Capital Management

Financial Capital

Financial capital plays multiple roles in the case of a financial sector organisation. It facilitates the expansion of operations by acquiring physical property, plant and equipment (manufactured capital) at the inception, and the perpetuation of operations by acting as a cushion for absorbing unforeseen losses as a going concern. It also serves as a regulatory restraint on unwarranted asset expansion. Maintaining adequate capital for absorbing unanticipated losses is imperative for the vibrancy of the financial intermediation and maturity transformation roles of a bank since these roles expose banks to a gamut of risks.

Financial Review

An overview

Continuing on the stellar performance the Bank is renowned for, we recorded another excellent year in terms of overall performance. With compounded annual growth rates of 17.44%, 16.94% and 16.83% respectively, total assets, loans and receivables, and deposits again doubled over the past five years. Our growth rates in

Sri Lanka have been in excess of the industry averages, enabling us to enhance our market share in total assets from 10.04% in 2012 to 11.11% in 2017.

Profit attributable to equity holders increased to Rs. 16.581 Bn., a growth of 14.25% compared to 2016. This is particularly significant since it is higher than the

“natural growth” the Bank could have achieved under normal circumstances with an estimated GDP (gross domestic product) growth of 3.7% and an inflation rate of 7.1% for the year, a reflection of the effective execution of a focussed strategy.

The Bank achieved growth of over Rs. 100 Bn. each in both loans and receivables (for the third consecutive year) and deposits (for the second consecutive year) during the year.

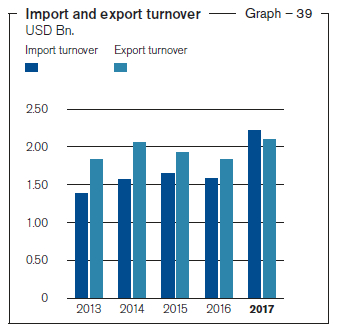

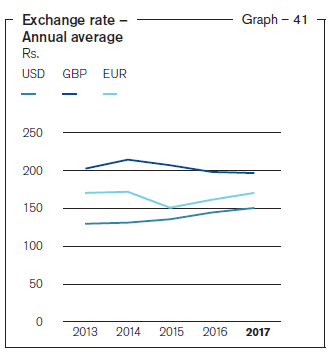

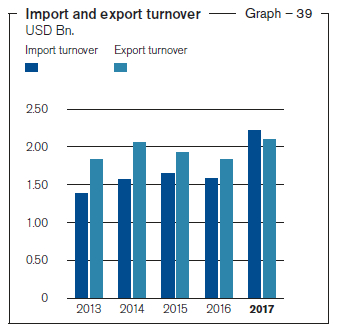

A highlight of the year was the significant increase in trade finance business of the Bank. Imports turnover grew by 39.33% over 2016, increasing the Bank’s market share to 10.56% from 8.36% in 2016. Exports turnover grew by 14.58% over 2016, increasing the Bank’s market share to 18.58% from 17.82% in 2016.

Commercial Bank ranked among World’s Top 1000 Banks for 7th successive year

Commercial Bank has been ranked in this prestigious global list compiled by “The Banker” magazine of the UK since 2010.

Demonstrating the perceived potential and future prospects of the Bank and the underlying value of its shares, the Bank’s shares were trading at a premium to their book value with a price to book value ratio

of 1.26 times as at December 31, 2017

(1.65 times as at December 31, 2016), the highest among all the banks listed on the Colombo Stock Exchange.

Having due regard to dividend policy, the capital requirements to support growth plans, and the increase in the number of shares consequent to the rights issue, the Board of Directors has declared a final dividend of

Rs. 2.00 per share in the form of shares, taking the total dividend to Rs. 6.50 per share for the year which is consistent with dividends paid for the past five years.

Given that the Bank accounted for 98.92% of the assets and 99.73% of the profit of the Group, the analysis below refers to the Bank’s financial performance. A brief commentary on Group performance is given later in this section.

Income Statement

Fund based operations

Interest income which accounted for 89.14% (86.68% in 2016) of the gross income of Rs. 115.594 Bn. grew to Rs. 103.034 Bn.

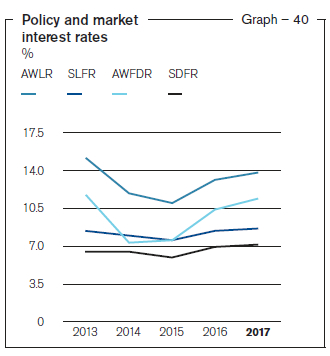

during the year from Rs. 80.738 Bn. in 2016 recording a growth of 27.62%. The main contributory factors were the growth in average interest earning assets by Rs. 110.269 Bn. (12.80%), the average interest rate thereon improving by 123 basis points to 10.60%, and the improvement in asset quality.

Interest expenses, which accounted for 62.13% of the interest income (59.35% in 2016), grew by 33.59% to Rs. 64.011 Bn.

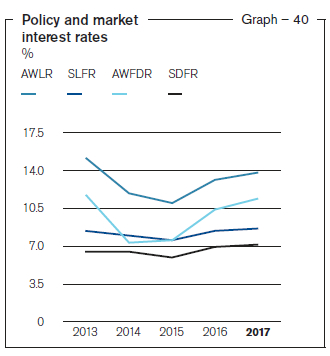

for the year, up from Rs. 47.915 Bn. in 2016. The main contributory factors were the growth in average interest bearing liabilities by Rs. 102.560 Bn. (12.96%), continuing decline of the CASA ratio to 39.23% from 41.67% in 2016, and the average interest rate increasing by 111 basis points to 7.16%.

Consequently, net interest income grew by 18.89% (compared to 8.17% in 2016) to Rs. 39.023 Bn. from Rs. 32.824 Bn. in 2016, accounting for 78.02% of the total operating income. This compares well against the growth of 12.24% in net interest income (NII) of the banking sector for the year. Net interest spread improved to 3.44% from 3.32% in 2016. Net interest income as a percentage of average assets of 3.62% too compares well with the 3.50% for the banking sector.

Vibrancy of financial intermediation

Table – 10

|

2017 |

2016 |

2015 |

2014 |

2013 |

| Average interest earning assets (%)* |

84.99 |

85.11 |

87.77 |

80.92 |

83.42 |

| Average interest bearing liabilities (%)* |

78.20 |

78.20 |

77.90 |

71.11 |

74.38 |

* As a % of total assets

Fee based operations

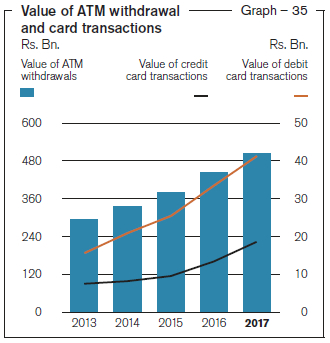

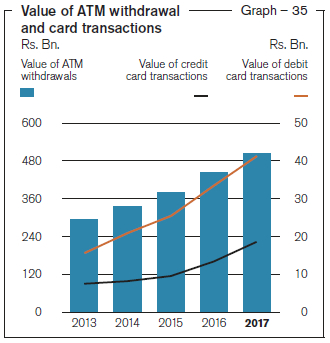

Fee and commission income too recorded

an impressive growth of 24.88% to

Rs. 10.169 Bn. for the year. The sources that recorded significant growth included services related to credit and debit cards, trade finance and remittance, and deposits. This was consequent to the Bank managing to significantly increase the number of credit and debit cards in issue as well as their utilisation, enhancing the Bank’s market share in both the trade finance and remittance business.

Fee and commission expenses which relate mostly to credit and debit cards related services increased by 38.96%. Consequently, net fee and commission income increased by 22.62% to Rs. 8.602 Bn. accounting for 17.20% of the total operating income (15.91% in 2016).

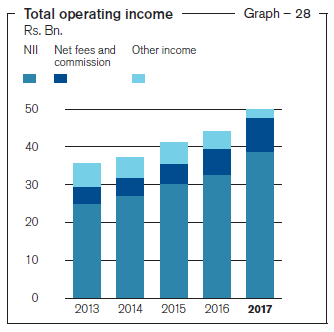

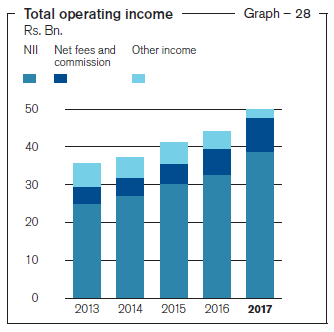

Total operating income

Improvements in NII and net fee and commission income as explained above coupled with the net gains from trading of

Rs. 233.956 Mn. (mainly as a result of exchange gains of Rs. 107.201 Mn. compared to an exchange loss of Rs. 1.429 Bn. in 2016) contributed to a growth of 13.41% in the total operating income amounting to Rs. 50.016 Bn. The relative contribution to total operating income from other income, however, declined compared to 2016 due to lower gains on the revaluation of foreign exchange.

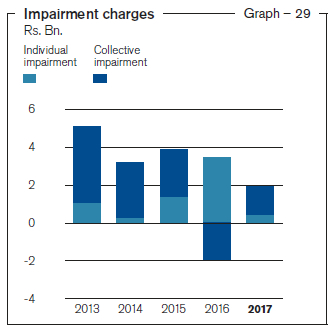

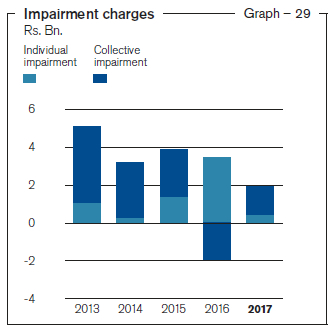

Impairment charges

Impairment charges for loans and other

losses for the year increased by 25.13% to Rs. 1.914 Bn. from Rs. 1.530 Bn. This comprised individual impairment charges of Rs. 401.716 Mn. (compared to Rs. 3.440 Bn. in 2016) and collective impairment charges of Rs. 1.554 Bn. (compared to a reversal of

Rs. 1.932 Bn. in 2016). Significant fluctuations in individual and collective impairment charges compared to 2016 are due to a revision of thresholds for identifying the loans to be subject to individual impairment in 2016 and the resulting shift of a sizable portfolio from collective impairment to individual impairment. Despite an improvement in asset quality, as reflected by a decline in the NPL ratio, the NPLs in absolute terms marginally increased. The substantial growth in the loan book recorded during the year too contributed to the increase in collective impairment provision.

Cumulative provision for collective and individual impairment was Rs. 17.261 Bn.

as at December 31, 2017 compared to

Rs. 17.373 Bn. as at end 2016.

Operating expenses

Total operating expenses increased by 6.49% to Rs. 20.038 Bn. for the year from Rs. 18.816 Bn. in 2016. While the increase corresponds to the general increase in prices due to inflationary pressures and the impact of VAT increase on general expenses, certain cost elements such as establishment expenses, maintenance of property, plant and equipment, and office administration expenses witnessed increases corresponding to the expansion of the Bank’s operations through conventional as well as alternate channels.

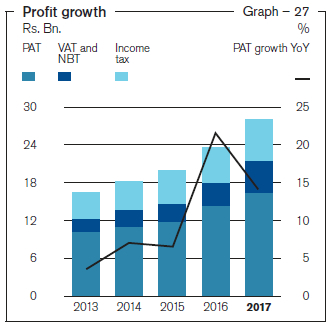

However, the benefit of the lower growth in operating expenses compared to the growth in operating income was partly offset by the significant increase in VAT (Value Added Tax) and NBT (Nation Building Tax) on financial services by 31.80% to Rs. 4.881 Bn. from Rs. 3.703 Bn. This was mainly due to the increase in VAT on Financial Services from 11% to 15% effective November 1, 2016, the full year’s impact of which was felt in 2017. Consequently, operating expenses including VAT and NBT on financial services increased by 10.65%.

More importantly, cost to income ratio decreased to 49.82% from 51.06% in 2016 and also the cost to income ratio excluding VAT and NBT on financial services improved to 40.06% from 42.67% in 2016.

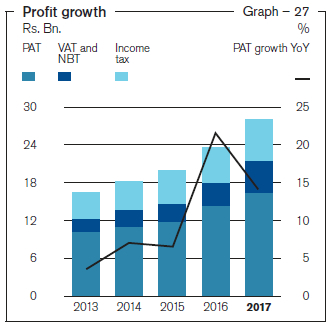

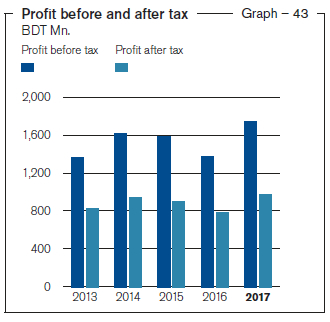

Profit before tax and profit after tax

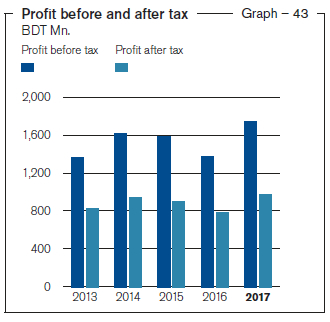

Profit before tax increased to Rs. 23.183 Bn.

for the year, up by 15.62% from

Rs. 20.051 Bn. reported in 2016. Income tax for the year increased by a higher percentage of 19.19%, thereby limiting the profit after tax to Rs. 16.581 Bn. which resulted in a lower growth of 14.25% compared to 21.92% reported for 2016.

The higher increase in income tax was mainly due to the VAT and NBT on Financial Services being disallowed for tax purposes.

Accounting for 57.24%, Personal Banking Division made the highest contribution to the profit before tax, followed by 24.59% from the Corporate Banking division, 17.63% from International Operations and less than 1% from Treasury.

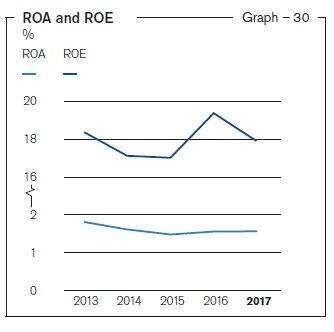

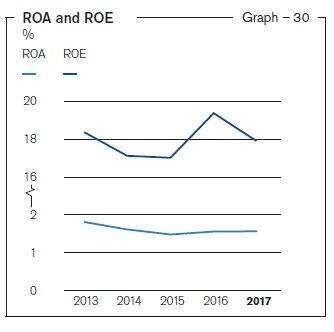

Profitability

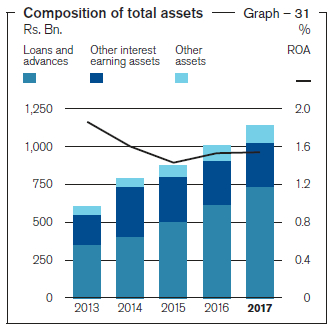

Reflecting the growth in profit for the year and average assets at approximately similar rates, Return on Average Assets marginally improved to 1.54% from 1.53% reported in 2016. However, Return on Average Equity decreased to 17.88% from 19.52% reported in 2016 due to average equity growing at 24.72% during the year compared to growth in profit for the year by 14.25% only. The reasons for higher growth in average equity was the infusion of Rs. 10.144 Bn. through the rights issue in June 2017 (but the funds were utilised only for part of the year for income generation), gains recognised in Other Comprehensive Income on favourable movement in the mark to market valuation of the Available-For-Sale portfolio and the recognition of the surplus on revaluation of land and buildings in December 2017.

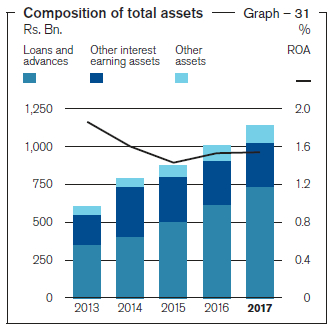

Statement of Financial Position

Assets

Total assets of the Bank grew by 12.96% during the year and reached Rs. 1.143 Tn. at the year end compared to Rs. 1.012 Tn. as at December 31, 2016. It is noteworthy that of the growth in total assets in absolute terms of Rs. 131.173 Bn. during the year, 92.49% or Rs. 121.317 Bn. came from loans and receivables, reflecting the robustness of the Bank’s primary activities of financial intermediation and maturity transformation. The asset growth of the banking industry moderated to 13.77% for the year.

Contribution from the Bank’s International Operations now accounts for 11.50% of total assets and 17.63% of profit before tax.

Loans and receivables

Loans and receivables is the single biggest asset of the Bank on its balance sheet, accounting for 64.50% of total assets compared to 60.86% a year ago. The Bank continued to sustain its growth momentum in loans and receivables from last year, recording a 19.71% growth to

Rs. 737.447 Bn. as at December 31, 2017 compared to Rs. 616.018 Bn. a year ago. This compares well with the industry growth of 16.18% for the year as well as our own 5-year CAGR of 16.94%. Key contributors to the loans and receivables growth came from term loans, overdrafts, and housing loans. Heightened focus on SMEs, new customer acquisition, higher Single Borrower Limit, etc. contributed to this achievement.

Asset quality

With loans and receivables accounting for two thirds of total assets, the importance of a quality portfolio cannot be overemphasised for the profitability and stability of the Bank. Following two consecutive years of decreases in absolute terms, NPLs increased marginally during the year by 3.0% as against the industry NPL increase of 12.90%. However, with the significant growth in loans and advances portfolio during the year both the gross NPL and net NPL ratios improved to 1.88% and 0.92% as at December 31, 2017 from 2.18% and 1.09%, respectively a year ago. Backed by the moderate risk appetite, the Bank has a conservative risk profile. The Bank’s NPL ratios compare well with the industry ratios of 2.5% and 1.3% for the gross and net NPLs, respectively.

Cumulative impairment provision for loans and other losses as a percentage of the loans and receivables as at the end of the year amounted to 2.29% compared to 2.74% in 2016. Provision cover improved to 51.05% in 2017 as against 50.11% in 2016. Open credit exposure ratio (which is net exposure on NPLs as a percentage of capital funds) improved from 9.53% at end 2016 to 7.60% as at December 31, 2017.

The loans and receivable portfolio is fairly well diversified across several industry sectors with exposure to any particular sector not exceeding 20% of the total.

Deposits

With a solid domestic franchise in Sri Lanka, deposits is the single biggest source of funding for the Bank and accounted for 74.35% of the total assets as at December 31, 2017 compared to 73.06% a year ago. Deposits grew by 14.95% during the year and reached Rs. 850.128 Bn. as at December 31, 2017 compared to Rs. 739.563 Bn. as at the previous year end. With the wide gap in interest rates between CASA and time deposits, shift of funds from current and savings accounts to high yielding time deposits continued as evident from the CASA ratio declining to 39.23% as at December 31, 2017 from 41.67% a year ago. Nevertheless, this compares well with the industry CASA ratio of 34%.

Other liabilities

The Bank has a strong and resilient funding profile. Customer deposits and equity capital together funded 83.72% of the total assets as at December 31, 2017 with all forms of other liabilities such as trade related payables and borrowings accounting for 16.28% or Rs. 186.147 Bn. compared to 19.19% or Rs. 194.284 Bn. as at December 31, 2016. Significant growth in deposits, borrowings of USD 100 Mn. from IFC coupled with the capital funds from the rights issue of shares lowered the need for other borrowings during the year. Securities sold under re-purchase agreements, borrowings from IFC, China Development Bank, and subordinated liabilities represented significant forms of borrowings as at the year end.

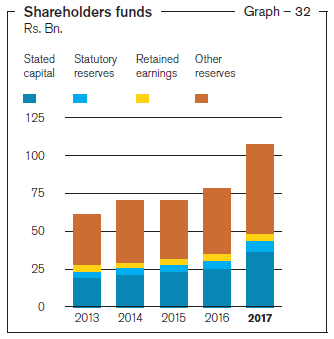

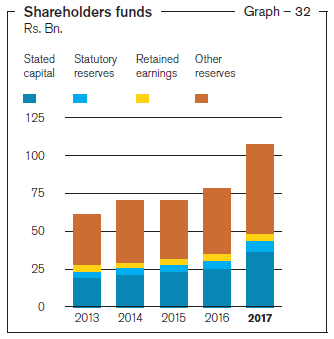

Capital

Equity funded 9.37% of the assets as at the current year end, a significant improvement in comparison to the 7.74% as at December 31, 2016. This was consequent to the successful rights issue of shares, as proactively identified through the ICAAP and also to meet the enhanced capital requirements under the Basel III, effective from July 2017 that infused Rs. 10.144 Bn. in capital to the Bank, increasing the loss absorption capacity further. In addition, the Bank ploughed back Rs. 12.098 Bn. out of profit for the year after setting aside the dividends declared. Consequently, both the Common Equity Tier 1 ratio and the total capital ratio improved to 12.11% and 15.75%, respectively as at December 31, 2017, exceeding the higher levels of minimum capital requirements imposed on the Bank under Basel III as a Domestic Systemically Important Bank and creating sufficient leeway for the planned expansion of the Bank’s operations. Consequently, the equity multiplier (gearing ratio) declined to 11.61 times from 12.76 times a year ago.

Liquidity

The liquidity position remained healthy across the banking industry throughout the year. In fact, during most of the year it remained above the level we would consider to be the optimum. While higher liquidity levels may be welcome from the perspective of some of the stakeholders, the Bank is mindful of the trade-off between liquidity and profitability and has already taken appropriate measures in this regard. Liquid asset ratio was 27.64% as at December 31, 2017. Loans to deposits ratio was 88.78%.

Available stable funding based on definitions prescribed by the CBSL stood at Rs. 865.468 Bn. as at December 31, 2017, leading to a Net Stable Funding Ratio (NSFR) of 127.87% comfortably above the statutory minimum of 100%.

Demonstrating the availability of unencumbered high quality liquid assets at the disposal of the Bank, the Liquidity Coverage Ratio (All currency) stood at 209.17% as at December 31, 2017 as against the statutory minimum of 80%.

Core Financial Soundness Indicators (FSIs)

Financial soundness indicators given below provide insights into the financial health and stability of the Bank.

Financial soundness indicators

Table – 11

| Financial soundness indicator (%) |

2017 |

2016 |

2015 |

2014 |

2013 |

| Capital adequacy: |

|

|

|

|

|

| Common Equity Tier 1 ratio |

12.11 |

10.37 |

– |

– |

– |

| Tier 1 capital ratio |

12.11 |

10.37 |

– |

– |

– |

| Total capital ratio |

15.75 |

14.87 |

– |

– |

– |

| Non-performing loans [net of interest in

suspense and specific provisions]

to equity |

6.39 |

8.65 |

10.36 |

10.95 |

12.58 |

| Equity to total assets |

9.37 |

7.74 |

8.00 |

8.86 |

10.06 |

|

|

|

|

|

|

| Asset quality: |

|

|

|

|

|

| Gross NPL ratio |

1.88 |

2.18 |

2.74 |

3.47 |

3.88 |

| Net NPL ratio |

0.92 |

1.09 |

1.41 |

1.86 |

2.12 |

| Total provisions made against gross loans

and receivables |

1.40 |

1.53 |

1.75 |

1.65 |

1.87 |

| Provision coverage ratio |

51.05 |

50.11 |

48.49 |

46.34 |

45.41 |

|

|

|

|

|

|

| Earnings and profitability: |

|

|

|

|

|

| Net interest income to total

operating income |

78.02 |

74.43 |

73.51 |

72.82 |

71.45 |

| Interest margin (Net interest income to

average assets) |

3.62 |

3.47 |

3.62 |

3.88 |

4.63 |

| Operating expenses to gross income |

17.33 |

20.20 |

22.22 |

21.62 |

19.73 |

| Impairment charge to total income |

3.83 |

3.47 |

9.55 |

8.64 |

14.36 |

| Return on assets |

1.54 |

1.53 |

1.42 |

1.60 |

1.87 |

| Return on equity |

17.88 |

19.52 |

16.90 |

17.01 |

18.40 |

| Cost to income ratio |

49.82 |

51.06 |

48.92 |

49.26 |

45.59 |

|

|

|

|

|

|

| Liquidity: |

|

|

|

|

|

| Statutory liquid assets ratio (DBU) |

27.28 |

27.19 |

26.24 |

33.15 |

33.66 |

| Statutory liquid assets ratio (OBU) |

30.95 |

30.19 |

49.13 |

31.43 |

29.38 |

| Liquidity Coverage ratio (All currency) |

209.17 |

150.45 |

– |

– |

– |

| Net Stable Funding ratio |

127.87 |

– |

– |

– |

– |

| CASA ratio |

39.23 |

41.67 |

49.70 |

48.38 |

43.51 |

| Gross Loans to deposits ratio |

88.78 |

85.64 |

84.31 |

79.79 |

94.59 |

|

|

|

|

|

|

| Assets and funding structure: |

|

|

|

|

|

| Deposits to total assets |

74.35 |

73.06 |

70.94 |

66.54 |

74.45 |

| Borrowings to total assets |

4.28 |

3.37 |

2.50 |

2.85 |

3.23 |

| Equity to total assets |

9.37 |

7.74 |

8.00 |

8.86 |

10.06 |

| Deposits to gross loans |

112.64 |

116.76 |

118.61 |

125.33 |

105.72 |

Subsidiaries and Associates

The Bank operates with six subsidiaries and two associates and group structure of the Bank is depicted in Note 1.3 to the Financial Statements. The following is an overview of the subsidiaries and associates of the Bank.

Commercial Development Company PLC (CDC)

Established in 1980 as the Bank’s first subsidiary, CDC was responsible for building the present Head Office building of Commercial Bank. The Bank holds a 92.97% stake in CDC which handles a major portion of the Bank’s utility services. A large part of its income is derived from renting space in the “Commercial House’ building and outsourcing staff.

At end 2017 CDC recorded a post-tax profit of Rs. 426.780 Mn. up 30.74% from Rs. 326.441 Mn. in the previous year.

ONEzero Company Ltd.

Providing Information Technology Services and Solutions to the Bank, ONEzero is a wholly-owned subsidiary of Commercial Bank. Its four main lines of business are:

- the provision of hardware and software related support services

- the supply of computer hardware and licensed software

- the development of software and

- the outsourcing of professional and skilled manpower to the Bank

Recording a post-tax profit of Rs. 44.274 Mn. at end 2017, ONEzero posted year-on-year growth of 33.32%.

Serendib Finance Ltd. (SFL)

Acquired by Commercial Bank in

September 2014 when it was Indra

Finance Ltd., this licensed specialised leasing company was renamed Serendib Finance Ltd. in March 2015. SFL plays a role in the Bank’s strategic plan to reach out to untapped market segments. The Company’s strategy reflects this goal and through a network of 11 branches provides leasing,

hire purchase, mortgage lending and business loans facilities. Company managed an asset portfolio of approximately Rs. 5 Bn. as at end 2017.

Commercial Bank of Maldives Private Limited (CBM)

Established during the latter part of 2016, CBM opened its Head Office and first

branch in the capital, Malé. During the year

it opened its second branch on the island

of Hulhumalé.

Commercial Bank has a 55% stake in CBM. Founded in May 2013 by a diverse group of successful shareholders in the Maldives, Tree Top Investments is the Bank’s Maldivian partner. It holds the balance 45% stake in CBM and contributes vital local market knowledge to the team.

While offering an extensive range of financial services, CBM’s goal is to be the most technologically advanced, innovative, customer friendly and most sought-after financial service organisation in the Maldives.

In just over a year of operation, CBM recorded a profit of Rs. 32.984 Mn.

Commex Sri Lanka S.R.L. – Italy

Having established itself as one of the

first Sri Lankan banks to launch money transfer facilities in Italy, the Bank incorporated its own subsidiary for these services. This marked the incorporation

of Commex Sri Lanka, in Rome as a fully-owned subsidiary of the Bank, to serve the fund transfer needs of Sri Lankan expatriates in Italy.

Able to break-even by January 2017 Commex recorded a profit after tax of

Rs. 17.702 Mn. by the year end.

CBC Myanmar Microfinance

Company Limited

Having identified the enormous potential available in the microfinance business in Myanmar, the Bank incorporated a 100% fully owned subsidiary, CBC Myanmar Microfinance Company Limited in

April 04, 2017. The Bank is in the process of finalising all formalities and necessary logistical arrangements to start commercial operations during the first half of 2018.

Commercial Insurance Brokers (Pvt) Ltd. (CIBL)

Through its subsidiary Commercial Development Company PLC., the Bank holds an indirect stake of 18.77% in CIBL. The line of business of the Company includes insurance brokering for all types of insurance through reputed life and general insurance companies in Sri Lanka.

CIBL recorded a growth of Rs. 3.1 Mn. profit after tax, for the year ended 2017 up from Rs. 25.614 Mn. in 2016. The Company’s total assets stood at Rs. 303.564 Mn. as at December 31, 2017.

Equity Investments Lanka Ltd. (EQUILL)

The Bank owns a 22.92% stake in EQUILL, a venture capital company established 27 years ago. EQUILL invests in Equity and Equity featured Debt Instruments.

The Company recorded an after tax loss of Rs. 6.716 Mn. compared to the profit after tax of Rs. 11.949 Mn. recorded for the previous financial year.

Returns to shareholders

The Bank’s business model enables creating value for its shareholders by delivering value to various stakeholders and deriving value from them in turn. Such value created enables the Bank to enhance shareholder wealth both in the short term and the long term through dividend payments and increases in the market capitalisation that enable them to realize capital gains.

The Bank’s dividend policy seeks to

balance the short-term shareholder returns and supporting business expansion in the

long-term.

Bank proposed a final dividend of Rs. 2.00 per share for the year ended December 31, 2017 which together with the two interim dividends add up to a total dividend of Rs. 6.50 for the year. Further, the Bank made a rights issue of shares on the basis of 1 for 10 at a discounted price of Rs. 113.60 and Rs. 90.80 for ordinary voting and non-voting shares respectively during the year. The Bank’s shares were trading at a premium to its book value throughout the year and the price to book value stood at 1.26 times as at December 31, 2017, the highest among all the banks listed on the CSE.

Key Business Lines Review

The Bank is cognisant that the requirement for financial services differs in many respects among its customers. In order to better understand them and align its value proposition in terms of products, services, and delivery channels to suit them, the Bank has segmented the customers and set up four primary customer facing business lines with several sub business lines coming under them as detailed in the table below. This has enabled the Bank to meet and regularly exceed customer expectations across all business lines. Further, it has afforded the Bank a certain degree of diversification in terms of exposures, sources of income and geographies to make growth more prudent and manage risks within the Bank’s risk appetite.

In line with strategic imperatives that

have the biggest impact on external stakeholders – customer centricity, digital leadership, and operational excellence – the Bank continued to expand its operations across all four business lines during the year, focussing mostly on the following:

- Diversifying products and services

- Widening its reach

- Streamlining service standards

- Optimising processes.

Activities that furthered these goals and strengthened the brand are discussed under the four business lines.

| Criteria |

Corporate |

SME |

Micro customers |

Mass market |

High net-worth |

|

| Income/Size of relationship/Business turnover/Exposure |

Annual business turnover>Rs. 750 Mn./Exposure> Rs. 250 Mn. |

Annual business turnover<Rs. 750 Mn./ Exposure< Rs. 250 Mn. |

Exposure<

Rs. 500,000 and availing dedicated products |

Individuals not falling into other categories |

Individuals with banking relationships above set thresholds |

|

| Price sensitivity |

High |

Moderate |

Low |

Low |

High |

|

| Products of interest |

Transactional, trade finance, and project finance |

Factoring, leasing and project financing |

Transactional |

Transactional |

Investment |

|

| No. of transactions |

High |

Moderate |

Low |

Low |

Low |

|

| Level of engagement |

High |

Moderate |

Low |

Low |

High |

|

| Objective |

Funding & growth |

Funding & growth |

Funding & advice |

Personal financial needs |

Wealth maximisation |

|

| Background |

Rated, large to medium corporates |

Medium business |

Self employed |

Salaried employees |

Business community/Professionals |

|

| No. of banking relationships |

Many |

Many |

Few |

Few |

Many |

|

| Level of competition from banks |

High |

Moderate |

Low |

Moderate |

High |

|

The type of segmentation illustrated here provides the Bank with greater knowledge and understanding of the customer and enables it to better align with the banking requirements of each category (refer Table 12).

Channel mix and target market based on perceived customer preference

Table – 12

| Customer Segment |

Branches |

Internet Banking |

ATMs |

Call Centre |

Mobile Banking |

Relationship

Managers |

Business

Promotion Officers |

Premier Banking

Units |

| Corporates |

√ |

√ |

X |

√ |

X |

√ |

X |

X |

| SMEs |

√ |

√ |

X |

√ |

X |

X |

X |

X |

| Micro |

√ |

X |

√ |

X |

√ |

X |

X |

X |

| Mass: |

|

|

|

|

|

|

|

|

| Millennials |

X |

√ |

√ |

√ |

√ |

X |

X |

X |

| Others |

√ |

√ |

√ |

√ |

√ |

X |

X |

X |

| High net-worth |

√ |

√ |

√ |

√ |

√ |

√ |

X |

√ |

The four business lines work in collaboration with each other and the various service units of the Bank to drive growth and

further strengthen the Commercial Bank brand.

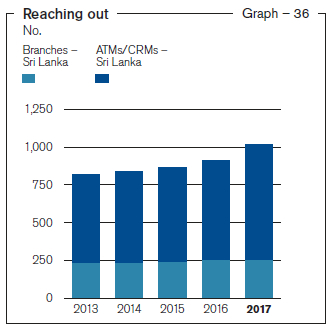

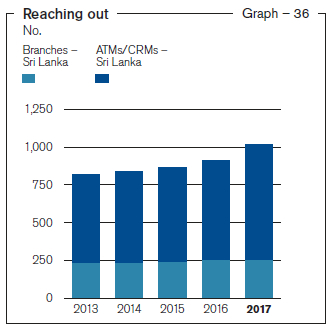

Personal Banking

Serving a total of over three million customers through its Personal Banking arm, the Bank continues to pursue its goals of increasing access to banking services, supporting wealth creation, and promoting financial inclusiveness across Sri Lanka’s diverse communities. With over 1,000 physical customer touch points, it has also invested deeply in plans to accelerate growth in online and mobile banking.

1,016

Customer touch points |

Deposits grew by over

14% |

Over

10%

Growth in savings account holders |

Advances grew by over

15% |

Growth in credit cards

(year on year)

17%

with total credit card outstanding reaching

Rs. 9 Bn.

by year end |

Market share in debit cards approx:

33%

market leader |

USD 1 Mn.

Investment in online and

mobile banking |

Products and services

The Bank’s Personal Banking portfolio is designed to cater to the ever-evolving banking needs of our customers as their aspirations and lifestyles change over time. This portfolio includes products and services used by the small and medium enterprise (SME) sector and the micro and mass market segments.

Products and services

Table – 13

| Deposits |

| Current accounts |

| Savings accounts |

| Foreign currency accounts |

| Call deposits |

| Fixed deposits |

| Treasury bill repos |

| Loans |

| Term loans |

| Personal loans |

| Home loans |

| Agriculture & Microfinance loans |

| Industrial loans |

| Leasing |

| Credit cards |

| Other |

| Bancassurance |

Focus on deposits

Personal Banking enhanced its products and services during the year, launching new offerings and initiatives for the benefit of key customer segments including SME and mass market. Intensifying its focus on deposits the Bank enhanced and promoted a number of products that encourage the saving habit for every stage of a customer’s life cycle. For instance, "Gedarata Thegi" was the Bank's biggest promotion during the year which helped grow the Bank's remittance business, while the “Arunalu Siththam” art competition promoted the Bank's flagship children’s account. This focus on deposits went hand-in-hand with the Bank’s strategy to increase both brick-and-mortar and digital banking channels, while reaching out to the peripheries of communities in its drive to support financial inclusion. In a challenging operating environment Personal Banking saw its deposit growth increase by 14.63% during the year to reach Rs. 646.742 Bn. The Bank’s CASA ratio of 39.23% remains higher than the industry.

SME and micro sector. The SME sector is the backbone of the Sri Lankan economy. As the country’s lead investor in this vital sector, the Bank continued to invest heavily on improving the lives and livelihoods of our SME and micro sector customers.

Commercial Bank affirmed Best SME Bank in Sri Lanka in 2016 by International Finance Magazine (IFM) of the UK

Commercial Bank was awarded for “making a significant difference and adding value, and achieving the highest standards of innovation and performance” for Small and Medium Enterprise clients.

The Mastercard branded Dual Interface Card was launched exclusively for entrepreneurs in the SME sector in collaboration with The Federation of Chambers of Commerce and Industry of Sri Lanka (FCCISL) and Channel 17 (CH17). Issued by the FCCISL to its members these cardholders will be eligible for special benefits such as substantial discounts on products and services ranging from telecommunications, healthcare and hospitality, to hardware and vehicle maintenance. This debit card complies with EMV (EuroPay, Master Card and Visa) standards providing greater security for our customers.

Commercial Bank launches NFC enabled card acquiring POS for both Visa and MasterCard

Commercial Bank became the first Bank in Sri Lanka to launch NFC enabled card acquiring POS for both Visa and Master cards.

Commercial Bank Biz Club was another important initiative that was launched in 2017. Its aim was to bring together SME customers and help create new business opportunities while providing them with support that goes beyond lending. The business club’s goal is to build a bridge that connects SMEs with each other and the larger businesses of the world. Consisting of four segments categorised as platinum, gold, silver and bronze, the Personal Banking Division focuses on the needs of each segment, providing free advice, training, networking opportunities and other benefits in order to advance each group to the next level.

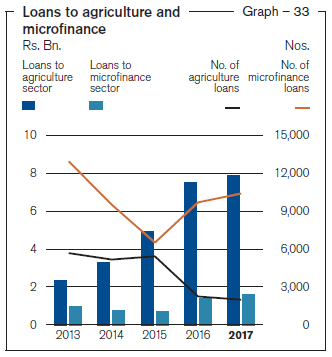

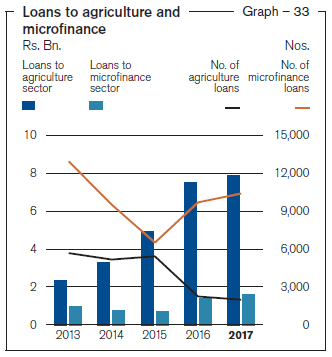

Our microfinance portfolio performed well during the year. Comprising loans below

Rs. 500,000/- this segment demonstrated a strong growth of nearly 14% during the year.

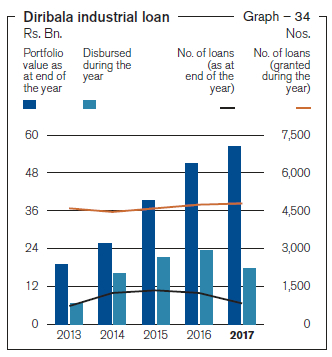

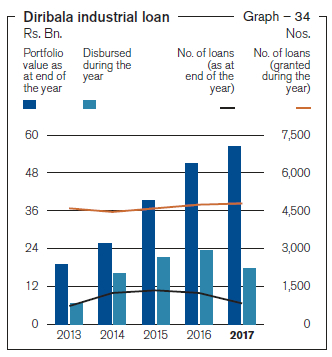

Diribala, the Bank’s branded SME industrial loan portfolio was reviewed to meet changing customer expectations and relaunched in 2016. Following this modification and relaunch loans in this portfolio grew by 10% to over Rs. 56 Bn. with NPL’s amounting to less than 1.5% at year end.

Dedicated to promote agriculture lending and micro finance, the Bank added one more Agriculture and Micro Finance Unit (AMFU) to its network during the year, taking the total number to 16. These AMFUs continue to assist the Bank in identifying the specific needs of people attempting to develop either their agricultural activities or micro businesses and these officers move beyond urban centres to reach out to the “unbanked”.

Partnering with WEBXPAY, the Bank launched an internet payment gateway (IPG) facility to support a new e-commerce platform in Sri Lanka that should increase sales for its SME customers. The new online platform facilitates e-commerce solutions for SMEs enabling transactions in Sri Lankan Rupees and US Dollars through credit and debit cards, mobile wallets and internet banking networks.

Commercial Bank reaches out to SMEs in Gampaha and Puttalam

Commercial Bank interacted with 160 entrepreneurs from the Gampaha and Puttalam Districts as part of the Bank’s ongoing initiative to develop entrepreneurship skills of the SMEs in the country.

During the year the Personal Banking Division conducted 8 seminars for SME customers on a range of subjects such as entrepreneurship and succession planning. A total of over 1,000 participants attended these seminars. In line with Government initiatives the Bank paid special attention on the support of female entrepreneurs.

Mass market sector. Encompassing regular Personal Banking customers whose main interest is transactional banking, this segment continues to be a key driver of growth for the Bank. A range of initiatives were launched during the year to enhance banking services to this important segment. Special emphasis was given to provide digital banking solutions that allow customers the freedom to conduct their banking transactions at their convenience.

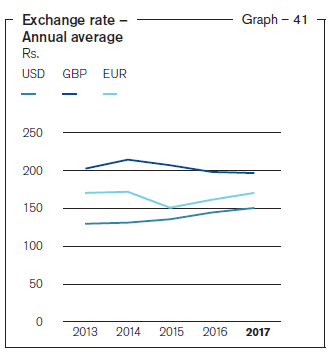

We further enhanced our Online Banking platform with the introduction of Electronic Fixed Deposits (or e-FDs) in both local and foreign currencies. These e-FDs can now be opened through the Bank’s online portal at www.combank.lk allowing customers to open a fixed deposit with ease and convenience at any time, any day of the year, regardless of their geographical location. Customers eligible to open e-FDs are Sri Lankan citizens and holders of foreign currency accounts in the Domestic Banking Unit. Foreign Currency e-FDs can be opened

in four major currencies, namely the US Dollar, Great British Pound, Euro or Australian Dollar.

Commercial Bank offers e-FDs online

The Bank’s Online Banking platform has been further enhanced with the introduction of Electronic Fixed Deposits (e-FDs) in both

local and foreign currencies.

It is encouraging to note that a growing number of customers are getting on board the e-Passbook facility launched in 2016. In 2017, just one year after it was launched, this ground-breaking mobile app won Gold for “Most Admired Customer Engaged Mobile App” at the sixth Asia Pacific Customer Engagement Awards in Mumbai, India. The Bank was the first financial services institution in Sri Lanka to offer customers an e-Passbook that provides real-time access to details of a range of deposit products and credit cards on Android and iOS powered mobile devices. This breakthrough digital mobile application offered free by the Bank enables account holders to view transactions of the past 30 days on their mobile phones or tabs even when the device is offline.

Commercial Bank’s “e-Passbook” wins gold at the 6th Asia Pacific Customer Engagement Awards by the Asian Customer Engagement Forum (ACEF) in Mumbai, India

One year after it was launched, Commercial Bank’s groundbreaking mobile app “e-Passbook” won a prestigious international award for design, creativity and innovation.

The app bagged the Gold for “Most Admired Customer Engaged Mobile App”

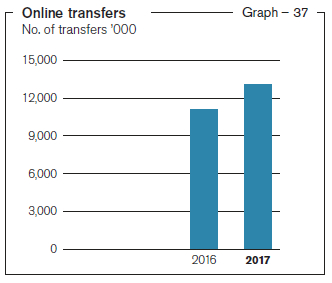

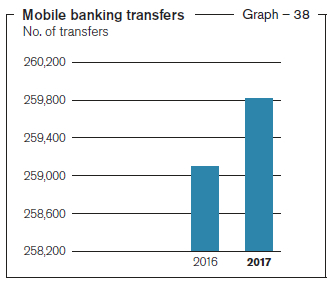

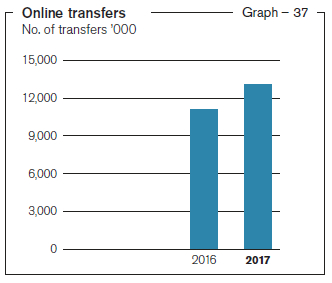

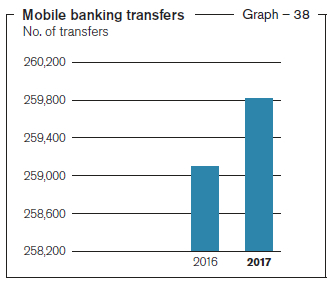

For the Bank, 2017 proved to be a good year for progressive technologies in banking with total fund transfers via mobile banking amounting to Rs. 12.34 Bn. for the year. Constantly looking to push the boundaries to offer the ultimate in technology-enabled convenience to customers, the Bank continues to invest in and explore new technologies that can improve the lives and lifestyles of its loyal customers.

In addition to lending the Bank also ventured further into innovations in lending. It launched Instant Loan Approvals for Personal Banking loans via an automated system. For the customer this means having faster access to funds without the hassle of multiple visits to a branch.

The Bank also enabled Loan on Fixed Deposit which allows customers access to funds on their deposit by way of a credit facility while their deposits earn interest. Funds can be obtained through ATMs via a Debit Card issued for customers who register for this facility.

Commercial Bank launches “Loan on FD” to offer emergency cash to fixed deposit holders

Commercial Bank launched a fixed deposit linked facility that provides depositors with credit against their fixed deposits in full or in part at their discretion while their deposits earn interest.

Another innovation in lending launched by the Bank in 2017 is Hybrid Leasing which makes leasing a higher value vehicle more affordable at commencement by combining the features of a Super Lease. This gives professionals and upwardly mobile executives the option of paying a comparatively low rental during the first six or 12 months, paying regular rentals thereafter, and a lump sum at the end of the lease.

The Bank introduced Mastercard Debit Cards with Chip and PIN technology for the first time in Sri Lanka. With their magnetic strips, these new cards are considered risk averse as they require the card holder to authenticate each transaction using a PIN, or an OTP (One Time Password) for e-commerce transactions.

Commercial Bank introduces Sri Lanka’s first Chip and PIN debit card

The new Chip and PIN Debit Card will minimise the possibility of fraudulent transactions at point-of-sale (POS) due to the PIN requirement.

During the year, point-of-sale (POS) usage was enabled for UnionPay cards by the Bank, making it possible for cardholders of the world`s largest card base in circulation to pay for purchases at local retailers with these cards. Visiting leisure and business travellers, from China in particular, benefit most as they enjoy the convenience of cashless payments in Sri Lanka. UnionPay cards have been accepted by the Bank’s ATMs since 2012. Commercial Bank was the first Sri Lankan bank to link its ATMS with UnionPay. EMV-enabled UnionPay cards also enjoy additional security following the upgrade of all Commercial Bank ATMs to offer significantly higher protection against counterfeit fraud.

FLEXI Plan, was another initiative launched in 2017. It is an easy payment scheme for credit cardholders who have been unable to convert high value transactions into easy payment plans at the point of purchase. Designed to ease the cardholder’s repayment burden, FLEXI Plan is effective when customers need to purchase air tickets, electrical appliances and consumer products or when they pay educational or medical bills.

Personal Banking grew its Bancassurance fee income to 34% during the year despite challenging market conditions. Competition from broker firms and other banks, and the possibility of new legislation being introduced are key concerns that could negatively impact growth in this business line.

During the year, the Bank also launched Combank Auto Bill Pay through which Personal Banking customers can settle monthly bills for several Dialog services by due date through their credit card.

The Bank launched the INSEE loyalty card in partnership with Siam City Limited. This card is the instrument through which all Siam City’s loyalty points are distributed.

Several other types of cards were also launched during the year to offer customers greater convenience. The Prepaid Web Card is designed for customers who carry out regular online transactions and prefer to maintain a separate card for ease of monitoring. A multipurpose Prepaid Spend Card was launched to enable customers to manage their spending individually, make a gift to their loved ones or manage the cash floats of their personal assistants or helpers.

Customer outreach

The Bank continued to invest in its Personal Banking channels increasing and improving customer touch-points even further.

The purchase of a new digital platform from Fiserv during the year will expand the Bank’s digital solutions offering for all customers soon, including the SME segment. While providing customers with a new and improved digital banking experience, this platform will significantly increase the Bank’s operational effectiveness.

The six new branches opened during the year take the Bank’s total number up to 261. In addition to expanding its branch network the Bank is also focusing on creating greener, more energy efficient branches (refer section on Natural Capital for more details). All new and refurbished branches will sport a uniform external façade, with automated banking facilities available for customers on a 24/7 basis.

Commercial Bank’s 256th Branch opens in Point Pedro

Commercial Bank opens 257th and 258th Branches at Katana and Rambukkana

Commercial Bank opens 259th, 260th and 261st Branches at Yatiyantota, Bopitiya and Kolonnawa

The Bank’s 700th ATM terminal was “opened for business” in Kilinochchi further increasing the Bank’s 24/7 customer touch points.

Commercial Bank commissions landmark 700th ATM in Sri Lanka at MAS Intimates Vidiyal in Kilinochchi

The Bank’s mobile payment solution, Fast Pay, described previously under mass market products and services, provides Personal Banking customers with yet another innovative channel through which to access their funds for daily expenses.

During the year the Bank added substantial number of new current and savings account relationships to its portfolio and provided every customer with access to internet banking. A one week “Online Banking Drive” was held at 38 selected branches with branch staff at hand to demonstrate the convenience of online banking. Continuously seeking out and initiating improvements, the Bank introduced a new initiative in its award-winning corporate website. The corporate website is now equipped with assistive technology to enrich the experience of differently-abled persons.

With financial inclusion always top-of-mind, the Personal Banking Division has begun investing in a Bank on Wheels – a mobile bank with automated banking facilities that would benefit traditionally “unbanked” customers who live far from urban centres. Working with its 16 AMFUs to identify areas that would benefit from such an innovation, the Bank will be sending this mobile bank to help ascertain the appetite for a brick and mortar branch in the area prior to investment.

Commercial Bank launches new version of its “Millionaire Account”

Commercial Bank relaunched its popular “Millionaire Account” enabling a larger group of aspiring savers to open accounts and benefit from its unique structure.

Benchmarked service standards. Personal Banking focuses on several key service standards to ensure it meets and exceeds the expectations of the Bank’s stakeholders.

To protect customer data the Bank has ensured that it is compliant with PCI Security Council standards which, for example, prevents the printing of a customer’s entire bank account number on ATM slips.

Following the introduction of 3D secure enabled cards the Bank revamped all cards, POS machines and ATMs to the EMV standard which will greatly reduce instances of card present fraud.

All IT and other equipment procured by the Bank for branches and other buildings is energy efficient, with “Energy Star 5” ratings that are compliant with the RoHS (Restriction of Hazardous Substances) standards. ATM machines that have been purchased during the year are energy efficient, able to function without air conditioning.

Streamlined processes. Providing customers with the service expected of one of Sri Lanka’s leading private-sector banks means ensuring that systems and processes are simple and streamlined – an ongoing exercise that the Bank takes very seriously.

The Central Credit Approval Unit (CCAU) now supports a majority of the micro and SME-related loan facilities up to a certain threshold, helping to track and eventually reduce the Bank’s non-performing loans. The centralisation and integration afforded by the CCAU allows greater uniformity in the assessment of credit quality.

Integrating our call centres in order to improve processes is another initiative that was begun during the year. The Bank’s four call centres – Card Centre, Digital Banking, Recoveries, and the regular telephone operators – are now in the process of being connected. Over the course of 2018 the integrated call centre will have the ability to track a single caller’s every contact with the Bank, including their interaction via social media.

In addition to the collaboration of front line teams from Branches and the “third line” team which is Audit, assurance mapping now directly involves the second line – teams from Procurement and Risk Management for instance – to ensure that risks are managed with even greater efficiency.

Impact on the economy

Through the activities of its Personal Banking arm Commercial Bank is making an indirect impact on the economy.

Furthering financial inclusion in Sri Lanka is one such initiative. The Bank works towards this goal mainly through the work of its AMFUs – taking banking to the peripheries, and by encouraging and supporting entrepreneurship through a range of effective awareness and education programmes.

Commercial Bank is a trusted brand that has a track record that stretches back to almost half a century. Thanks to its brand reputation and strength the Bank is able to partner with international organisations such as MasterCard and Visa and widen the scope of banking related initiatives that its Personal Banking customers may avail themselves of. Often these initiatives result in greater upward mobility for more people.

Through its Personal Banking Division the Bank is also preparing customers for the new digital revolution in financial services. Investing in top-of-the-line online and mobile banking services, conducting digital banking awareness campaigns and making banking more convenient and accessible for its over three million customers – these are some of the many ways in which the bank indirectly impacts the economy.

Corporate Banking

Our corporate customers rely on us to be a trusted partner, able to provide financial services that are tailored, relevant, and timely. For us, living up to their expectations and maintaining their loyalty means using our global and local networks, insights, and experience to enable them to reach their full potential in the industries and communities within which they operate.

Accounted for

24%

of the Bank’s assets portfolio and

25%

of its profits before tax |

23%

Growth in Corporate loan book (year on year) |

0.6%

Non-performing loans ratio |

Accounted for

10.56%

of Sri Lanka’s imports and

18.58%

of the country’s exports |

Rs. 7.8 Bn.

Funds raised by Investment Banking unit |

Funded domestic airport

in the Maldives |

Professional client guidance training for all

Relationship Managers |

Products and services

With an in-depth understanding of customer needs gleaned over nearly half a century of expertise in the field, the Corporate Banking team continued to develop customised solutions that include project lending and packaged facilities for medium to large corporates.

Corporate Banking products and services

Table – 14

| Financing |

Transaction Products |

Investment Banking |

| Overdraft |

Trade Finance services |

Initial Public Offerings (IPOs) of equity and debt |

| Short-term loans |

Combank Online |

Private placements of equity and debt |

| Import financing |

Pay Master |

Securitisations |

| Export financing |

Interest rate swaps |

Syndications |

| Long-term financing |

Currency swaps |

Specialised project financing |

| Term loans |

|

Margin trading |

| Customised project loans |

|

Escrow accounts |

| Leasing |

|

Custodian services |

| Factoring |

|

Advisory services on equity and debt |

| Islamic Banking |

|

|

Corporate Banking was able to acquire new corporate clients during the year with a total relationship over Rs. 40 Bn.

Loans in the Corporate Banking Division grew by 23% as the Bank strove to maintain a balance between growth, asset quality

and pricing.

Usage of Pay Master increased by 12.97% year on year. Pay Master is a revolutionary payment solution that relieves customers of the burden and cost of large scale, repetitive but highly important tasks such as regular payments to suppliers and salary payments to employees. This product frees business owners, allowing them more time to focus on their core business.

The Corporate Banking arm was able to increase its green lending portfolio during the year. Social and Environmental Management System (SEMS) ensures that the Bank’s lending is environmentally sustainable, socially acceptable and economically viable. Green lending contributed to Commercial Bank being named among the “Top Companies in Asia” and the “Top Green Companies in Asia” at the 2017 Asia Corporate Excellence & Sustainability (ACES) Awards.

Commercial Bank among Top Companies in Asia – recognised for leadership and green efforts

Commercial Bank was named among the “Top Companies in Asia” and the “Top Green Companies in Asia” at the 2017 Asia Corporate Excellence and Sustainability (ACES) Awards that honour and showcase Asia’s finest and most responsible corporate leaders

During the year a new database was set up to ensure lending officers knowledge of key industries is always up to date. Supported by the Bank’s Research and Development Department this initiative has received positive feedback from lending officers.

Corporate Banking was able to grow the Bank’s import and export volumes by 39.33% and 14.58% respectively

(Graph 39), during the year.

Commission income from trade contributed approximately 17% of the commission income of the Bank supported by increased focus on this area by Corporate Banking.

During the year Corporate Banking put together a strategic team that worked on developing new products, modifying existing products, expanding delivery and expanding revenue. The results of their work will be apparent in 2018 and beyond.

Always tuned into the needs and preferences of its customer base Corporate Banking was happy to launch a new initiative that filled a need identified by customers. The Bank launched a monthly “Economic Overview” developed in collaboration with Treasury and Research and Development Unit for Corporate Banking customers. This monthly report is designed to provide customers with useful information from their trusted Bank.

The establishment of two new accounts under Margin Trading with facilities totalling Rs. 600 Mn. despite suppressed market conditions and rising interest rates was another achievement worth noting for the year under review.

Islamic Banking was another area that

the Bank focused on during the year.

A marketing campaign to highlight Islamic Banking and a successful collaboration with Branches contributed towards growth of this segment. Mudaraba Savings and Mudaraba Investments, deposits products in the Islamic Banking Unit increased by 19.83% over 2016 while assets products increased by 17.56%.

Customer outreach

Corporate Banking continued to look at new ways to improve customer touch-points during the year.

With 55 correspondent banks and 261 branches our clients have access to seamless banking solutions irrespective of whether they operate in a global market or a bustling rural village.

Corporate Banking considered face-to-face meetings an important channel to reach out to and stay in contact with its customers. Special training programmes during the year provided relationship managers with the skills they need to be able to exceed the expectations of high-ranking customers. Additionally, performance dashboards

were introduced during the year to help monitor the activity of relationship managers visiting clients to ensure an adequate number of customer visits and uniformity

of service quality.

Benchmarked service standards

Corporate banking division constantly reviews its’ service standards and conducts benchmarking of such service standards with peers with a view to providing superior customer service. Plans are afoot to carry out a customer survey and a work study in order to identify any areas for further improvement.

Streamlined processes

During the year, Corporate Banking paid special attention to the review of all processes relating to Credit, Import, and Export to optimise efficiency, enhance customer convenience, and reduce costs.

To ensure processes within Corporate Banking remain smooth, a review of employee skills was conducted and the appropriate core banking training and personal development guidance provided for all staff within this business line.

The automation of Overdraft Overline Report for excess monitoring and the automation of monitoring mechanism of Stocks and Debtors positions against exposures were two initiatives that greatly improved internal processes during the year.

The monitoring of borderline advances were further strengthened using “Early Alerts” to minimise non-performing loans.

Impact on the economy

In Sri Lanka, Corporate Banking supports the many specialised banking requirements of its corporate customers, opening the door for large scale economic activities within these economies. The Bank accounts for 10.56% of imports and 18.58% of exports in Sri Lanka, drawing on its vast experience in Trade Finance to play an important role in facilitating trade.

Reflecting key areas of growth for the

Sri Lankan economy, Corporate Banking noted loan growth in the health care, trading, apparel, education and leisure sectors.

Treasury

The Treasury Department has the overall responsibility for managing the Bank’s balance sheet which demands balancing and managing the capital, funding and liquidity requirements of the Bank. It also plays a key role in managing market risk – interest rate and exchange rate risks in particular – and underlying margins and mismatches in assets and liabilities. Treasury’s role is crucial to maintain the financial security and stability of the Bank while enabling other business lines to readily access funds as they endeavour to meet customer needs.

A key player

in interbank foreign exchange and fixed income securities

|

Contributed

22%

of Bank’s assets through fixed income securities |

| Mobilised

USD 410 Mn.

by way of foreign currency borrowings |

Strategic rebalancing of fixed income securities portfolio

|

Products and services

Treasury operations comprise three specialised areas, Foreign Exchange and Corporate Sales, Fixed Income Securities Investment and Trading, and Assets and Liabilities Management (ALM Operations).

Reporting to the Head of Global Markets and the Head of Global Treasury, the Treasury manages the following products and services.

Treasury products and services

Table – 15

| Investment products |

Foreign Exchange |

Fixed Income Products |

Financial Derivatives |

| Sri Lanka Development Bonds |

Forward Contracts |

Treasury Bills |

Interest Rates Derivatives |

| Special Foreign Currency Investment Deposit Accounts |

Spot Contracts |

Treasury Bonds |

Currency Options |

|

|

REPOs |

|

|

|

Reverse REPOs |

|

Through the prudent management of these products and services Treasury reported the following results during the year.

The Bank’s Fixed Income Securities portfolio is one of the largest in the country, and accounts for approximately 22% of the Bank’s total assets. It is managed to support the liquidity of the Bank, while optimising earnings.

The Treasury Division’s fixed income portfolio is a combination of both Rs. - and USD- denominated Sri Lanka Government debt securities. The USD denominated bonds in particular are a very attractive investment option, although the Sri Lanka Development Bond (SLDB) portfolio may lose some of the tax exemptions in 2018. By maintaining a major portion of the USD investments

in floating rated bonds Treasury has been able to successfully hedge the risk of increasing USD rates, while maintaining

a positive margin.

The Bank’s forex profit of Rs. 588.213 Mn. reflects increased volumes of trade finance business and remittances. Treasury remains the market leader in Interbank FX Operations, providing liquidity in spot, forward and swap transactions.

During the year the Treasury Division diversified its foreign currency borrowing base and increased business relationships in order to support the Bank’s other business lines, such as Personal Banking and Corporate Banking. Through structured funding (DPR) and bilateral agreements, Treasury also increased the duration of borrowings at a relatively low increase in borrowing costs. This improved the Bank’s stable funding position supporting Basel III driven Net Stable Funding Ratio

(NSFR) requirements.

The Bank’s Treasury arm also increased its Special Foreign Currency Investment Deposit Account (SFIDA) and investment in Government security (G-sec) through Securities Investment Account (SIA).

To support the lending and investment activities of the Bank, the Treasury was successful in borrowing USD 100 Mn. from the International Finance Corporation (IFC) during the year.

Other activities during the year included entering the interest rate derivative market, arranging funding lines from reputed Development Finance Institutions (DFIs), and introducing SLDB and Sri Lanka Sovereign Bonds (SLSB) backed REPOs.

The Treasury Division also worked with an advisory from the International Finance Corporation (IFC) to educate employees on how to better promote green lending.

Customer outreach

The main customers of Treasury are the Bank’s business lines and, subsequently, their customers. The department is structured to ensure that it operates at an optimal level.

As one team, the Treasury Division focuses on and emphasises customer satisfaction, both internal and external. Its business strategy is based on meeting and satisfying customer needs. Constantly working towards this goal, Treasury maintains a close rapport with the Personal Banking and Corporate Banking divisions of the Bank, providing relevant market information, supporting client acquisition and proposing suitable instruments and solutions to meet client-specific needs. Through its dedicated sales desk, which is the largest unit within

Treasury, it services all key stakeholders, striving to maintain high standards throughout all interactions.

During the year, the Foreign Exchange and Corporate Sales team conducted foreign exchange trading operations while supporting the Personal Banking, Corporate Banking, and Trade Finance businesses. They also managed the foreign exchange requirements of their customers and the Bank’s Foreign Exchange risk.

ALM Operations focuses on maintaining adequate liquidity for the Bank’s operations, while ensuring optimal pricing for its assets and liabilities. The Department was also actively engaged in the activities of the asset-liability committee (ALCO) and regularly provided strategic direction for banking operations.

Treasury assigned dedicated dealers for each product, improving this important customer channel – face-to-face customer interaction.

Benchmarked service standards

During the year, the Treasury Division conducted process improvements to ensure attending to customer needs with greater speed and accuracy.

Systems capabilities were also reviewed and enhanced with an eye to the future. As the Bank prepares to make the most of future opportunities, this Division too is dedicated to being future-ready.

Streamlined processes

Treasury focused on optimising internal relationships while gearing staff to make the most of potential opportunities.

The Treasury Division streamlined its process of cross-selling with Corporate Banking as this provides access to financially stable customers with whom the Bank already has a relationship.

To further streamline existing processes, a skills assessment of people within Treasury resulted in additional training for all levels of employees, an initiative dedicated to ensure that employees were engaged in value-added activities rather than routine work. This also resulted in the transfer of experienced senior staff to top positions in international offices.

Impact on the economy

Declining interest rates resulted in decreasing mark to market losses, increasing the shareholders’ equity, leading to an increase in net book value per share. Government initiatives taken to make the process more transparent and declining US Government treasury rates resulted in greater foreign inflows to Sri Lanka

as foreign investors looked for higher yielding securities.

As one of the largest players in the market, Commercial Bank accounts for 10.56% of imports to and 18.58% of exports from

Sri Lanka. Ties with foreign DFIs (Development Finance Institutions) improved the reach of the Bank in terms of Foreign Currency funding.

With customers more informed and keener to experience more complex products, Commercial Bank’s Treasury Department was able to offer a range of hedging instruments and new products for their benefit.

International Operations

The Bank’s International Operations is progressing from strength to strength. From our initial overseas venture in Bangladesh in 2003, we have expanded to Italy, Myanmar and the Maldives. When we acquired the operations of Crédit Agricole Indosuez in Bangladesh it consisted of two branches and two booths. We have been successful in expanding our business and network over the years, and will be setting up an Automated Banking Centre (ABC) in the country shortly.

Bangladesh operations now accounts for

7%

of the Bank’s assets

|

AAA

for the seventh successive year for Bangladesh operations by Credit Rating Information and Services Limited. |

Third

in terms of profitability, among the nine foreign banks in Bangladesh and first among regional banks |

|

Maldivian operation began to

record profits

|

|

The opening of the

second branch

on the island of Hulhumalé in the Maldives

|

|

“Commex Sri Lanka S.R.L. – Italy”

nine

agents covering Northern region of Italy

|

|

A contribution of

17%

to the Bank’s profit before tax from International Operations

|

Overview of Bangladesh Economy

Rising income, low inflation and increased public expenditure coupled with resulting increase in consumption led to Bangladesh achieving GDP growth of 7.24% in 2017. Per Capita Income also increased to USD 1,602, leading to a decline in poverty rates. Industrial sector followed by services sector made significant contributions to growth. Stronger Taka is attributed as one of the reasons for poor performance in exports. Remittances to the country from expatriate workers continued to decline. Standard & Poor and Moody rated Bangladesh at BB- and Ba3 respectively with stable outlook. Banking sector faces challenges in terms of rising non-performing loans, lower levels of capital adequacy, slippages of addressing fiscal reforms, political uncertainties and governance related issues. Year 2018 is significant for Bangladesh since the country is set to graduate from a least developed country and also a General Election is due to be held early 2019.

Other countries

Our subsidiary in Italy continues to boost our leadership position in inward remittances. Our fully-fledged Tier 1 Bank in the Maldives has already begun to return profits. During the year, the Bank obtained an Operation Licence to carry out microfinance business in Myanmar and arrangements are being made to commence commercial operations in the near future. As our horizons continue to expand we are banking on a promising future.

Products and services

Commercial Bank has been in operation for close to 50 years. It is this experience and strength which propels the success of the Bank’s international operations in the form of products and services that have proven successful.

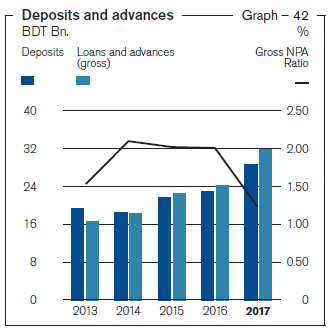

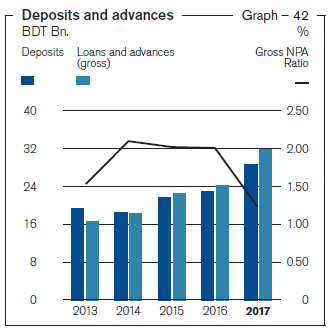

The number of accounts in Bangladesh grew by over 9% during the year, while deposits and advances grew by 24.58% and 31.31% respectively compared to 2016.

Having offered exceptional relationship banking to our corporate banking customers, and expanded the Corporate Banking portfolio in Bangladesh, we are on par with the multi-national banks operating in the market in terms of products and services.

As a foreign bank we have good access

to large corporates but must compete

with international banks and local banks in this space.

In our efforts to be the preferred service provider for Personal Banking customers in Bangladesh we offer a superior online banking platform, innovative products, and customer service that is of a high standard. Despite our conservative ethos and competition from other commercial banks including the nine new banks established in 2013, we are able to attract a quality deposit mix consisting of savings and low cost deposits. We also introduced a new

Floating Rate Housing Loan product to the market which at this early stage, is showing much promise.

Our Treasury operations in Bangladesh offer consistent, cost-effective fund management and trade finance services providing customers with some of the best treasury products available in the region. Thanks to our proven expertise and market knowledge in foreign exchange, money market, and fixed income products we are able to compete with other foreign banks and big local banks that enjoy larger business volumes due to their global and local references.

Online banking in Bangladesh is picking up with the total number of online fund transfers during the year amounting to BDT 598 Mn.

Active users of the ePassbook among Personal Banking customers in Bangladesh and the Maldives reached 2,835. This was the first time such a product was offered in either of these countries.

In the Maldives the number of accounts grew by approximately 74% year on year.

Customer outreach

With our overseas employees now numbering 281, an increase of over 9% over 2016, and contributing approximately 17% of profit before tax, International Operations provides a source of risk diversification and greater stability for the Bank.

We have been successful in expanding our business in Bangladesh to 11 branches, six SME centres, two offshore banking units, and 20 ATM machines (including three off site). Shortly we will be setting up an Automated Banking Centre (ABC) attached to the new Corporate branch, with a real time cash deposit machine – the first of its kind in the country.

The subsidiary, namely Commercial Bank of Maldives Private Limited, is a fully-fledged Tier 1 bank under the licence issued by the Maldives Monetary Authority has began to make profit during the year. With the opening the second branch this year, and commissioning of digital banking services, business volumes in Maldives have grown rapidly since its commencement in 2016.

Commercial Bank of Maldives opens its second branch in Hulhumale

The Commercial Bank of Maldives (CBM), a subsidiary of the Bank, opened its second branch in the Republic of Maldives, a little over a year since it commenced operations in the archipelago.

With nine agents covering the northern region of the country, Commex Sri Lanka S.R.L. – Italy, is a fully-owned subsidiary of the Bank which commenced its own business under the Authorized Payments Institute (API) License issued by the Bank of Italy in February 2016. This licence allows the Bank to expand further across Europe and plans to do so are currently being laid out.

The Bank opened a representative office in Myanmar in June 2015, and during the year, received a micro finance licence. Leveraging its expertise in this sector, Myanmar Operations will commence expanding customer touch points and growing its micro finance business.

The Bank also has placed its own Business Promotion Officers (BPOs) in key markets around the world to cater to the banking needs of Sri Lankans working in those markets. Products and services offered include money transfer facilities via the Bank’s e-Exchange remittance services. International Operations continued to facilitate mobile to account remittances in real time with the Bank’s partner in the Sultanate of Oman. In the Kingdom of

Saudi Arabia, the Bank’s partner continued to facilitate real time transfers through the ATM network and online banking channels.

Benchmarked service standards

The Bank’s license in Italy is valid throughout the European Union. In addition to signalling that Commercial Bank’s service standards are in line with European requirements it also opens the door for the Bank to expand across the continent.

Streamlined processes

The Bank’s Bangladesh operation’s pricing strategy was further streamlined and customised enabling loan growth and an increase in overall returns on advances.

Risk acceptance processes were strengthened to further enhance asset quality.

Employee competencies were classified across the Bank with career guidance, and training and development provided where necessary. In Bangladesh in particular, where nine commercial banks were opened together in 2013, human resources are stretched. This exercise helped the Bank redistribute talent where it is needed the most – including overseas postings which ensure that experienced personnel head key operations while receiving invaluable career opportunities and experience.

Impact on the economy

The Bank’s International Operations allow Sri Lankan corporates, SMEs and Personal Banking customers the opportunity to widen their horizons.

At the same time, the presence of a stable, long-standing bank like Commercial Bank in Bangladesh, Italy, the Maldives, Myanmar, and also the Middle East region (through BPOs), brings greater investor attention and business opportunities to Sri Lanka.

The Bank also grew its market share of remittances in Sri Lanka from 16% to 18% during the year – a major achievement for the Bank, providing greater liquidity in the market.

Inward remittances from migrant workers,

a vital source of foreign exchange for

Sri Lanka, amounted to USD 7,164 Mn. for the year 2017, a decrease of 1.07% over 2016. One of the biggest markets for migrants, Italy has an estimated population of 150,000 Sri Lankans. The monthly value of fund inflows from Italy to Sri Lanka amounts to roughly Rs. 3 Bn.

Using the Bank’s e-Exchange and other remittance services Commercial Bank acted as a catalyst, promoting many overseas

Sri Lankans who had previously used informal channels to remit money to Sri Lanka.

Commercial Bank fetes top customers and business partners in Abu Dhabi

Commercial Bank hosted the Bank’s top customers and business partners in the remittance business in the United Arab Emirates.