How We Govern

Introduction to governance at the Bank

Growing public distrust of authority, the complexity and dynamism of operations, diverse and often conflicting stakeholder demands and proliferating regulations demand that corporates adopt sound governance practices and be transparent and clear in their public disclosures. Due to the very nature of the business activities where the shareholders’ equity is substantially geared by mobilising public deposits and the resulting fiduciary duty, the application of good corporate governance practices to a bank is even more important. That is why the financial institutions are perhaps the most highly regulated institutions in the world. Stakeholders are increasingly appreciative of the importance of good corporate governance and the role it plays in ensuring that banks are run efficiently and transparently to meet strategic goals and create value for them.

Annual corporate governance report

The pages that follow identify the overarching principles and components of the Bank’s corporate governance framework. They also detail the governance structure and its constituent elements. This together with the extent of compliance with the applicable codes and guidelines on the subject given in Annex 2: Governance constitute the annual corporate governance report. This is required to be published as per the Banking Act Direction No. 11 of 2007 on Corporate Governance which clearly elaborates how well corporate governance is being practiced at the Bank and how the Bank measures up against external benchmarks for governance.

Messrs KPMG, External Auditors of the Bank reviewed the Bank’s compliance with the Banking Act Direction No. 11 of 2007 on Corporate Governance and they have provided their Assurance Statement thereon to the Central Bank of Sri Lanka.

The Bank is committed to high standards of corporate governance, integrity and professionalism and has complied with all the applicable laws, rules, regulations, and codes in the spirit of good governance.

Compliance with the Banking Act Direction No. 11 of 2007 and the Code of Best Practice on Corporate Governance of The ICASL is given in Annex I and II respectively. As the Bank is fully compliant with all requirements of the Banking Act Direction No. 11 of 2007, the CSE has exempted the Bank from disclosure of compliance with the Directions stipulated in Section 7.10 of the Continuing Listing Requirements on Corporate Governance.

Corporate governance framework

The stewardship role of the members of the Board of Directors, corporate, and senior management teams and each and every staff member in the Bank is based on a corporate governance framework which includes governance structures, processes, systems, and policy frameworks and is underpinned by the following overarching principles of good governance:

- Leadership – Steering the Bank to achieve the strategic goals and fulfil stakeholder expectations

- Accountability – Being answerable to the stakeholders for the decisions made

- Integrity – Acting ethically in the best interest of the Bank and the stakeholder and being able to withstand scrutiny of the stakeholders

- Transparency – having clear procedures, roles, and responsibilities for making decisions and exercising power

- Sustainability – Commitment to ensure future vitality of the Bank and create value in the short, medium and long-term for the benefit of all the stakeholders

These principles guide the Bank in all its decisions relating to such aspects as

- Board oversight

- Delegation of authority

- Division of responsibilities

- Resource allocation

- Risk management

- Compliance

- Performance appraisal and compensation

- Related party transactions, and

- Financial reporting

Accordingly, the Bank conducts its affairs with the utmost intellectual honesty and diligence and with due care for the social and environmental obligations.

The Bank reviews its Corporate Governance framework regularly to identify areas for improvement to ensure that all elements of the governance framework are fit for purpose, enabling value creation, and growth.

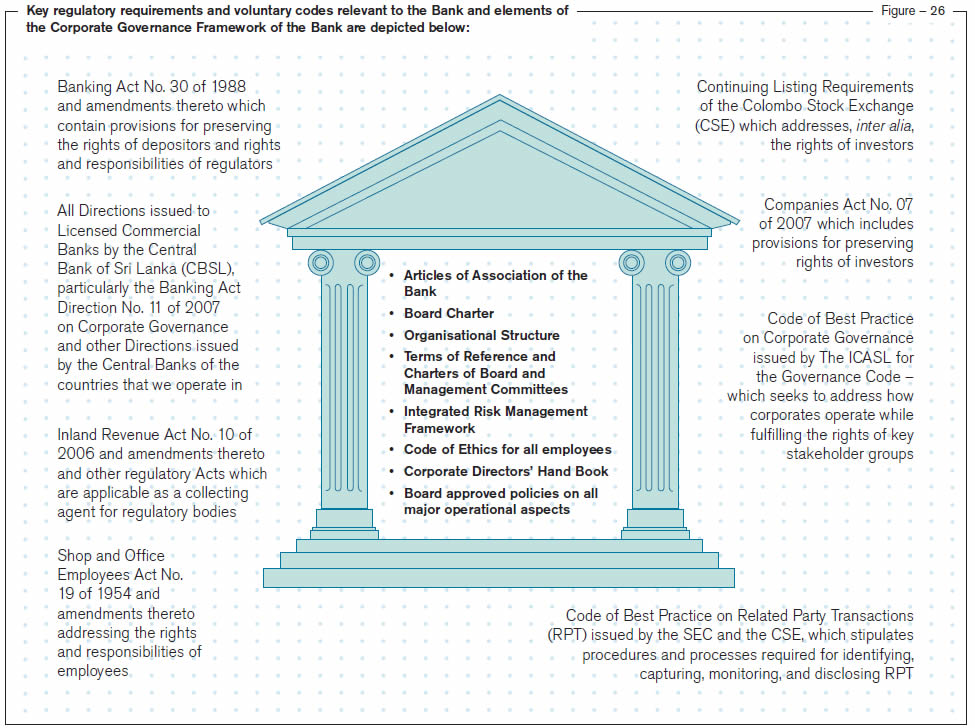

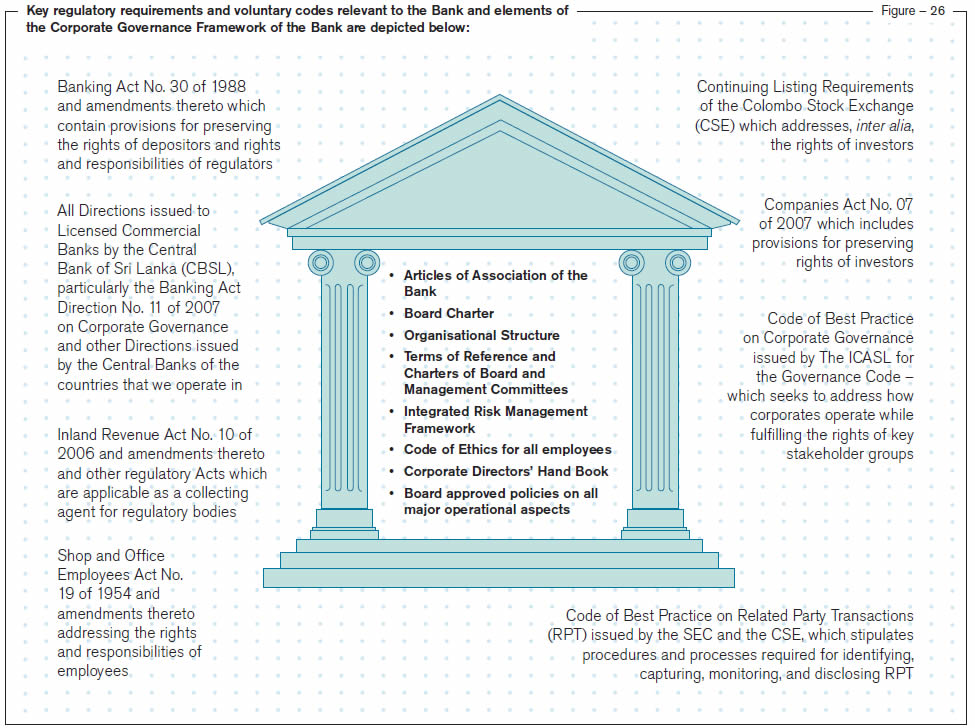

Provisions in a number of statutory enactments, directions, determinations, circulars, and guidelines issued by the regulators under these enactments as well as codes and voluntary guidelines based on global best practice and internal rule books are relevant to the governance of the Bank as shown in the diagram below:

Rules applicable on the Bank share purchases/disposals by the Board of Directors of the Bank have been approved by the Board in the year 2015. The Board approved “Internal Rules applicable on the Bank share purchases/disposals by employees of the Bank” has been issued to the employees. Guidelines have also been included in the Code of Ethics given to the employees by the Bank with regard to insider dealing in securities.

With the objectives of incentivising employees to achieve better performance, retaining staff for a longer period, succession planning for major shareholders and raising equity funding, the Bank has structured Employee Share Option Plans. These plans give a right to the eligible employees to buy

a set number of shares at a fixed price during a given period of time. All these plans have been approved by the shareholders at Extra Ordinary General Meetings (egms).

Governance structure

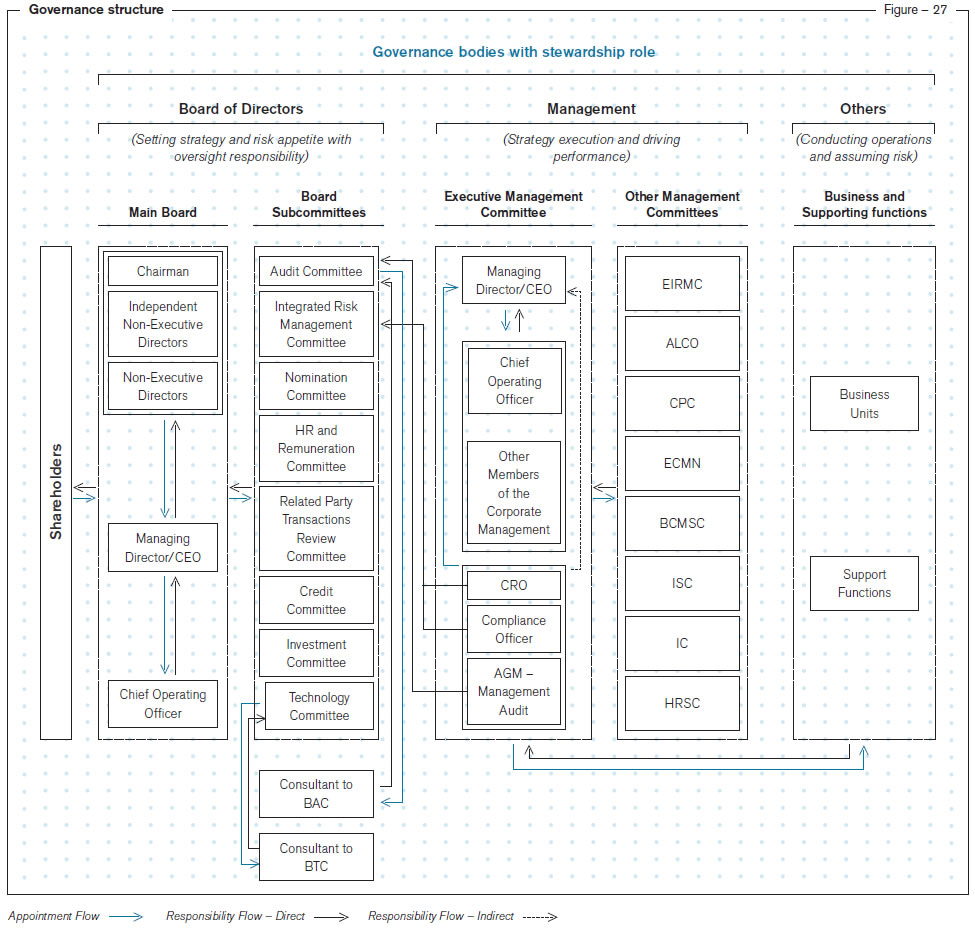

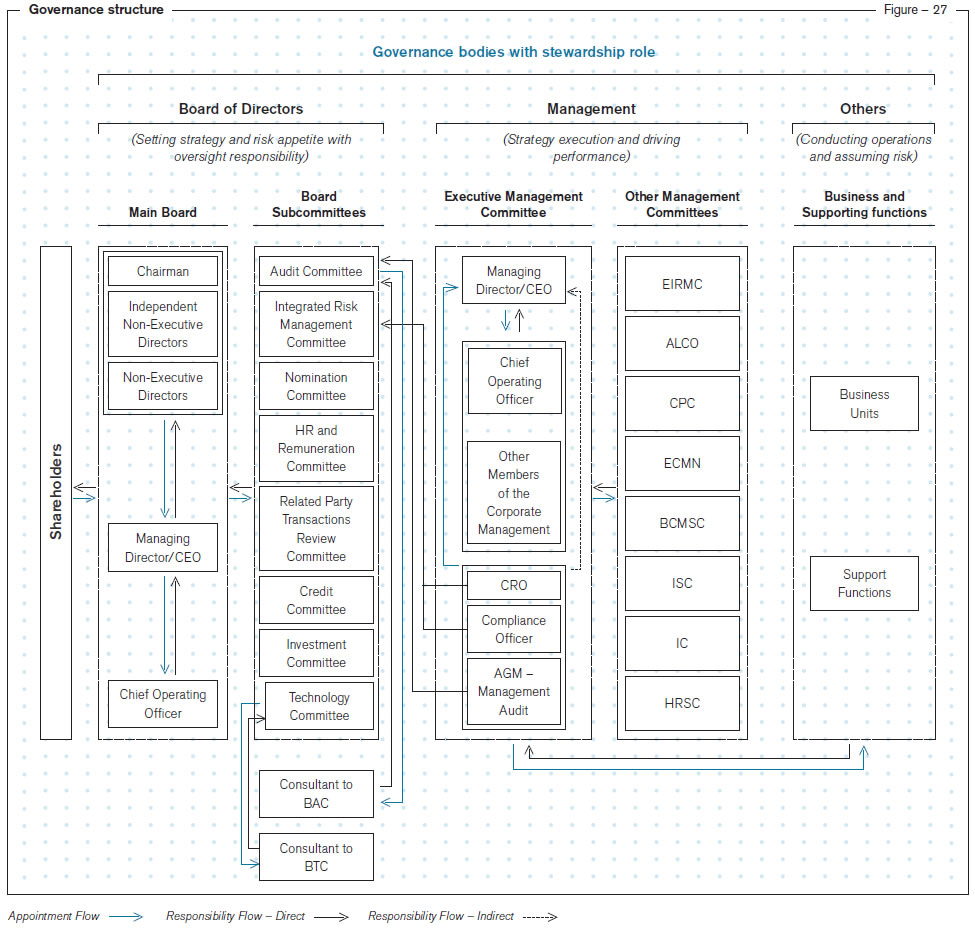

The Bank has established a cohesive governance structure made up of several governance bodies with well-defined roles and responsibilities, greater accountability and clear reporting lines. These include the Board of Directors and several Board subcommittees supported by consultants where necessary with responsibility for setting strategy, risk appetite, and oversight. They also include Management and several Management committees with responsibility for executing strategy and driving performance, and business units and support functions with responsibility and accountability for conducting operations and assuming risk.

Figure 26 provides an overview of the governance structure of the Bank.

BAC - Board Audit Committee, BTC - Board Technology Committee, CRO - Chief Risk Officer, EIRMC - Executive Integrated Risk Management Committee,

ALCO - Assets and Liabilities Committee, CPC - Credit Policy Committee, ECMN - Executive Committee on Monitoring NPAs, BCMSC - Business Continuity Management Steering Committee, ISC - Information Security Council, IC - Investment Committee, HRSC - Human Resources Steering Committee

A proficient board

The Board of Directors is the highest decision-making authority of the Bank and is responsible for providing leadership by setting strategic direction and risk appetite. It also takes responsibility for approving strategies in order to create sustainable value. It oversees Corporate Management who is responsible for day-to-day operations and ensures that an effective system of internal control is in place. The relationship between the Board and the Management can best be described as that of a strategic partner.

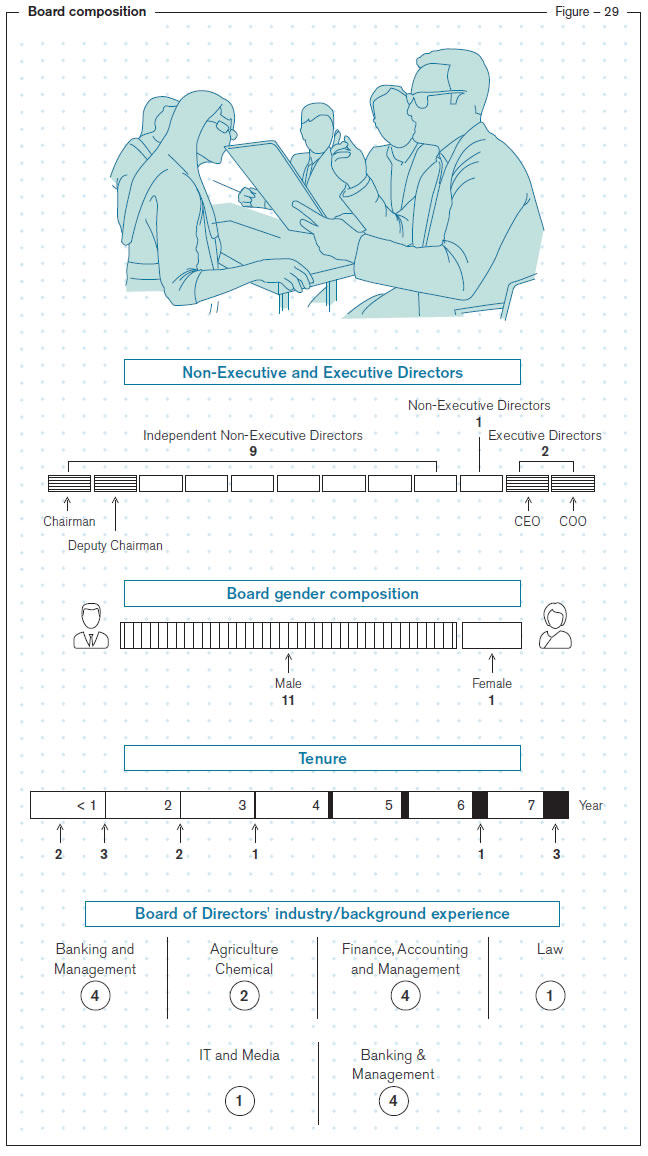

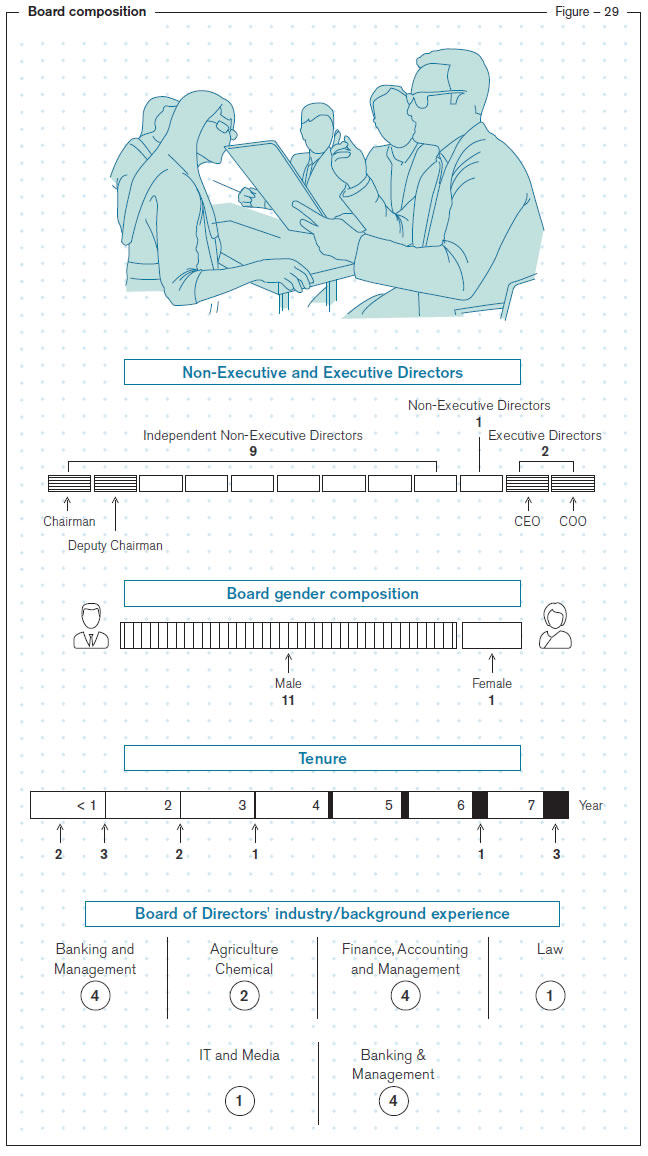

The Board comprises 12 Directors of whom nine are Independent Non-Executive Directors (INEDs) who are eminent professionals in their respective fields with the skills and expertise necessary to constructively challenge management and enrich deliberations on matters set before the Board. They act in the best interest of the shareholders and avoid any conflict of interest. They understand and appreciate the dynamism and complexity of the Bank’s operations, particularly in the wake of new global developments threatening to challenge conventional business models.

Profiles of Board Members are given in the section on Board of Directors and Profiles in the chapter on Strategic Report together with their memberships in Board subcommittees and other significant appointments. The Board is assisted by the Company Secretary,

Mrs Ranjani Gamage, Attorney-at-Law, whose profile is also given in the section on Board of Directors and Profiles in the chapter on Strategic Report.

Collectively they combine expertise in accounting, banking and finance, economics, engineering, information technology, and law, having risen to the highest echelons of Government institutions or commercial organisations, bring their independent judgement to bear on matters reserved for the Board. Bringing together banking, entrepreneurial, investor, and regulatory perspectives, our Board is able to explore matters from diverse points of view to facilitate long-term value creation.

Board process

The Board meets at least once a month based on a schedule of meetings agreed at the beginning of the year. Additional meetings are also convened as and when circumstances require. Directors regularly attend the meetings and actively participate in deliberations. The Chairman is responsible for determining the agenda for the meetings. This agenda is prepared with the assistance of the Company Secretary and the CEO.

The Company Secretary circulates the agenda to the Directors with the accompanying Board papers one week in advance of the meetings, allowing reasonable time for Board members to study and be better prepared for productive deliberations, with urgent Board papers submitted at short notice or tabled at the meetings on an exceptional basis. Board members too can request inclusion of

items in the agenda for discussion.

The Chairman ensures that the Board receives all the information required to fulfil its responsibilities. Board members typically spend at least seven days a month on matters relating to the Board.

The Board is sufficiently diverse enough to enhance dynamics and its effectiveness, promote healthy and constructive exchange of views and embrace different perspectives, leaving no room for group think. Deliberations and decisions made at the meetings are minuted in sufficient detail. In addition to the two Executive Directors, other members of the Corporate Management are invited for meetings on a need basis. Members of the Board are allowed to seek independent professional advice, if necessary, at the Bank’s expense. Directors annually declare their interests and necessary procedures are in place to ensure that there are no conflicts of interest that will compromise independence of the members. The Bank maintains a register of such interests declared. The Directors are covered by a Directors and Officers Liability Insurance Policy.

Board subcommittees

In order to strengthen governance, the Board has delegated authority to eight Board subcommittees. These subcommittees deal with and decide on certain subject-specific and specialised matters. The Board, however, retains responsibility for subcommittee decisions. Four out of five mandatory Subcommittees were formed as required by the provisions in the Banking Act Direction No. 11 of 2007, while the other subcommittee, the Board Related Party Transactions Review Committee was formed in 2014 by early adapting the requirements of the “Code of Best Practice on Related Party Transactions”, issued by the Securities and Exchange Commission of Sri Lanka, which became mandatory from January 01, 2016. The other three voluntary subcommittees have been established considering the business, governance and risk management needs of the Bank as permitted by the Bank’s Articles of Association. These subcommittees have been constituted with Board-approved terms of reference, hold regular meetings and report to the Board.

Their areas of oversight and executive support together with composition and attendance at meetings are summarised below.

Table – 22

Board and Board Subcommittees – Areas of oversight and executive support

| Board subcommittee |

Areas of oversight |

Executive support |

|

|

|

| Mandatory Subcommittees |

Board Audit Committee

(BAC) |

Financial reporting, internal controls,

internal audit, and external audit.

BAC Report is given in the section on Board Sub-Committee Reports |

The Managing Director/CEO, Chief Operating Officer (COO), Chief Financial Officer, Chief Risk Officer, Compliance Officer, and the Assistant General Manager – Management Audit attend the meetings by invitation together with other relevant Key Management Personnel (KMPs).

The Committee is supported by the Inspection Department and the Assistant General Manager – Management Audit serves as the Secretary to the Committee. |

Board Integrated Risk Management

Committee (BIRMC) |

Risk appetite, risk governance, risk policy frameworks, risk monitoring, and compliance,

and risk management.

BIRMC Report is given in the section on Board Sub-Committee Reports |

Chief Risk Officer attends meetings by invitation.

The Committee is supported by the senior staff of the departments handling credit, market, and operational risks.

The Chief Financial Officer serves as the Secretary to the Committee. |

| Board Nomination Committee (BNC) |

Selection and appointment of Directors

and KMPs, succession planning, and evaluating the effectiveness of the Board and its subcommittees.

BNC Report is given in the section on Board Sub-Committee Reports |

Executive support is provided by the Human Resources Department whenever required.

The Company Secretary serves as the Secretary to

the Committee. |

| Board Human Resources and Remuneration Committee (BHRRC) |

Remuneration of Managing Director and KMPs, HR policies including Remuneration Policy, organisational structure, and HR systems including performance evaluation.

BHRRC Report is given in the section on Board Sub-Committee Reports |

Executive support is provided by the Human Resources Department whenever required.

The Deputy General Manager – Human Resource Management serves as the Secretary to the Committee. |

Board Related Party Transactions Review Committee

(BRPTRC) |

Related Party Transactions Policy and processes, market disclosures on Related Party Transactions to the Securities and Exchange Commission (SEC), and quarterly and annual disclosures of Related Party Transactions.

BRPTRC Report is given in the section on Board Sub-Committee Reports |

The Assistant General Manager – Finance serves as the Secretary to the Committee. |

| Voluntary Subcommittees |

Board Credit Committee

(BCC) |

Credit policy and lending guidelines, credit risk control measures including pricing of credit risk, and performance of credit risk indicators.

BCC Report is given in the section on Board Sub-Committee Reports |

The Committee is supported by the Credit Risk Unit of the Integrated Risk Management Department.

The Assistant Company Secretary of the Bank serves as the Secretary to the committee. |

| Board Investment Committee (BIC) |

Review of economic climate, capital markets activity, and economic and monetary policy direction, the Bank’s investment policy, and the review of the Bank’s investment portfolios and their performance.

BIC Report is given in the section on Board Sub-Committee Reports |

Head of Global Treasury, Chief Financial Officer, Head of Global Markets, Assistant General Manager – Corporate and Investment Banking and Chief Risk Officer attend meetings by invitation.

The Committee is supported by the Head of Global Treasury who serves as the Secretary to the Committee. |

| Board Technology Committee (BTC) |

The Bank’s technology strategy, significant procurements of technology, and emerging trends and their potential.

BTC Report is given in the section on Board Sub-Committee Reports |

Deputy General Manager – Marketing and Assistant General Manager – Information Technology attend meetings by invitation.

The Committee is also supported by the IT Department of

the Bank.

Assistant General Manager – Information Technology serves as the Secretary to the Committee. |

Table – 23

Board and Board Subcommittees – Composition and attendance at meetings

| Composition of Board/Board subcommittee |

No. |

Name of Director |

Membership |

Meeting attendance |

|

|

|

Status |

DOA |

Eligible to attend |

Attended |

|

|

|

|

|

|

|

| Main Board |

|

|

|

|

|

|

|

|

| Executive Directors |

2 |

Mr K G D D Dheerasinghe |

C |

NED |

ID |

20.12.2011 |

16 |

16 |

| Non-Executive Directors |

10 |

Mr M P Jayawardena |

M |

NED |

ID |

28.12.2011 |

16 |

16 |

| Independent Directors |

9 |

Mr J Durairatnam |

M |

ED |

NID |

28.04.2012 |

16 |

16 |

| Non-Independent Directors |

3 |

Mr S Swarnajothi |

M |

NED |

ID |

20.08.2012 |

16 |

16 |

| Male |

11 |

Mr S Renganathan |

M |

ED |

NID |

17.07.2014 |

16 |

16 |

| Female |

1 |

Prof A K W Jayawardane |

M |

NED |

ID |

21.04.2015 |

16 |

16 |

| Age below 50 years |

Nil |

Mr K Dharmasiri |

M |

NED |

ID |

21.07.2015 |

16 |

16 |

| Age above 50 years |

12 |

Mr L D Niyangoda |

M |

NED |

ID |

26.08.2016 |

16 |

16 |

|

|

Ms N T M S Cooray |

M |

NED |

ID |

19.09.2016 |

16 |

16 |

|

|

Mr G S Jadeja |

M |

NED |

NID |

19.09.2016 |

16 |

11 |

|

|

Mr T L B Hurulle |

M |

NED |

ID |

05.04.2017 |

11 |

11 |

|

|

Justice K Sripavan |

M |

NED |

ID |

26.04.2017 |

11 |

11 |

| Mandatory Subcommittees |

|

|

|

|

|

|

|

|

| Board Audit Committee (the BAC) |

|

| Executive Members |

2 |

Mr S Swarnajothi |

C |

NED |

ID |

24.08.2012 |

10 |

10 |

| Non-Executive Members |

5 |

Prof A K W Jayawardane |

M |

NED |

ID |

29.04.2015 |

10 |

7 |

| Independent Members |

5 |

Mr K Dharmasiri |

M |

NED |

ID |

28.08.2015 |

10 |

10 |

| Non-Independent Members |

2 |

Ms N T M S Cooray |

M |

NED |

ID |

30.09.2016 |

10 |

8 |

| Male |

6 |

Justice K Sripavan |

M |

NED |

ID |

28.04.2017 |

7 |

7 |

| Female |

1 |

Mr J Durairatnam |

I |

ED |

NID |

28.04.2012 |

10 |

10 |

| Age below 50 years |

Nil |

Mr S Renganathan |

I |

ED |

NID |

17.07.2014 |

10 |

9 |

| Age above 50 years |

7 |

|

|

|

|

|

|

|

| Board Integrated Risk Management Committee (the BIRMC) |

|

|

|

|

|

|

| Executive Members |

2 |

Mr M P Jayawardena |

C |

NED |

ID |

30.12.2011 |

5 |

5 |

| Non-Executive Members |

5 |

Mr J Durairatnam |

M |

ED |

NID |

28.04.2012 |

5 |

5 |

| Independent Members |

5 |

Mr S Swarnajothi |

M |

NED |

ID |

24.08.2012 |

5 |

5 |

| Non-Independent Members |

2 |

Mr K Dharmasiri |

M |

NED |

ID |

21.07.2015 |

5 |

5 |

| Male |

7 |

Mr L D Niyangoda |

M |

NED |

ID |

30.09.2016 |

5 |

4 |

| Female |

Nil |

Mr T L B Hurulle |

M |

NED |

ID |

28.04.2017 |

4 |

4 |

| Age below 50 years |

Nil |

Mr S Renganathan |

I |

ED |

NID |

29.08.2014 |

5 |

5 |

| Age above 50 years |

7 |

|

|

|

|

|

|

|

| Board Nomination Committee (the BNC) |

|

|

|

|

|

|

| Executive Members |

1 |

Mr K G D D Dheerasinghe |

C |

NED |

ID |

30.12.2011 |

6 |

6 |

| Non-Executive Members |

4 |

Mr M P Jayawardena |

M |

NED |

ID |

29.08.2014 |

6 |

6 |

| Independent Members |

3 |

Mr S Swarnajothi |

M |

NED |

ID |

29.04.2015 |

6 |

5 |

| Non-Independent Members |

2 |

Mr G S Jadeja |

M |

NED |

NID |

30.09.2016 |

6 |

5 |

| Male |

5 |

Mr J Durairatnam |

I |

ED |

NID |

29.08.2014 |

6 |

6 |

| Female |

Nil |

|

|

|

|

|

|

|

| Age below 50 years |

Nil |

|

|

|

|

|

|

|

| Age above 50 years |

5 |

|

|

|

|

|

|

|

| Board Human Resources and Remuneration Committee (the BHRRC) |

| Executive Members |

1 |

Mr K G D D Dheerasinghe |

C |

NED |

ID |

30.12.2011 |

5 |

5 |

| Non-Executive Members |

3 |

Mr M P Jayawardena |

M |

NED |

ID |

29.08.2014 |

5 |

5 |

| Independent Members |

3 |

Mr S Swarnajothi |

M |

NED |

ID |

29.04.2015 |

5 |

5 |

| Non-Independent Members |

1 |

Mr J Durairatnam |

I |

ED |

NID |

29.08.2014 |

5 |

5 |

| Male |

4 |

|

|

|

|

|

|

|

| Female |

Nil |

|

|

|

|

|

|

|

| Age below 50 years |

Nil |

|

|

|

|

|

|

|

| Age above 50 years |

4 |

|

|

|

|

|

|

|

| Board Related Party Transactions Review Committee (the BRPTRC) |

| Executive Members |

2 |

Mr K G D D Dheerasinghe |

C |

NED |

ID |

26.12.2014 |

4 |

4 |

| Non-Executive Members |

4 |

Mr J Durairatnam* |

M |

ED |

NID |

26.12.2014 |

4 |

4 |

| Independent Members |

4 |

Mr S Swarnajothi |

M |

NED |

ID |

26.12.2014 |

4 |

4 |

| Non-Independent Members |

2 |

Mr S Renganathan* |

M |

ED |

NID |

26.12.2014 |

4 |

4 |

| Male |

6 |

Mr L D Niyangoda |

M |

NED |

ID |

30.09.2016 |

4 |

4 |

| Female |

Nil |

Justice K Sripavan |

M |

NED |

ID |

28.04.2017 |

2 |

2 |

| Age below 50 years |

Nil |

|

|

|

|

|

|

|

| Age above 50 years |

6 |

|

|

|

|

|

|

|

| Voluntary Subcommittees |

|

|

|

|

|

|

|

|

| Board Credit Committee (the BCC) |

| Executive Members |

2 |

Mr K G D D Dheerasinghe |

C |

NED |

ID |

30.12.2011 |

12 |

12 |

| Non-Executive Members |

2 |

Mr J Durairatnam |

M |

ED |

NID |

29.08.2014 |

12 |

10 |

| Independent Members |

2 |

Mr S Renganathan |

M |

ED |

NID |

25.11.2014 |

12 |

10 |

| Non-Independent Members |

2 |

Prof A K W Jayawardane |

M |

NED |

ID |

29.04.2015 |

12 |

12 |

| Male |

4 |

|

|

|

|

|

|

|

| Female |

Nil |

|

|

|

|

|

|

|

| Age below 50 years |

Nil |

|

|

|

|

|

|

|

| Age above 50 years |

4 |

|

|

|

|

|

|

|

| Board Investment Committee (the BIC) |

|

|

|

|

|

|

| Executive Members |

2 |

Mr K G D D Dheerasinghe |

C |

NED |

ID |

13.03.2013 |

12 |

12 |

| Non-Executive Members |

3 |

Mr J Durairatnam |

M |

ED |

NID |

13.03.2013 |

12 |

12 |

| Independent Members |

2 |

Mr S Renganathan |

M |

ED |

NID |

29.08.2014 |

12 |

12 |

| Non-Independent Members |

3 |

Mr K Dharmasiri |

M |

NED |

ID |

28.08.2015 |

12 |

12 |

| Male |

5 |

Mr G S Jadeja |

M |

NED |

NID |

30.09.2016 |

12 |

9 |

| Female |

Nil |

|

|

|

|

|

|

|

| Age below 50 years |

Nil |

|

|

|

|

|

|

|

| Age above 50 years |

5 |

|

|

|

|

|

|

|

| Board Technology Committee (the BTC) |

| Executive Members |

2 |

Prof A K W Jayawardane |

C |

NED |

ID |

29.04.2015 |

4 |

4 |

| Non-Executive Members |

3 |

Mr J Durairatnam |

M |

ED |

NID |

18.06.2012 |

4 |

4 |

| Independent Members |

3 |

Mr S Renganathan |

M |

ED |

NID |

29.08.2014 |

4 |

4 |

| Non-Independent Members |

2 |

Ms N T M S Cooray |

M |

NED |

ID |

30.09.2016 |

4 |

2 |

| Male |

4 |

Mr T L B Hurulle |

M |

NED |

ID |

28.04.2017 |

3 |

3 |

| Female |

1 |

|

|

|

|

|

|

|

| Age below 50 years |

Nil |

|

|

|

|

|

|

|

| Age above 50 years |

5 |

|

|

|

|

|

|

|

Status

C – Chairman, M – Member, I – By Invitation, ED – Executive Director, NED – Non-Executive Director, ID – Independent Director, NID – Non-Independent Director, DOA – Date of Appointment

Notes:

Mr S M A Jayasinghe (Consultant to BAC) attended 7 out of the 10 meetings held during the year.

Mr D B Saparamadu (Consultant to BTC) attended 3 out of the 4 meetings held during the year.

* Consequent to the reconstitution of the committee as required by the Code of Best Practices on Corporate Governance issued by the ICASL, Mr J Durairatnam and Mr S Renganathan attend meetings by invitation from January, 2018.

Management Committees

In addition to the Board Committees, several Management Committees have been constituted under delegated authority from the

Chief Executive Officer on specific subjects to facilitate decision-making in relation to the execution of the Board-approved strategies.

All the Management Committees have approved terms of reference and operate under a structure and process similar to the

Board Committees. These committees undertake extensive deliberations, cooperate across departments and debate on matters

considered critical for the Bank’s operations as described in the Table 24 below:

Table – 24

Management Committees

| Management Committee |

Purpose and tasks |

Composition |

| Executive Integrated Risk Management Committee (EIRMC) |

Monitors and reviews all risk exposures and risk-related policies and procedures affecting credit, market and operational areas in line with the directives from the BIRMC. |

CEO, COO and key members of the Risk Management, Personal Banking, Corporate Banking, Treasury, Inspection/Internal Audit, Compliance, and Finance Departments. |

| Assets and Liabilities Committee (ALCO) |

Optimises the Bank’s economic goals whilst maintaining liquidity and market risk within the Bank’s predetermined risk appetite. |

CEO, COO and key members of the Treasury, Corporate Banking, Personal Banking, Integrated Risk Management, and Finance Departments. |

| Credit Policy Committee (CPC) |

Reviews and approves credit policies and procedures pertaining to the effective management of all credit portfolios within the lending strategy of the Bank. |

CEO, COO and key members of the Corporate Banking, Personal Banking, Integrated Risk Management, Inspection, Recoveries, and Branch Credit Monitoring Departments. |

Executive Committee on Monitoring

NPAs (ECMN) |

Reviews and monitors the Bank’s Non-Performing Advances (NPAs) above a predetermined threshold to initiate timely corrective actions to prevent/reduce credit losses to the Bank. |

CEO, COO and key members of the Corporate Banking, Personal Banking, Credit Supervision and Recoveries, and Integrated Risk Management Departments. |

| Business Continuity Management Steering Committee (BCMSC) |

Directs, guides, and oversees the activities of the Business Continuity Plan of the Bank in accordance with the Bank’s strategy. |

Key members of the Bank’s Corporate Management covering all business lines. |

| Information Security Council (ISC) |

Focuses continuously on meeting the information security objectives and requirements of the Bank. |

Key members of the Integrated Risk Management, Information Systems Audit, Operations, and IT Departments. |

| Investment Committee (IC) |

Oversees investment activities by providing guidance to the management. |

CEO, COO and key members of the Investment Banking, Treasury, and Finance Departments. |

| Human Resources Steering Committee (HRSL) |

Setting guidelines and policies on any matter that may affect the Human Resource management of the Bank and make recommendations on policy matter to the Board Human Resources and Remuneration Committee and/or address any issues that may need review at Board level. |

CEO, COO, DGM-HRM, DGM-PB, DGM-CB and CFO |

Effective meetings

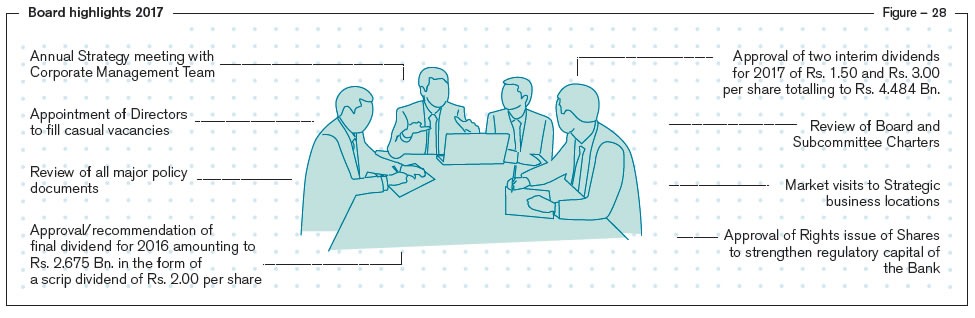

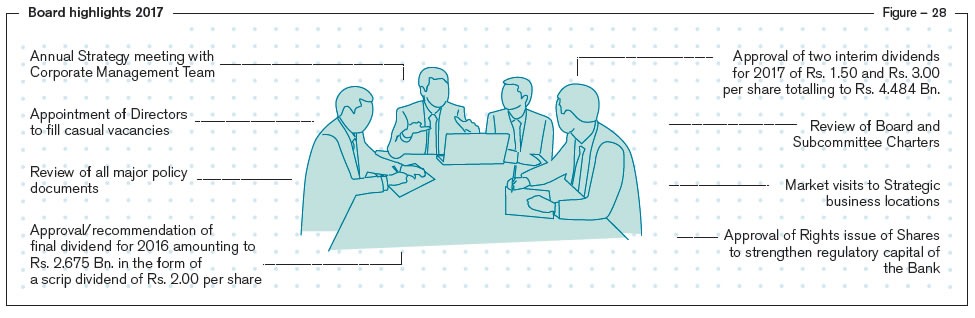

Meetings provide an effective platform for discharging the oversight responsibility of the Board. The Board held 16 scheduled meetings which included one meeting devoted exclusively to strategy with all members of Corporate Management whilst 15 meetings were devoted to matters including large and material transactions, review of performance, review of policy frameworks, and strategy.

During the year, the Board played an active role in strategy formulation providing clear directions to Management for the preparation of the Bank’s five-year strategic plan which was then reviewed and approved at a meeting convened for the purpose. Alternative strategies were explored and evaluated by the Board prior to approval and allocation of resources for execution of the same. The performance review in relation to the strategic plan is a regular agenda item on the monthly Board meetings with significant attention and time devoted to reviewing progress and identifying areas of concern requiring further attention of the Board. Specialised areas identified for oversight by Board subcommittees are monitored by the respective committees who report on progress made and concerns to the Board as outlined in Table 22.

A synopsis of the important matters deliberated and decided upon by the Board during the year is given below:

Board roles and responsibilities

The role of the Board and its responsibilities are set out in the Board Charter which includes a schedule of Powers Reserved for the Board as detailed below.

Roles, responsibilities and powers

of the Board

Role of the Board

- To represent and serve interests of shareholders by overseeing and appraising the Bank’s strategies, policies and performance

- To provide leadership and guidance to the Management for the execution of strategies

- To optimise performance and build sustainable value for shareholders in accordance with the regulatory framework and internal policies

- To establish an appropriate governance framework

- To ensure regulators are apprised of the Bank’s performance and any major developments

Key responsibilities

- Selecting, appointing, and evaluating the performance of the Chief Executive Officer

- Setting strategic direction and monitoring its effective implementation

- Establishing systems of risk management, internal control, and compliance

- Ensuring the integrity of the financial reporting process

- Developing a suitable corporate governance structure, policies and framework

- Strengthening the safety and soundness of the Bank

- Appointing and overseeing the External Auditors’ Responsibilities

- Approving interim and annual financial statements for publication

Powers reserved for the Board

- Approving major capital expenditure, acquisitions and divestitures, and monitoring capital management

- Appointing the Board Secretary in accordance with Section 43 of the Banking Act No. 30 of 1988

- Seeking professional advice in appropriate circumstances at the Bank’s expense

- Reviewing, amending and approving governance structures and policies

The positions of Chairman and CEO are separate in line with best practice in Corporate Governance facilitating a balance of power and authority. The Chairman is a Non-Executive Director while the CEO is

an Executive Director appointed by the Board and their roles are clearly set out in the Board Charter.

Role of Chairman

The Role of the Chairman is distinctive with clear and effective separation of accountability and responsibility as set out in the Board Charter. The Chairman establishes good corporate governance and the highest standards of integrity and probity throughout the Group. He provides leadership to the Board, preserving order, and facilitating the effective discharge of the duties of the Board. He is also responsible for ensuring the effective participation of all Directors and maintaining open lines of communication with KMPs, acting as a sound Board on strategic and operational matters.

Role of the CEO

The Role of the CEO as set out in the Board Charter requires him to conduct the management functions as directed by the Board. The Board sets corporate objectives for the CEO and jointly develops his duties and responsibilities. The CEO is responsible for leading the Management in the day-to-day business operations of the Bank and implementing strategies, plans, and budgets approved by the Board.

The CEO conducts the affairs of the Group upholding good corporate governance and the highest standards of integrity and probity as established by the Board.

Role of Independent Non-Executive Directors

Independent Non-Executive Directors are expected to complement the skills and experience of the other members of the Board by bringing an objective and independent view on matters, challenging the Board and Management constructively using their expertise and assisting in providing guidance on strategy.

Role of Company Secretary

The Company Secretary plays a critical role in facilitating good Corporate Governance and her responsibilities are summarised below:

- Ensure conduct of Board and General Meetings in accordance with the Articles of Association, the Board Charter, and relevant legislations;

- Maintain statutory registers;

- Communicate promptly with the regulators and shareholders and file statutory returns in time;

- Facilitate best practice on Corporate Governance including assisting the Directors with respect to their duties and responsibilities;

- Facilitate access to legal advice in consultation with the Board, where necessary.

The appointment and removal of the Company Secretary is a matter for the Board as a whole.

Appointment of Directors

The BNC has set in place a formal and transparent procedure for nomination of candidates for appointment as Directors. The BNC evaluates the resumes of potential candidates as recommended by the Board for consideration as Non-Executive Directors and makes recommendations to the Board for nomination. Such nominations may include an interview with the candidate.

This process is based on an annual assessment of the combined knowledge, experience, and diversity of the Board in relation to the Bank’s strategic plans in order to identify additional perspectives to ensure its effectiveness at all times.

The process for appointing Executive Directors is similar except that candidates are selected from amongst the KMPs of the Bank.

Appointments of new Directors are communicated to the CSE and shareholders through press releases subsequent to obtaining approval from the CBSL.

The communications typically include a brief résumé of the Director, relevant expertise, key appointments, shareholding and his status of independence.

Re-election

The two longest serving NEDs offer themselves for re-election at each AGM in rotation with the period of service being considered from the last date of re-election or appointment. If there are more than two Directors who qualify for re-election, the Directors may decide amongst themselves

or draw lots to determine the Directors who will offer themselves for re-election.

If a Director has been appointed as a result of a casual vacancy that has arisen since the previous AGM, that Director will offer himself for re-election at the immediately succeeding AGM.

Mr T L B Hurulle and Justice K Sripavan were appointed to the Board during the year to fill casual vacancies and are offering themselves for re-election at the AGM to be held on March 28, 2018.

Induction and training of Directors

On appointment, Directors are provided with access to the electronic support system for Directors which archives minutes for the past two years and an induction pack which comprises the Articles of Association, Banking Act Directions, Corporate Directors’ Handbook published by the Sri Lanka Institute of Directors, Code of Best Practice on Corporate Governance, the Bank’s organisational structure, Board Charter and the most recent Annual Report of the Bank. All Directors are encouraged to obtain membership of the Sri Lanka Institute of Directors which has a robust programme to support Directors. It is mandatory for the Directors to attend Director Forums organised by the Central Bank of Sri Lanka. Members of the Corporate Management and external experts make regular presentations with regard to the business environment in relation to the operations of the Bank.

Directors’ and Executive Remuneration

The BHRRC is responsible for making recommendations to the Board regarding the remuneration of Executive Directors.

This vital committee comprises entirely of NEDs who also meet the criteria for independence as set out in the Code.

They consult the Chairman and the CEO regarding the same and also seek professional advice whenever it is deemed necessary. Remuneration for NEDs is set by the Board as a whole. Remuneration for Executive Directors is set out with reference to the Remuneration and Benefit Policy. These processes ensure that no individual Director is involved in determining his or her own remuneration. The Board and the BHRRC engage the services of HR professionals on a regular basis to assist in the discharge of their duties in this regard.

Remuneration and Benefits Policy

The Remuneration and Benefit Policy seeks to provide a distinctive value proposition to current and prospective employees that attracts and retains people with capabilities and values in line with the business needs of the Bank. It must also provide a framework for the employer to design, administer, and evaluate effective rewards programmes to inspire and motivate desired behaviours and results.

The level and make up of remuneration

It is the responsibility of the BHRRC to ensure that the remuneration of both Executive Directors and NEDs is sufficient to attract eminent professionals to the Board and retain them as contributing members in driving the performance of the Bank. Remuneration and benefits of the Executive Directors and KMPs are determined in accordance with the remuneration policies of the Bank which are designed to be attractive, motivating and capable of retaining high performing, qualified, and experienced employees at the Bank.

The total remuneration of KMPs is made up of three components, guaranteed remuneration being the fixed component and the annual performance bonus and Employee Share Option Plan (ESOP) being the variable components. The Bank makes every effort to be transparent of the basis of granting ESOPs and their features when approval is sought from the shareholders. The Executive Directors of the Bank who are employees are also eligible for these ESOPs in the capacity of employees. The BHRRC seeks the assistance of professionals in structuring the remuneration and benchmarking with market on a regular basis to ensure that total remuneration levels remain competitive in order to attract and retain key talent whilst balancing the interests of the shareholders. It also takes into consideration the views of the Bank’s two employee associations – the Association of Commercial Bank Executives and the Ceylon Bank Employees Union (CBEU) with whom they maintain a regular dialogue.

Guaranteed pay includes the monthly salary and allowances which are determined with reference to the qualifications, experience, levels of competencies, skills, roles, and responsibilities of each employee. These are reviewed on an annual basis and adjusted for promotions, performance and inflation. The annual performance bonus is determined with reference to a multi-layered performance criteria matrix which is clearly communicated to the relevant categories of employees.

The ESOP approved by the shareholders at the AGM held on March 31, 2015 is also part of the performance-related remuneration for Executive Officers in Grade 1A or above. NEDs are not eligible for ESOPs of the Bank.

Refer Notes 53.2 and 54to the Financial Statements on “Share-based Payment” for details of the ESOPs and the eligibility criteria.

There are no compensation commitments in employment contracts for early terminations and there were no instances of early termination during the year that required compensation.

Board and Subcommittee evaluations

The Board and its Subcommittees annually appraise their own performance to ensure that they are discharging their responsibilities satisfactorily in accordance with the Board Charter which includes the responsibilities set out in the Governance Code and the Banking Act Direction No. 11 of 2007. This process requires each Director to fill a Board Performance Evaluation Form which incorporates all criteria specified in the Board Performance Evaluation Checklist of the Governance Code. The responses are collated by the Company Secretary and submitted to the BNC and discussed at a Board meeting. Board evaluations for 2016 at the January 2017 Board Meeting.

Appraisal of the CEO

The Board assesses the performance of the CEO on an annual basis and this is a matter reserved for the Board as a whole. Assessment criteria are agreed with the CEO at the beginning of the year and performance is reviewed formally based on same at

the end of the financial year taking into account the operating environment.

The Chairman discusses the evaluation with the CEO and responses received are given due consideration prior to approval of the same which is finalised within four months of the close of the financial year. The Board is supported by the BHRRC in this process.

Shareholder relations

The Bank has 9,812 shareholders of which 5.63% are institutional shareholders holding 79.97% voting ordinary shares and the balance 94.37% are retail investors.

They play a key role in the re-election of Directors and the External Auditor.

They also vote on material matters including the adoption of the Annual Report and Accounts. The Bank recognises that the engagement with shareholders and potential investors is part and parcel of good corporate governance and has a structured process in place to facilitate same.

All Shareholders are encouraged to participate at the AGMs and exercise their votes. Consequently, a total of 228 Voting and 107 Non-Voting shareholders attended the Annual General Meeting held on

March 30, 2017 while a further 159 Voting shareholders exercised their right to vote through proxy.

A Shareholder Communication Policy is in place to ensure that there is effective and timely communication of material matters to shareholders. Accordingly, shareholders were notified of quarterly results, dividend declarations, resignation, and appointment of Directors through announcements made to the CSE and the media. The Bank’s website also has an area dedicated to investors which includes Interim Financial Statements and Annual Reports with the most recent report being offered in both a PDF format as well as an interactive format to facilitate readability. The Interactive Report also has a tab for investor feedback. In addition to financial information, the Bank also provides Risk Management information to address the concerns of investors.