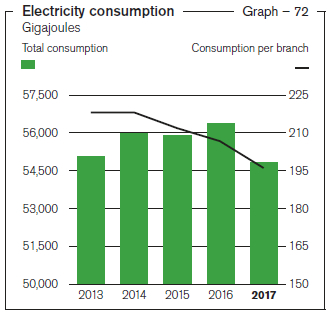

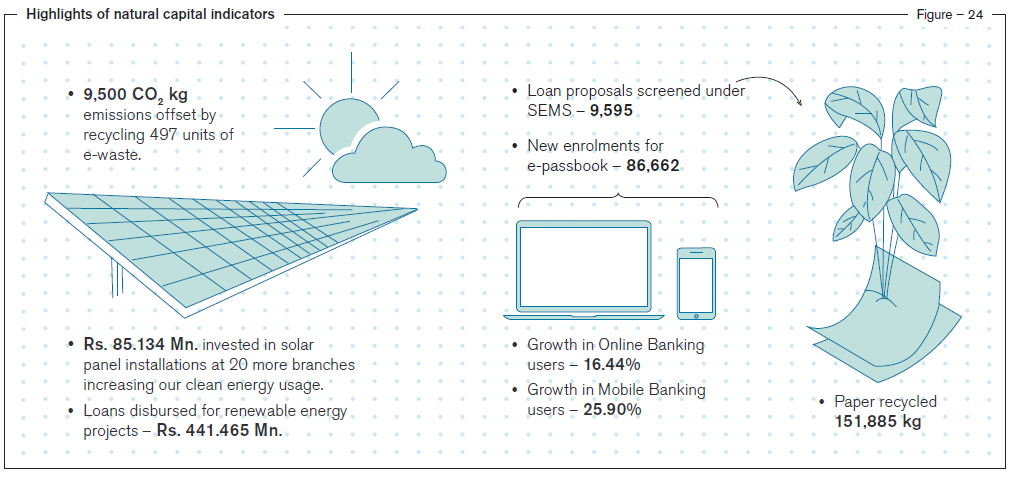

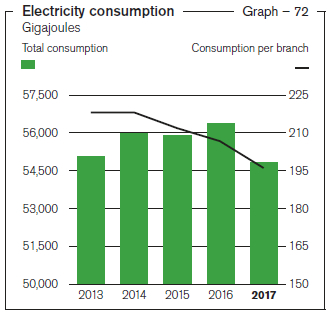

During the year under review 20 more branches were powered by solar energy bringing the total number to 28. Generating 839 kWh of power these branches have contributed towards bringing the Bank’s total energy spend down. The Bank's energy consumptions in 2017 stood at 54,820 Gj, a reduction of 1,539 Gj from 56,359 Gj in 2016 (refer graph 72). All new and newly furbished branches maximise the use of natural light and are equipped with energy efficient lighting and equipment. The photo-cell technology used for interior and exterior branch signage also significantly reduces the Bank’s energy footprint.

The Bank uses and procures IT and other equipment that is energy efficient, with “Energy Star 5” ratings that are compliant with the RoHS (Restriction of Hazardous Substances) standards. When procuring ATM machines it focuses on those that can function without air conditioning and further save energy.

Energy intensity is a measure of an organisation’s energy efficiency. It is measured by the quantity of energy needed to produce a unit output or activity. The use of less energy to provide a service reflects a low energy intensity. The Bank’s energy saving measures and process efficiencies have had a positive impact on

its energy intensity.

Commercial Bank adjudged ‘Most Responsible Bank in Sri Lanka’ by the London based print journal and online resource “Capital Finance International”

This significant accolade was awarded especially in recognition of Commercial Bank’s commitment to improve Green financing – such as renewable energy projects on a large scale – by exploring the Green energy potential in the country.

Water

Being part of the services industry the Bank’s water use is limited to consumption and sanitation purposes. Use of this precious resource is well regulated within the Bank and employees are regularly reminded of the importance of water conservation through awareness programmes and notices in pantries and washrooms.

Managing outputs. Diligent in its responsibility towards the environment and the promise of a better future for all, the Bank is stringent in its management of outputs. Reducing waste and emissions is a priority.

Emissions

- Scope 1, or direct emissions, are negligent for the Bank. They consist mostly of emissions generated from owned motor vehicles and those belonging to senior managers and such numbers are low because the Bank uses a combination of owned and rented vehicles with owned vehicles being in the minority.

- Scope 2 emissions are those generated from purchased electricity. The Bank undertakes many initiatives to reduce such emissions such as the use of natural light, LED lights and solar energy

- Scope 3 emissions are not reported as they are not applicable to the Bank’s operations.

Effluents and waste

The Bank uses waste management companies that follow international standards in disposal practices for the dispatch of e-waste and paper. These third parties are monitored by the Bank’s Services and Information Technology Departments. A total of 9,500 kg of CO2 emissions were offset, during the year under review, by recycling 497 units of e-waste. The Bank further disposed 151,885 kg of used paper for recycling.

The Services Department continues to ensure employees are provided with the knowledge and awareness they need to uphold the Bank’s environmental principles as they engage with suppliers and customers.

Commercial Bank wins international award for Best Sustainable Strategies

A strategic approach to sustainable business won Commercial Bank a prestigious award at the Global Sustainability and CSR Excellence and Leadership Awards in Mumbai, India.